Present Value

When somebody from financial institution come to you and offer some investment opportunities. Usually they will hand you the table of the value of your money after some period of time. This table is usually calculate from present or future value calculation. Where your current money is treat as a value parameter.

Net Present Value

And from the term written in wiki, present value itself is value on a given date of future payment. Discounted to reflect the time value of money and other factors such as investment risk. As you can find in some investment opportunities offering, present value calculations are widely used in business and economics to provide a means to compare cash flows at different times on a meaningful “like to like” basis.

Present Value Formula

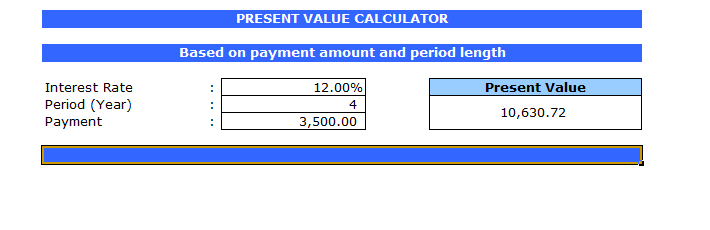

This present value or pv calculator consist of three worksheets. The first worksheet is used to calculate present value based on interest rate, period and yearly payment. Say, that somebody offering you an investment where you have to invest USD 10,000 for 4 years and then they will pay you USD 3500 per year. So, you have to compare whether it is worth to invest on it or just put it in a bank with 12% interest rate. The calculation shows that the value of your money is higher than your current money. So, the investment is profitable for you because it give interest more than your bank.

PV Formula

The second worksheet has the same example as the first one, except the investment proposal will pay you once by the end of 4 year period, with amount USD 14,000. The calculation result gives you value of your money is less than the value of your current money. So, it is not profitable. Don’t be tempted with the absolute different (14,000 – 10,000) because if you put your money in the bank, the value after 4 years will be more than USD 14,000.

The third worksheet is pv comparator worksheet which compares side by side. The investment calculated in the first worksheet and second worksheet, so you can see it objectively. And still, as I always put in all my financial calculator. Use this calculator as your side reference only. The calculation method for some investment should be different than the standard calculation method.