A recipient liable to pay tax under reverse charge is required to issue a GST Payment Voucher at the time of making payment to supplier.

Rules of GST Payment Voucher

A payment voucher referred to in clause (g) of sub-section (3) of section 31 shall contain the following particulars:

- Name, address and GSTIN of supplier if registered.

- Consecutive serial number not exceeding sixteen characters, in one or multiple series.

- Date of issue.

- Name, address, and GSTIN of recipient.

- Description of goods and services.

- The amount to be paid.

- The rate of tax

- The amount of tax payable in respect of taxable goods and services.

- Place of supply with the name of State and its code.

- Signature or digital signature of the supplier, authorized representative.

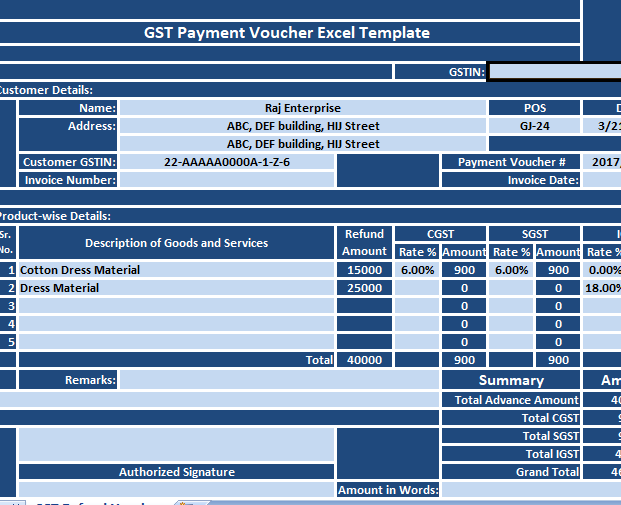

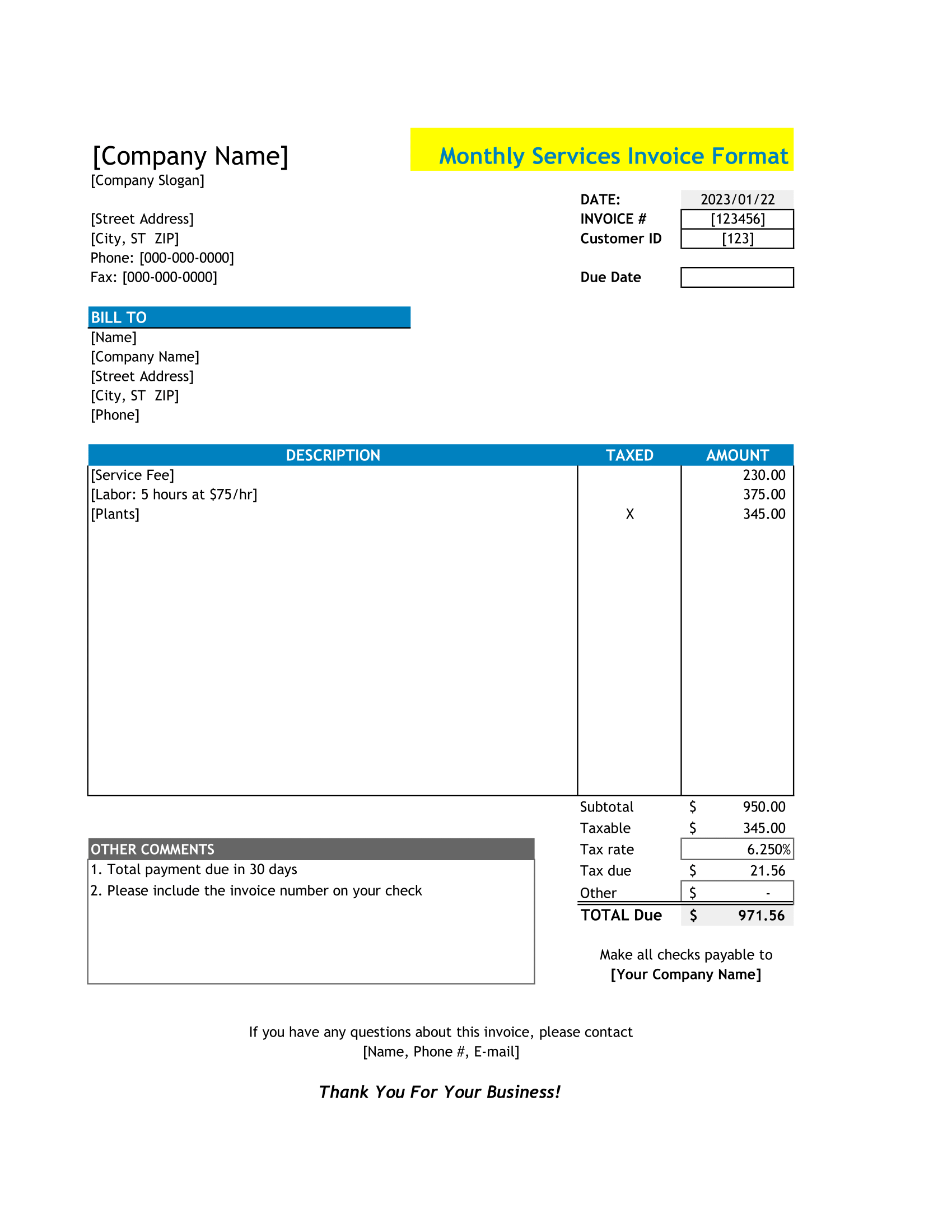

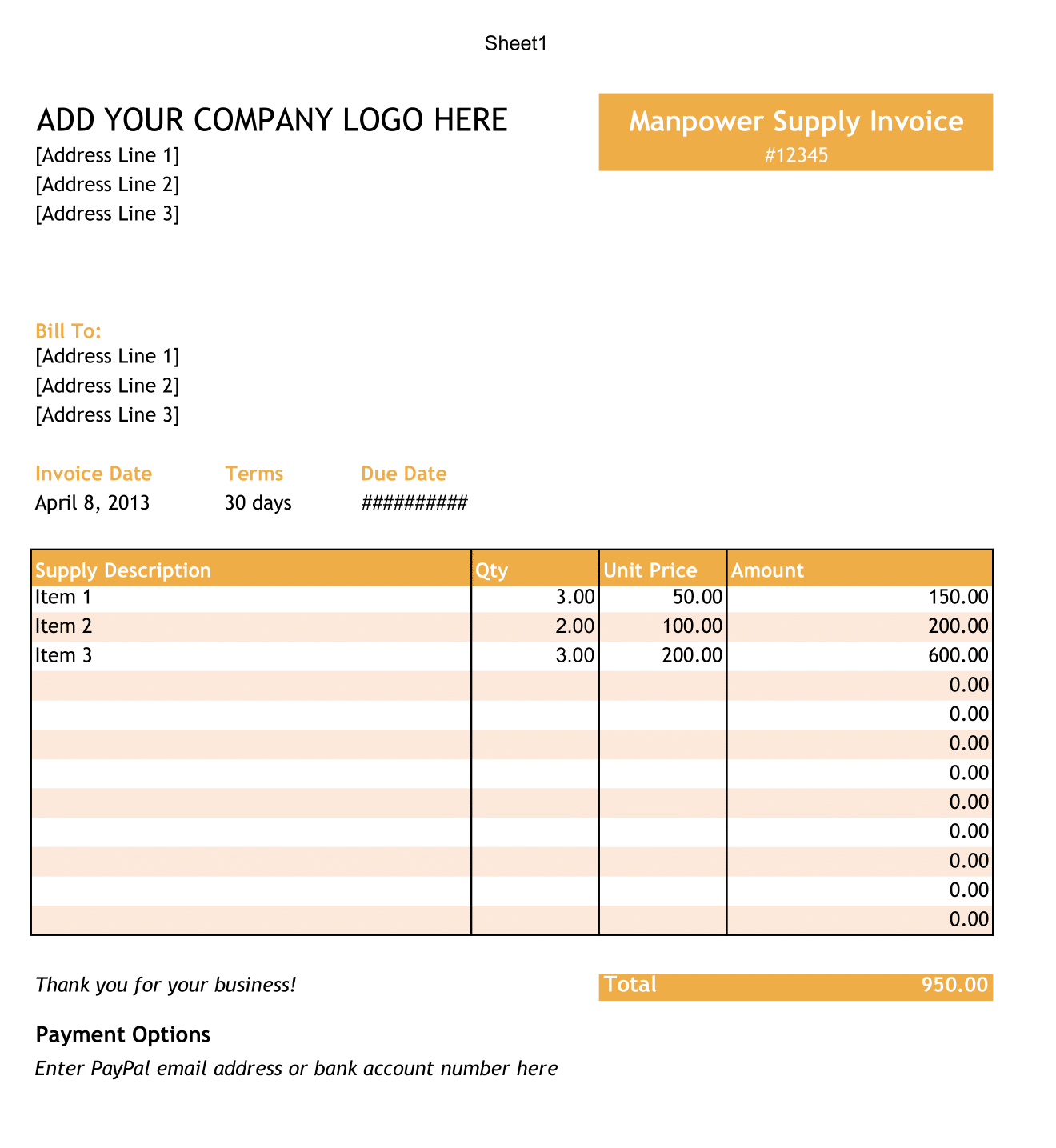

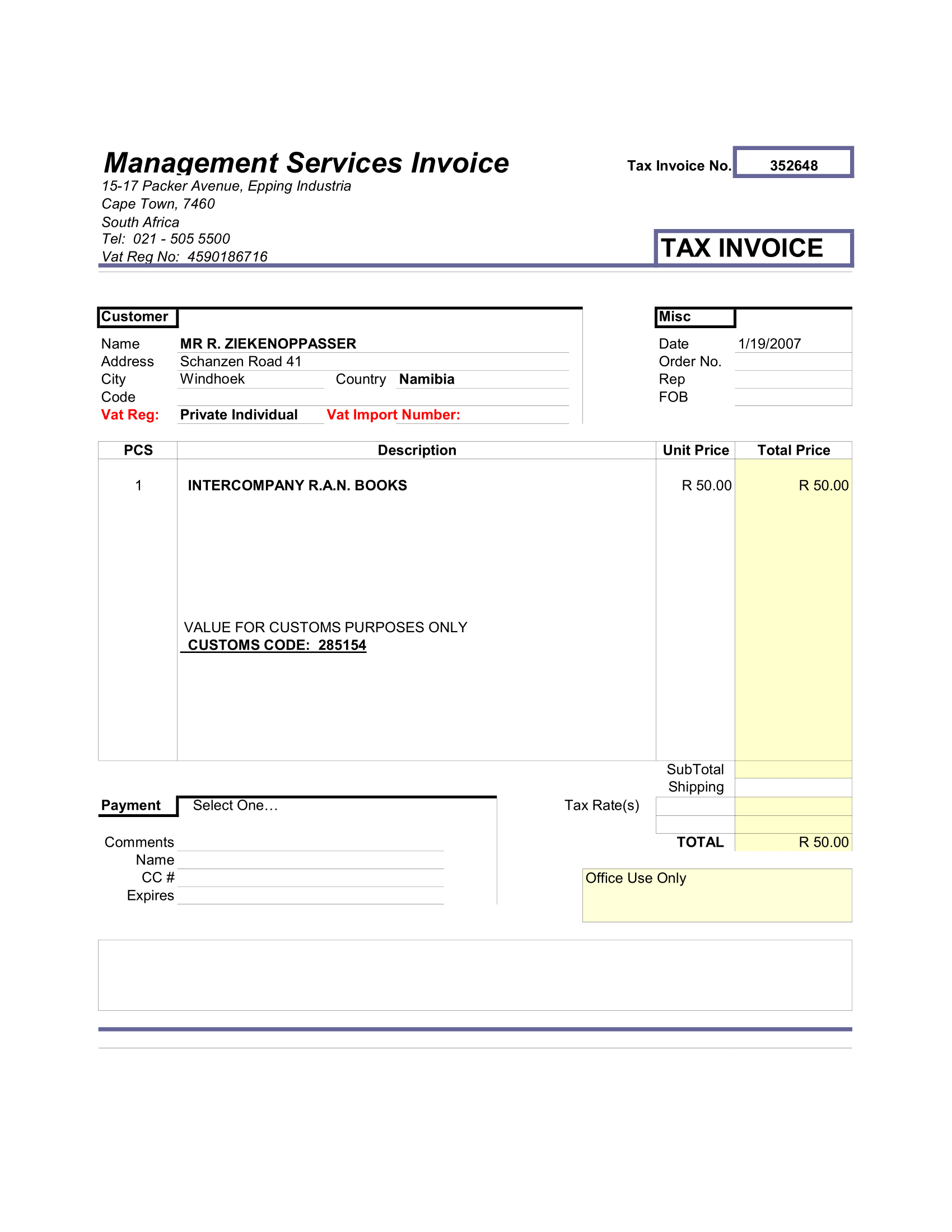

GST Payment Voucher Excel Template

We have created a GST Payment Voucher Excel Template in compliance the above-mentioned rules. You just need to enter a few details and the template will compute all rest items for you.

This template helps you to efficiently and easily issue voucher for payment under Reverse charge to supplier of goods or services.

It is useful for Accounts Assistant, Accountants, Audit Assistants.

Contents of the Payment Voucher Template

This consists of 4 sections

- Firstly, Header Section.

- The, Customer Details.

- The, Product Details.

- The, Signature Section.

1. Header Section

Header section consists of company name, company address, company logo, invoice number, GSTIN and the heading of the sheet “GST Payment Voucher Excel Template”.

2. Customer Details

Customer Detail consists of details of customer such as a date, the name of the customer, address, customer GSTIN, Place of Supply, Invoice Number, Invoice date against which the payment is made.

3. Product Details

This section consist of multiple subheadings:

Sr. No.: Serial number of products.

Product Description: Description of the Product.

Payment Amount: The amount of payment to be paid.

CGST: The Rate and the Amount. The rate is applicable rate of CGST which is to be enter manually. The template calculates the amount of CGST automatically when Payment amount X Rate of CGST.

SGST: The rate is the applicable rate of SGST which is to be enter manually. SGST amount calculates automatically when Payment amount X Rate of SGST.

IGST: The rate is the applicable rate of IGST which is to enter manually. The Amount is the Payment amount X Rate of IGST.

5. Signature and Summary Section

Signature Section consists of remarks, Signatures of receiver and the name of the signatory.

The amount in words: The grand total of Payment Voucher.

The summary consists of total of Payment voucher by customer.

Thus, Grand Total = Total Payment Amount + CGST + SGST + IGST.