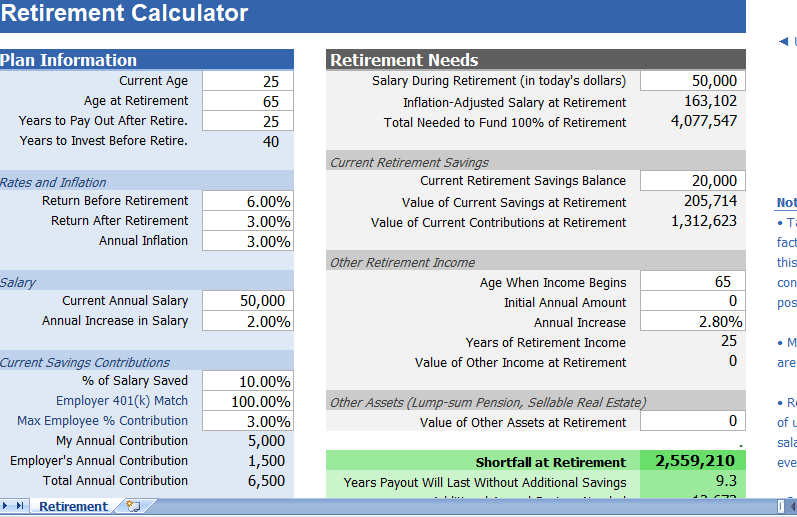

How much of your salary do you need to save to reach your future retirement goal? That is not a simple question to answer, but that is what this retirement calculator spreadsheet attempts to help you with. It makes quite a few assumptions, and doesn’t include too much detail as you will find in professional financial planning software. But, for a quick estimation it is useful.

Simple Retirement Calculator Spreadsheet

The most important thing about this spreadsheet is to understand that future rates of return, inflation, salary, disasters, how long you’ll live, and other life events which you cant know for sure. So, if you are going to use this, realize that it is a mathematical exercise and the inputs that you choose and how you interpret the results at your own responsibility.

Rates of Return and Inflation

These are values that just have to be estimated. You can’t know future rates with certainty. However, one of the unique feature about this spreadsheet is that you can enter different rates of return for the accumulation period and the retirement period. This is useful because during retirement period, your portfolio will likely to be weighted towards lower risk, lower return investments.

Defining Your Retirement Goal

1: Your Salary. write a salary you want to live on during retirement in today’s dollars. This should represent a personal lifestyle rather than an actual income or withdrawal amount. The payouts during retirement will adjust for inflation (pension contributions calculator). If you are expecting to receive income during retirement, the amount withdrawn from your nest egg is reduced to account for that purpose.

2: Years to Pay Out. The number of years you want your retirement money to last is the second aspect of your retirement goal. Are you going to live until you are 100? Are your kids going to support you when your retirement money runs out?

Savings withdrawal calculator

The amount that you will save is based on a percentage of your salary. That way, as your salary increases, the amount that you will save will also increase.

Your annual savings contributions in this spreadsheet is not limit to just 401k contributions. However, if you specify an Employer Match, the spreadsheet may believe you are first contributing to a 401k, and then any savings beyond the 401k limits are place in other accounts.

Social Security

This spreadsheet doesn’t include social security calculations. Instead, you can use the Other Retirement Income section to includes estimates of other income like social security. The social security administration provides a Retirement Estimator that you can use to get a rough idea of what your social security benefits might be.