As a business owner, you need to understand every aspect of the business’s operation, and effect its activities have on health of the business. Traditional financial accounting reports provide some of the information business owner needs.

Operating Activities

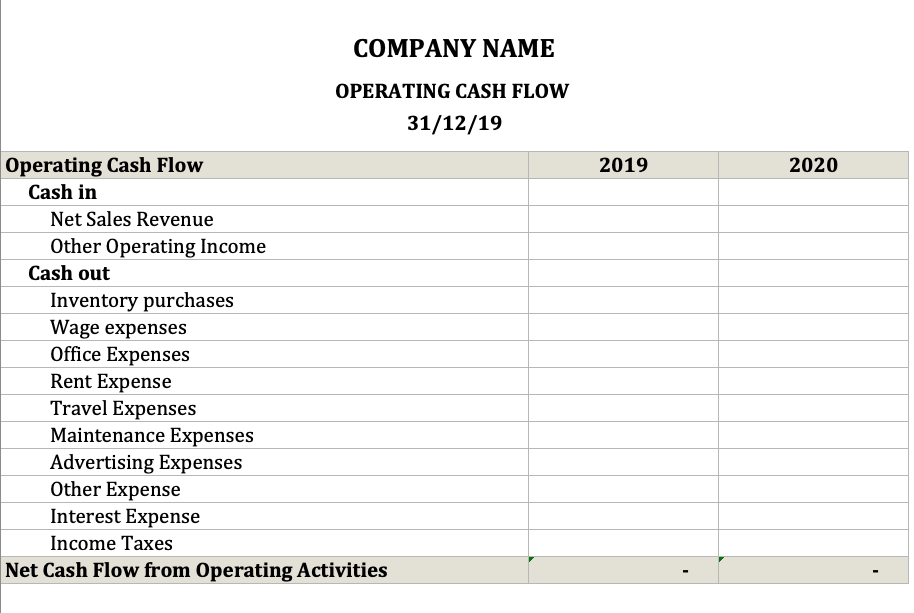

Balance sheets gives level of assets and liabilities, accounts receivable, accounts payable, owner’s investment (or capital) in the business, financing activities, and much more. Accounting income statements give information on gross income, depreciation expense, net income, income tax, general expenditures, and overall profitability. And Reconciliation of Net Worth pulls information from each to report Owner’s Equity position. This operating cash flow calculator can help.

Importance of Operating Cash Flow Formula

Only business cash flow statements succinctly detail from where a business’s cash is derived and where business’s cash is used.

Our Operating Cash Flow Calculator is a critical tool that will help you track. It also gauge the effectiveness of, and understand the impact of your business’s core activities.

We stress “core” here because nearly all legitimate business activities either use or generate cash. But only a subset of those activities relates to core operation of the business.

Cash Flow From Operating Activities

Bill payments, funds available for capital expenditures, tax payments, and reduction in loans or accounts payable also come from cash. These activities may be important to business’s success, but may not involve in core operation that drives the business.

This template reflects activities of only those processes necessary to drive the business’s core operation. Other tools are available that include these ‘non-core’ activities. Cash flow calculators focuses on core activities because, if they consume more cash than they provide, the business is very likely to be in real jeopardy.

Operating Cash Flow Calculator Models

The template provides two models, the Yearly and Monthly, and is built in Excel, so you already have everything you need to run it.

Importance

These examples demonstrate how important it is for you, the business owner, to be aware of your cash position, and to gauge how effective your core operating practices are. It is not unusual for any businesses to suffer cash shortfalls during certain times of the year. The owner/manager must remain aware of this possibility, anticipate them, and make plans to adjust them.

Typically prepared financial statements do not provide owner with this kind of critical information.

For this reason, we recommend that you use Operating Cash Flow templates to monitor both on-going and anticipated future business activities regularly. Knowing when cash is require and where it might come from is just as important as deciding when and where to spend it.