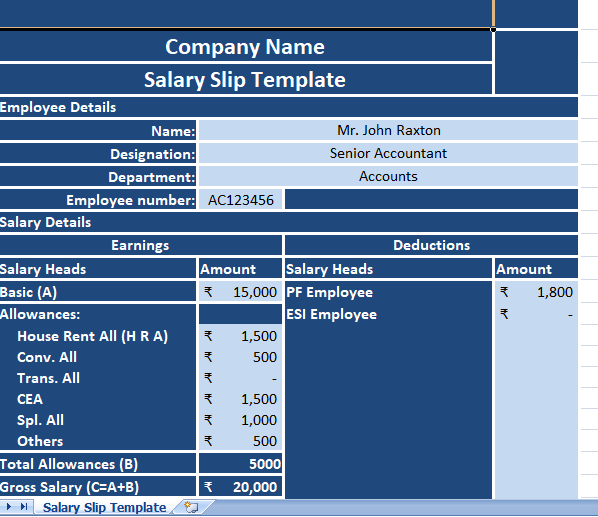

9 ready-to-use Salary Slip Templates in Excel to issue salary slip at the end of the month in just a few minutes.

As per the law, Every organization issues a salary slip to their employees at the end of every month or whenever the salary is paid. So, We have combined the top 9 frequently used salary slip templates. Moreover you can choose the one that best suits for your requirement.

Pay Slip

Hence, Salary Slip is payroll document that contains details of salary paid to any employee which include basic salary, allowances, deductions, attendance, leave record.

Moreover, We have created the 9 ready-to-use Salary Slip Templates with predefine formulas. You need to enter the payroll data of your employees and print.

Components of Pay Slip

However, There are three major components of the Salary: Basic Pay, Allowances, and Deductions.

Basic Salary

Description: So, Basic salary is the fixed amount to be paid to an employee addition of any allowances or subtraction any deductions. Usually, the basic salary is 40-50% of CTC. Though, It is a part of Take-Home Salary.

Taxability: Basic salary is 100% taxable if it crosses the Income Tax Slabs.

Part of Take-Home Salary: Yes.

Allowances

In addition to the basic salary, Allowances are extra financial benefits that employers provide to their employees.

Dearness Allowance

House Rent Allowance (HRA)

Conveyance Allowance

Medical Allowance

Special Allowance

TA – Travel Allowance

Bonus Pay

Deductions

Provident Fund (Employee Contribution)

Salary Advance

Professional Tax

Tax-Deducted At Source (TDS)

Salary Slip Templates

However, This is different for industry and organizations. So, Some companies pay in cash, some through cheque and some through direct bank transfers.

Although, This Template is specifically for Indian organizations, where the provident fund is mandatory. It includes automated Provident Fund calculation according to the government rules. If they change you need to make minor changes in the formulas.

This template is useful to HR assistant, accountants of medium and large scale companies in India.