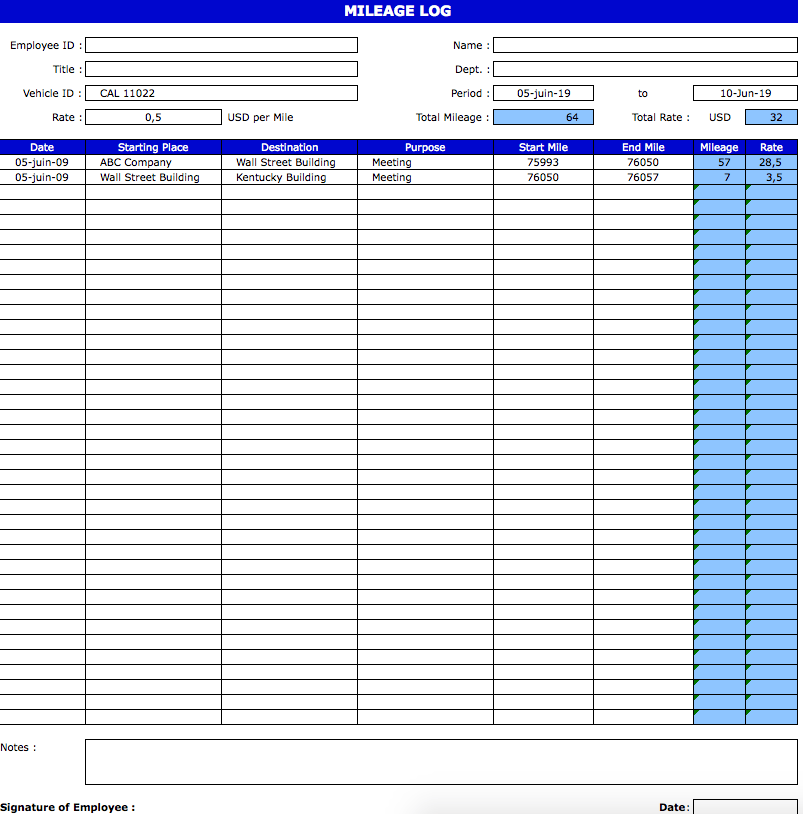

This is a common mileage log used by many companies to track their vehicle cost or car operational expenses. I have create this template as a basic tutorial template for the one who worked in General Affairs Department. He wants to learn how to create template in excel that could be useful for him in his company.

Free Mileage Log

This mileage log is actually the same with other mileage log you could find in several internet sites, because it only record the mileage and calculate the total mileage of the car within specific period of time. You can fill the average cost per mile if you want to calculate the expense of that car.

Printable Mileage Reimbursement Form

If you are looking for an advanced version where it is use to calculate and generate for more than 1 car in a single excel template, you might try and download the “Car Fleet Management” template. It is use to record other information instead of just recording mileage distance for tax deduction only. You can record any daily activities of your car, for example, its expenses (service, toll, parking etc). You can also monitor and assign drivers, you can monitor specific car when it has to go for a general service and many more.

Gas Mileage Tracker

Many businesses simply estimate the mileage they use for their business. This works well enough for many. When it opens companies up to a greater risk if they’re audited by the IRS. In the case of an audit, you need to have detailed records of your mileage. There are even lawsuits in which the taxpayer lost years of deductions due to improper record keeping of mileage (Royster vs. Commissioner).

While it may not seem likely that you’ll face an audit, knowing that it is possible and you may face deduction losses. Sole proprietors face a higher risk of audit due to a lack of separation between personal miles and business miles. It is one of the most commonly scrutinized deductions for businesses, and it’s better to be prepared than not.