With the implementation of Goods and Services Tax from 1st July 2017, as every register business entity need to issue a GST invoice whenever the supply of taxable goods or services is made.

There are two types of GST invoice under GST regime. Those business register under the general category will issue a Tax Invoice under GST. Those businesses registered under the Composition Scheme will issue Bill of Supply.

GST E Invoices

Depending on nature of the supply you can define 3 types of invoices:

- Intra-State Invoice

- Inter-State Invoice

- Export Invoice

A business has to issue an Intra-state invoice when supply is done within the state in which the business is register. The issuer of invoice has to collect CGST and SGST on this invoice.

When a supply takes place between two different state the business needs to issue an Inter-state invoice. The business have to collect IGST on this invoice.

When we supply outside the country, an Export Invoice is issue.

Rules To Follow When Creating a GST Invoice

The government has define some rules for issuance of GST Invoices. Subject to rule 7, a tax invoice in section 31 shall be issued by registered person containing the following particulars:-

- Name, address, and GSTIN of supplier.

- A consecutive serial number not exceeding sixteen characters, unique for a financial year.

- Date of issue.

- Name, address and GSTIN or UIN

- Name and address of the recipient and the address of delivery, along with name of State and its code.

- HSN Code of goods or Accounting Code of services.

- Description of goods and services.

- Quantity in case of goods and unit Unique Quantity Code thereof.

- The total value of supply of goods or services.

- The taxable value of supply of goods and services or both taking into account.

- The rate of tax

- The amount of tax charged in respect of the taxable goods or services. Place of supply along with name of State, in case of supply in the course of inter-State trade or commerce.

- Address of delivery where same is different from the place of supply.

- Whether tax is payable on reverse charge basis and

- A signature or digital signature of supplier or his authorized representative.

GST Bill

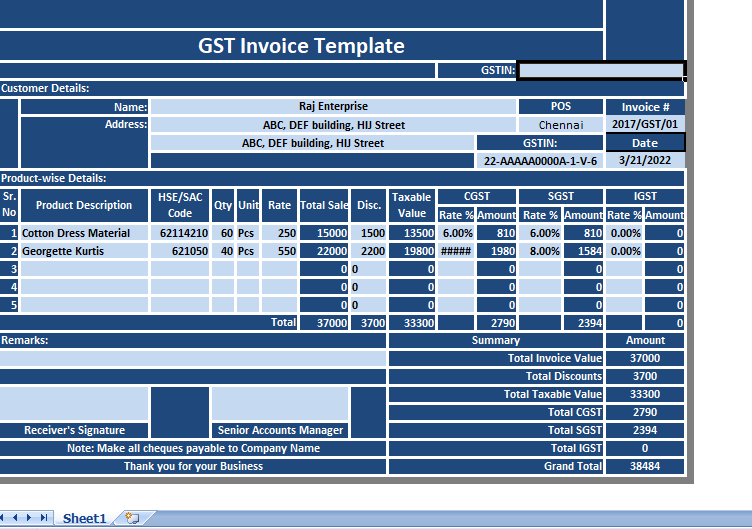

Keeping in mind the rules we have create 10 different formats of invoice under the GST regime. All formats vary in terms of design, industry, calculation method.

Enter a few details and the template will compute all the rest items for you. It is useful for Account Assistant, Accountants, Audit Assistants.

This template helps you to efficiently and easily issue invoices to your clients with CGST, SGST, and IGST Computations.