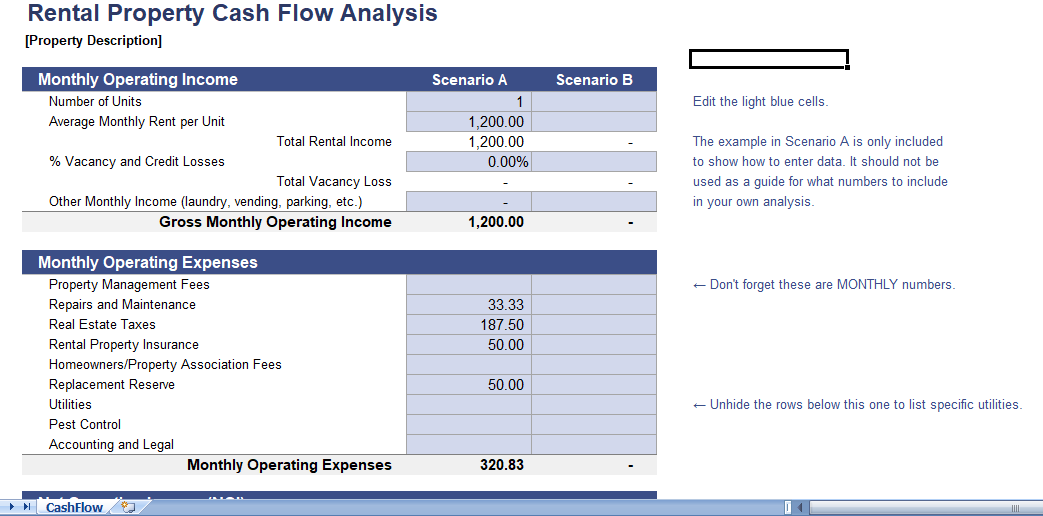

This Rental cash flow spreadsheet is for those who are thinking about purchasing rental property for the purpose of cash flow and leverage. It is fairly a basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, cash flow, and cash on cash return.

Rental Real estate cash flow

This worksheet is not going to analyze you how to be a good real estate investor. It is just a simple tool to help you put into practice some techniques for property evaluation and cash flow analysis.

Rental property cash flow analysis

The calculations for doing a rental property valuation and cash flow analysis are not very tough. This Excel spreadsheet makes things even more simple by providing a convenient way to calculate and compare results for the property.

Cash flow investment properties

If you can add more rows to the operating expenses, double check the formula that are used to total the expenses to make sure it is summing all of all the expenses.

You can find other spreadsheets that provide a more thorough investment analysis (such as 10-year cash flow projection). This one is designed for people who are still willing to learn the basics of rental property investing for cash flow.

How to Use this Spreadsheet

Step 1st: Estimate Rental Income and Expenses

You may get some information from a real estate sales brochure or proforma, but you should also verify all numbers.

The expenses will depend on many factors such as including the type of property, age, location, condition and whether you are using a property management firm or handle it all by yourself. However your property manager may help you come up with estimates on other expenses. This is extremely important that you do proper research before purchasing real estate.

Step 2nd: Enter a Cap Rate to Calculate the Property Valuation

However, with an accurate picture of what rent you can charge and the operating expenses, you can now enter your desired capitalization rate to determine the property valuation, or the initial offer price.

What is Cap Rate?

The capitalization rate is your expected rate of return on your investment, calculated as Net Operating Income divided by the Asset Value. It has to do with whether the income minus expenses provides a decent return on the value of the property. It does not take into account leverage. If you pay cash for the property or fully pay off the loan, this is the return you’d be expecting. Certainly it’s under 3%, you should ask yourself if it might be easier to invest in a CD. If it’s over 10%, you are receiving excellent income compared to the value of the property.

Step 3rd: Enter Loan Information to Calculate Cash-on-Cash Return

Mostly the financial leverage you get from a loan is one of the main purposes of investing in a rental property. However the cash-on-cash return is the key metric formula calculated by this worksheet. It is the net annual “cash flow” divided by your initial “cash” investment. The cap rate percentage is the same regardless of whether you have a loan or you own the property outright. The cash-on-cash return is where you can see the effect of leveraging the bank’s money.

Above all, This spreadsheet assumes the loan is a fixed rate loan. Enter your down payment, fees, and rate of interest to calculate the initial investment and total debt service.

Summary of the Formulas Used

Total Effective Rental Income = Rental Income – Vacancy and Credit Losses

Net Operating Income = Operating Income – Operating Expenses

Valuation (Offer Price) = Net Operating Income / Desired Cap Rate

Capitalization Rate = Net Operating Income / Purchase Price

Total Debt Service = Principal Payment + Interest Payment

Annual Cash Flow = Net Operating Income – Total Debt Service

Initial Investment = Down Payment + Acquisition Costs and Loan Fees

Cash on Cash Return = Annual Cash Flow / Initial Cash Investment