It is mandatory for all to maintain records of sales and purchase under the new GST regime. Every registered person has to maintain GST Sales Register in order to calculate the Output tax and GSTR-1.

At the end of every month, when you file GSTR-1 and GSTR-2, tax collected will deduct from the tax pay on purchases.

You will have to just pay difference amount.

For the above purpose, we have created template for GST Sales Register in Excel.

You can maintain records of all your GST sales made during a particular month.

Contents of GST Sales Register

GST Sales register contains 2 sections:

- Header Section

- Sales Data Section

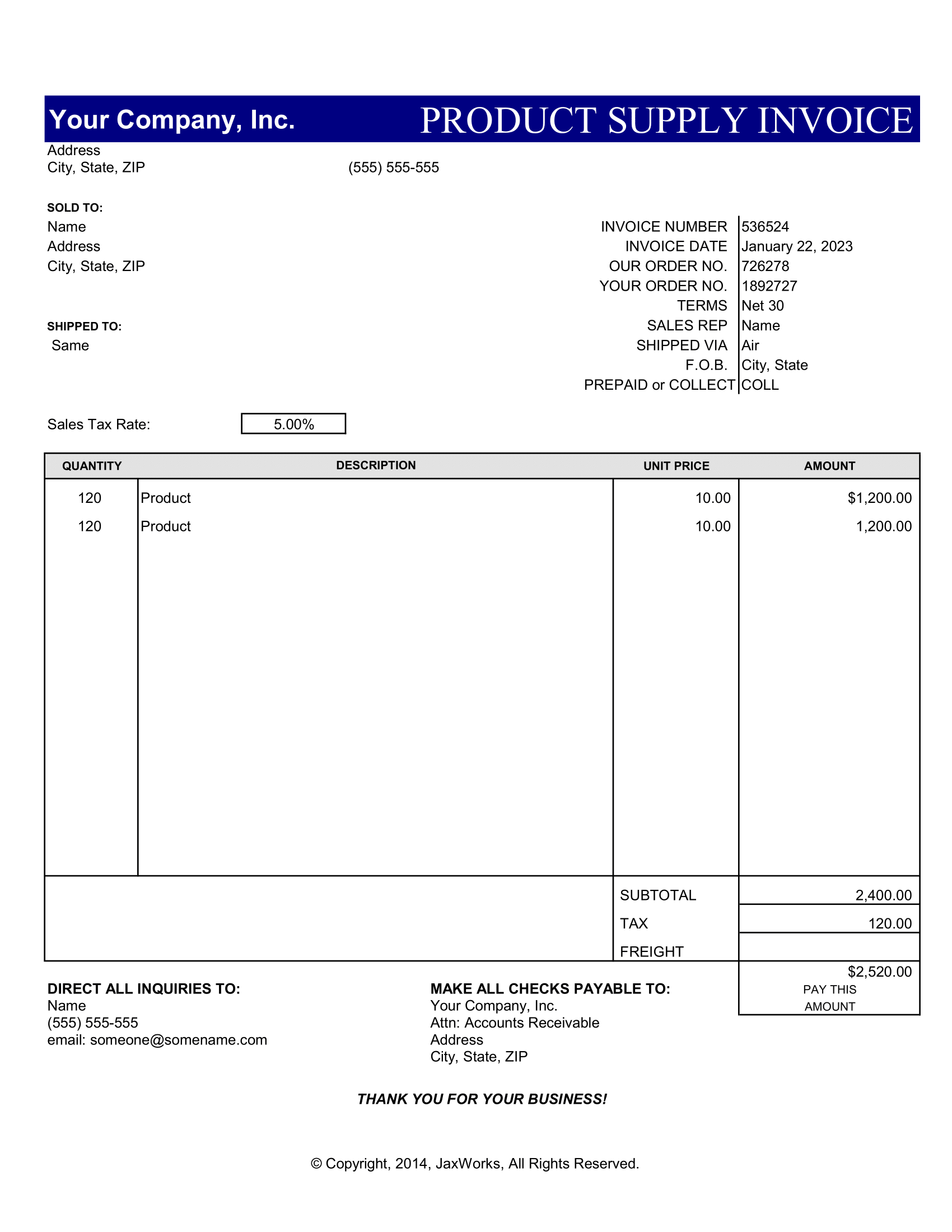

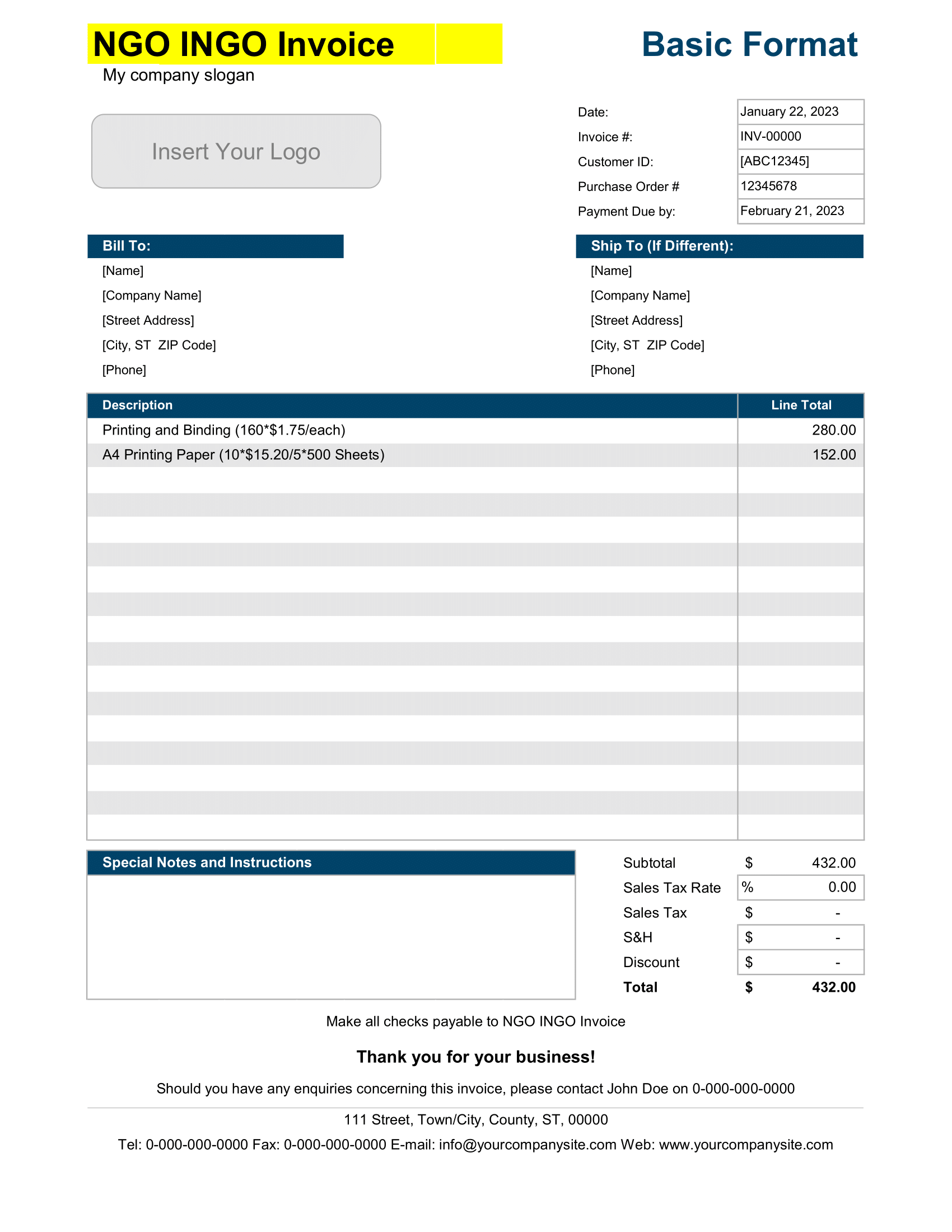

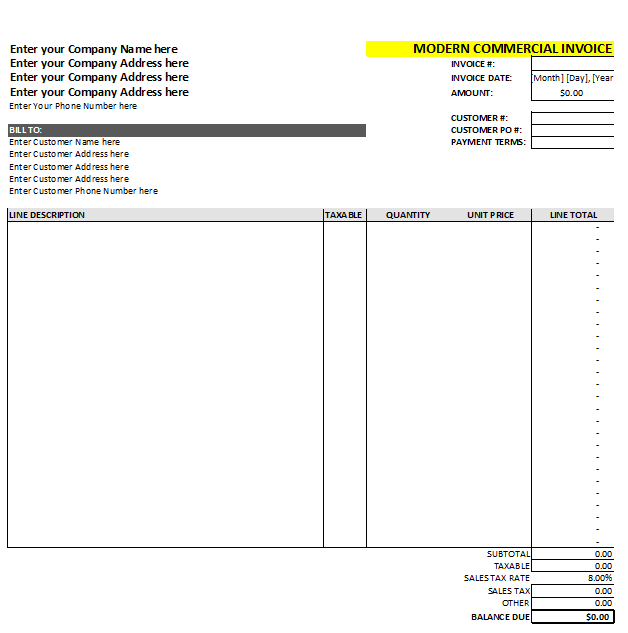

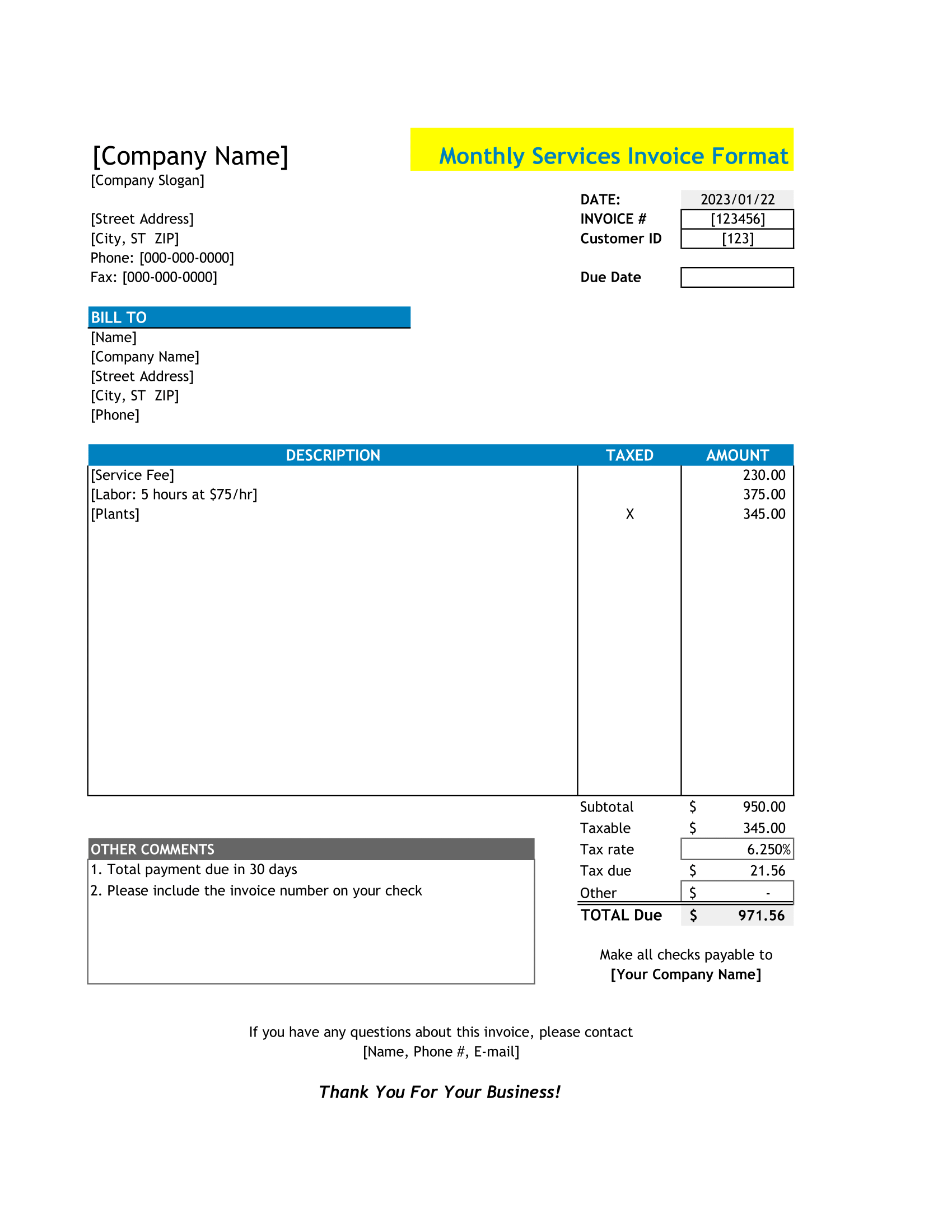

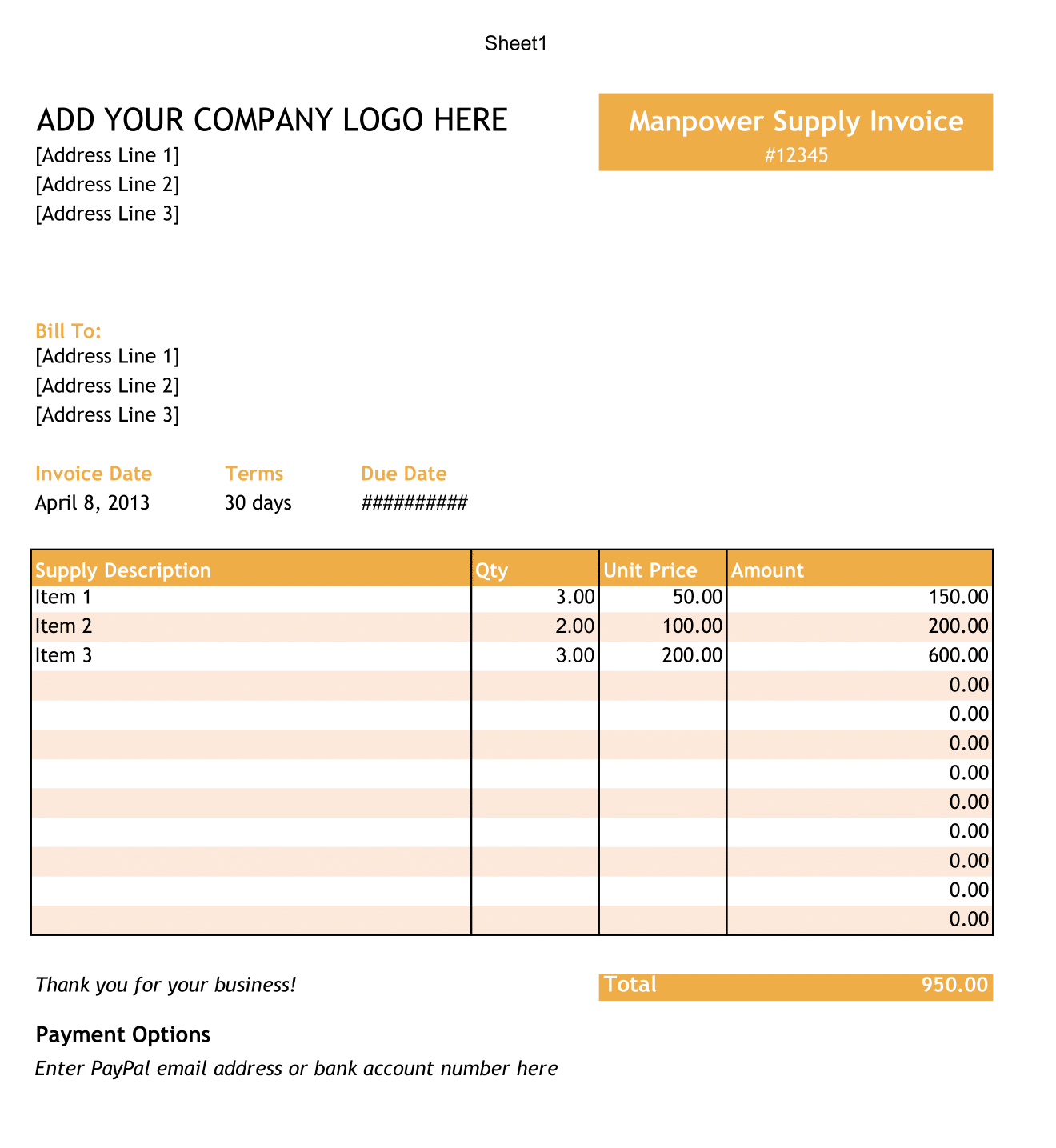

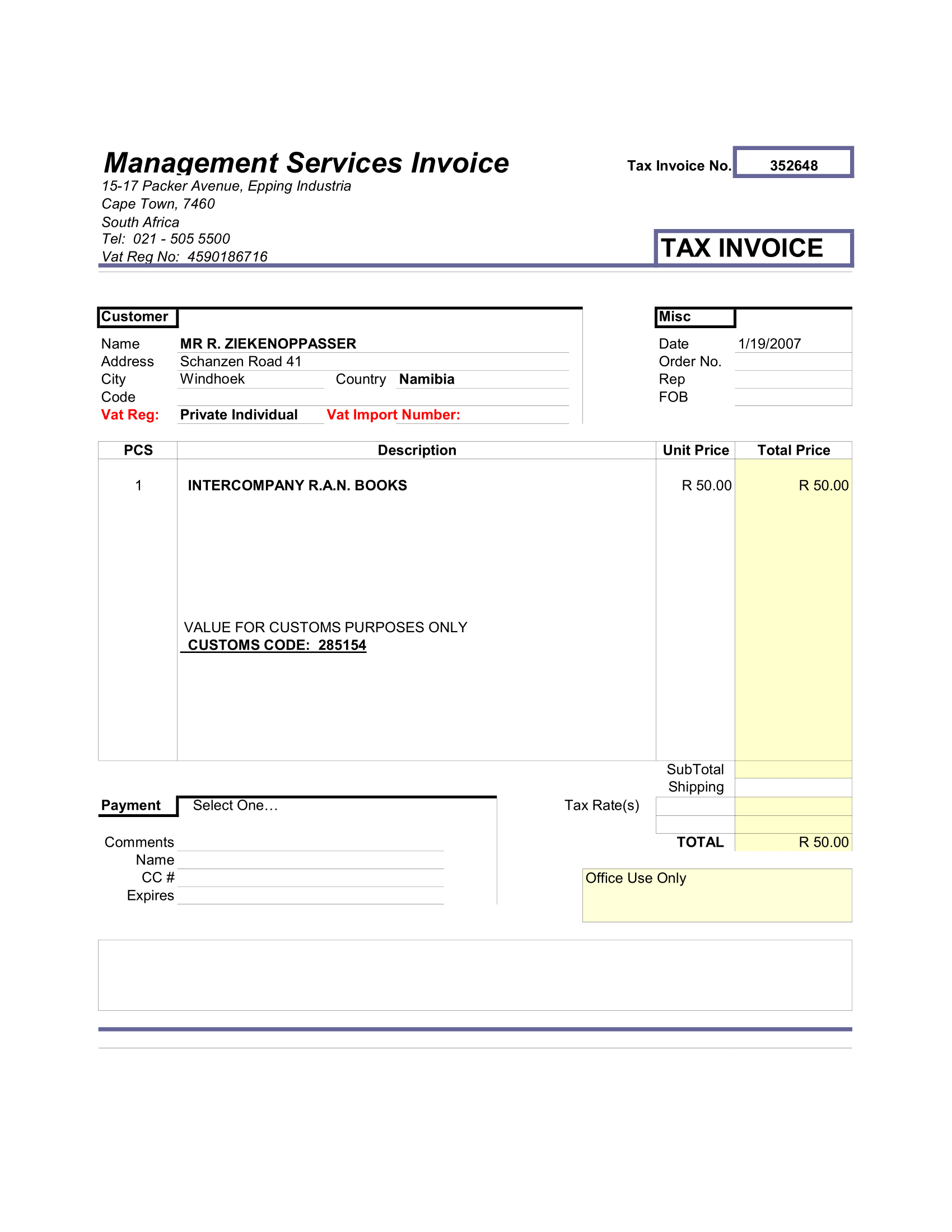

1. Header Section

This section consists of the company name, address, GSTIN, heading of the Sheet “GST Sales Register”, month and year for which it is prepare.

2. Sales Data Section

The sales data section consists of following subheadings:

Sr.No.: Serial Number.

Invoice No: Invoice number of the sale is enter here. The series of invoices have to be maintained as per the GST Law.

Invoice Date: Date of issue of Sales Invoice.

Buyer’s Name: Name of the register or non-register company to which the sale has been made.

GST No.: GSTIN of Buyer. If the buyer doesn’t have GSTIN leave it vacant. Please keep in mind that you will have to pay the GST under Reverse Charge Mechanism.

Taxable Amount: Amount after deducting discount. The taxable amount is amount on which the tax is calculate.

CGST, SGST, and IGST: Just enter the applicable tax percentage tax of Central, State or Integrated and it will auto calculate the amount.

Total GST: Total GST = CGST + SGST + IGST.

Invoice Amount: Invoice amount = Taxable Amount + CGST + SGST + IGST.

At the end, there is the total of each column at the bottom.