How much money do you have in savings account? If you’re like many other Americans, your answer may be zero only. If your savings account is looking slim, don’t worry. There is still hope. But it will require intentional planning and effort on your part. This money goal tracker may help you check “manage your money” off your to-do list.

Free Printable Savings Goal Chart

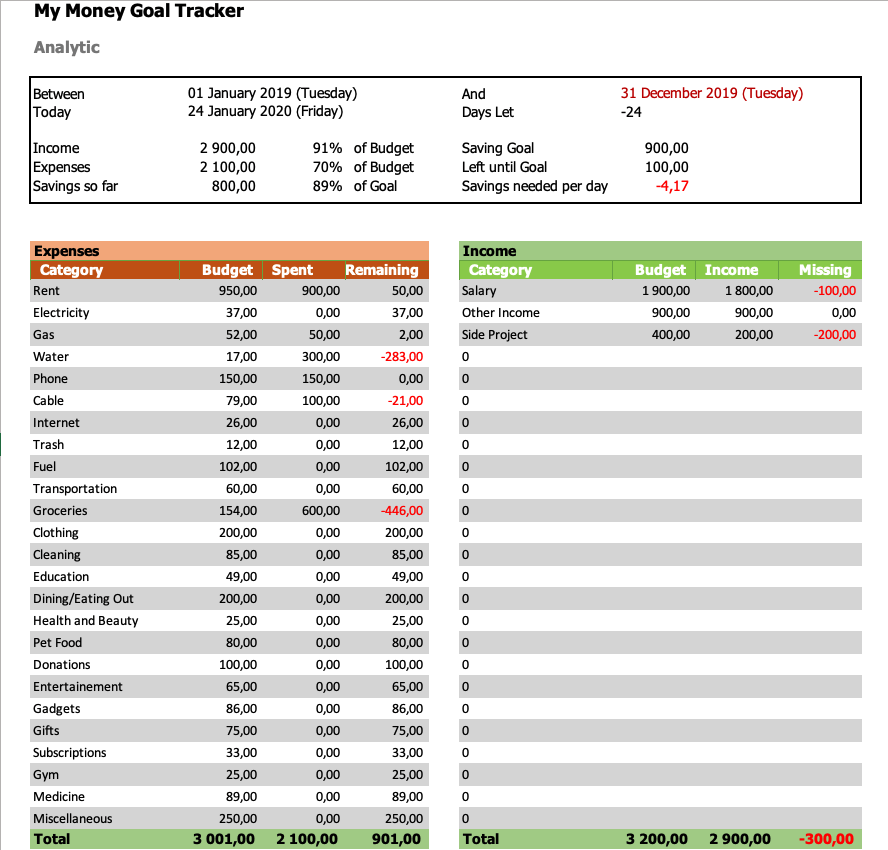

Once you have download the file, you can now begin customizing it to get a better picture of your financial reality. After all, you can’t save money and increase balance in your savings account without understanding where you are currently standing.

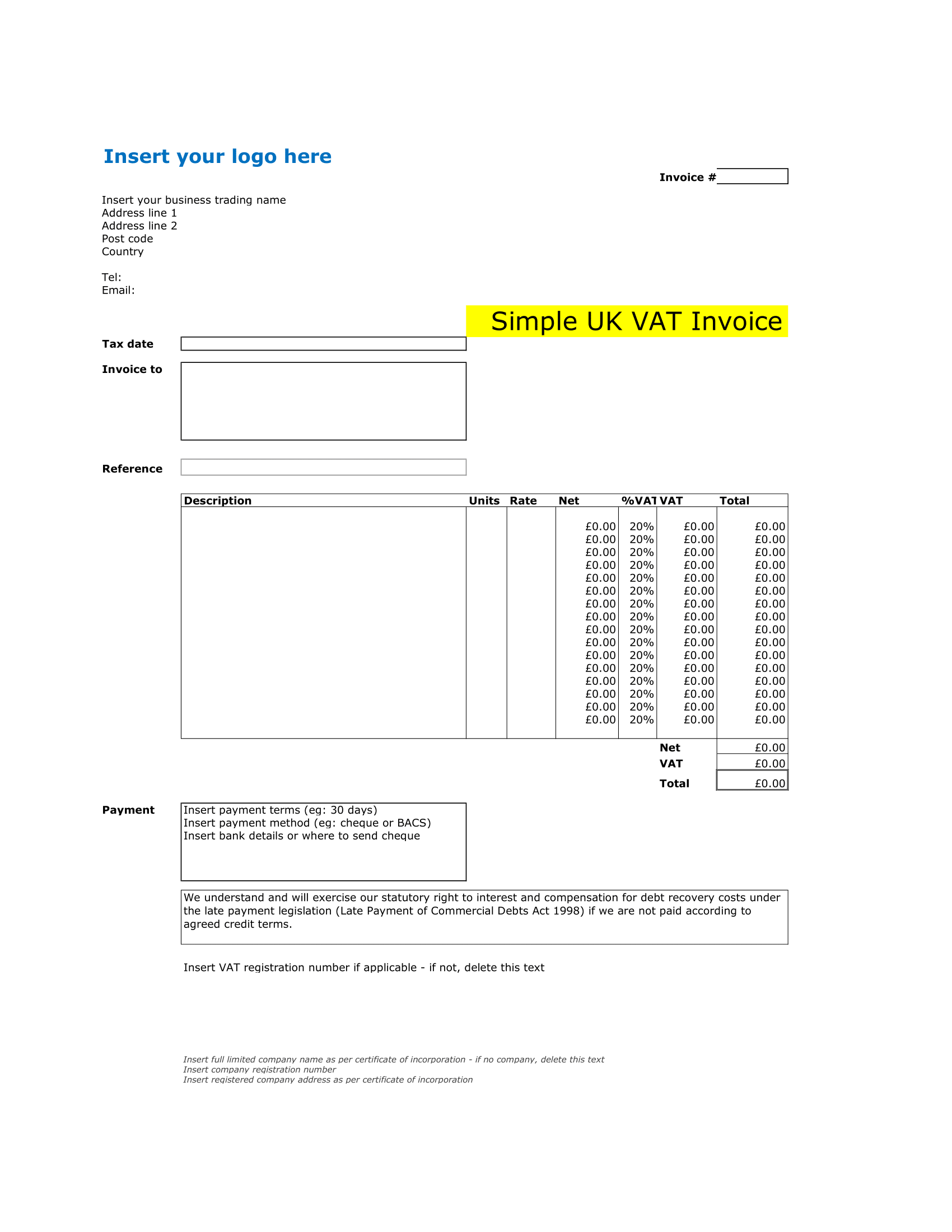

The first worksheet will help you document your regular income and expense. It will also help you create a very realistic savings goal.

Money Saving Tracker Dates

Do you want to create a monthly budget, or an annual one? There are pros and cons of both styles, so pick the one that makes the most sense for your situation. This Excel template is currently set up with formulas for an annual budget, so if you prefer to keep things simple, go with an annual version.

Financial Goal Tracker of Your Income

How much money do you expect to earn during this particular period? Go ahead and enter any projected income from salary, extra cash from side hustles, or other sources.

Enter Your Expenses

Now it’s time to dive into your expenses and show where your money needs to go exactly. Sit down and think about each expense that you have. Many common expenses are listed, but feel free to add more as require.

Create Your Savings Goal

What are your financial goals? How much of your income do you want to save? Many financial experts recommend putting at least 20% of the income towards savings. This includes both long-term and short-term savings whether it is getting a new car, vacation, emergency fund or saving some extra money for a rainy day or as an emergency fund.

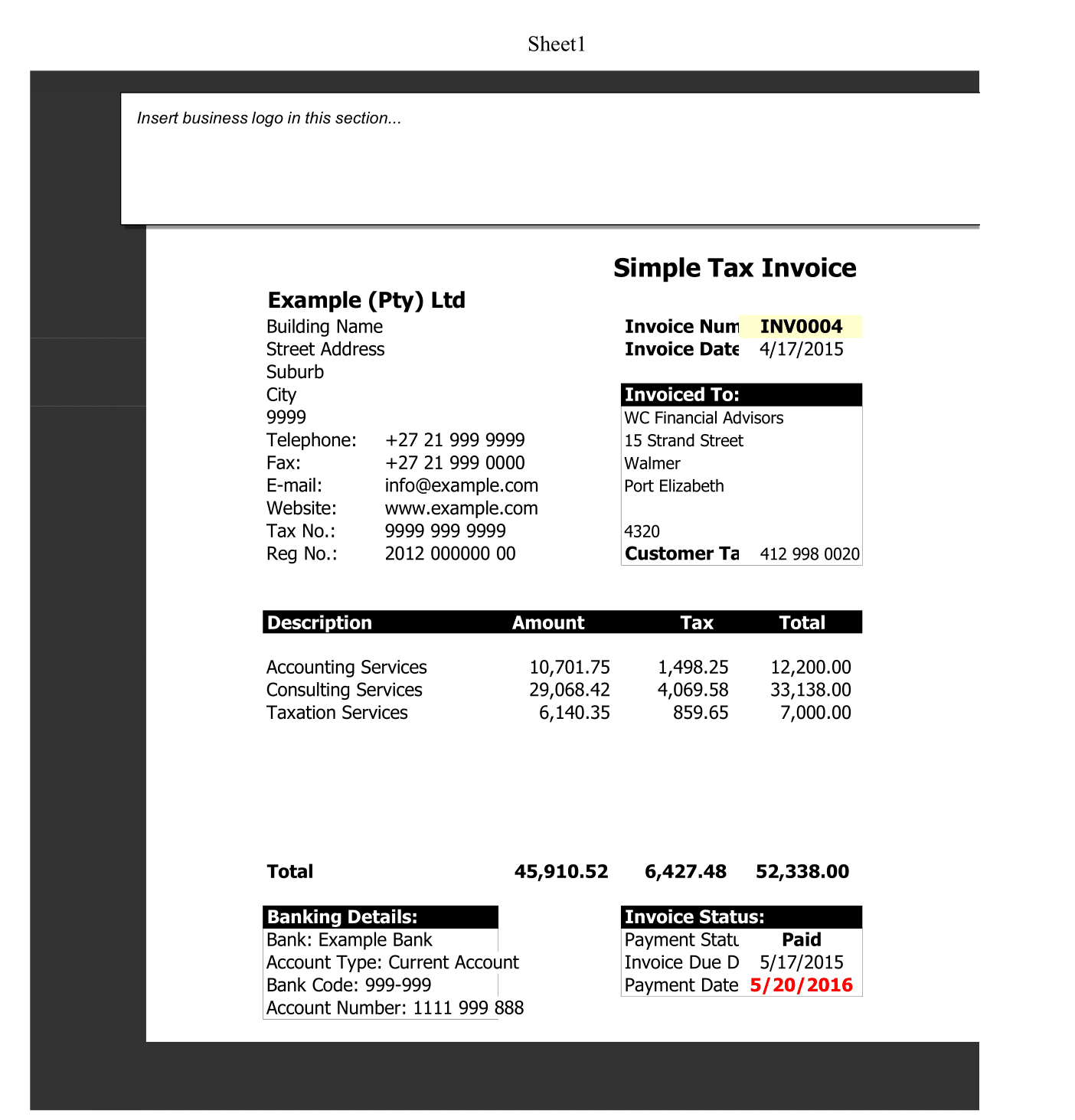

How to Customize the Analytics Worksheet

This savings goal tracker worksheet has a lot of formulas, so be very careful when you’re making change

The numbers in this spreadsheet will automatically update as you enter your income and expenses in the next two worksheets.

How to Track Your Income

Whenever you have money coming into your bank account, it’s important to track it regularly. You can enter your income on Income worksheet.

How to Track Your Expenses

Keeping track of where you spend your money is an essential component of money management. This Excel worksheet provides digital record so you can go back and see where your money went.

At top of this worksheet, you can see how much money you budgeted for the month. You can also see how much you have recorded as spent.

When you see where your money is going, you can look for spending habits you need to change. You can get this inspired to lower your expenses and grow your savings.

The four worksheets in this Money Goal Tracker can help you reach your savings goals. As you work through them to create budget, record your income, and track your expenses, you can take control of your financial destiny.