If you’re self-employed, preparing a Profit and Loss statement may feel like an overwhelming task. No matter how expert you are in the trade, odds are you never studied finance. You got into what you do because you love it, or are good at it – and not because you love crunching numbers every month.

Accounting has been widely practice since ancient times. Some of the oldest writing ever recovered – from ancient Sumer, one of the oldest civilizations known – related to finance and trade.

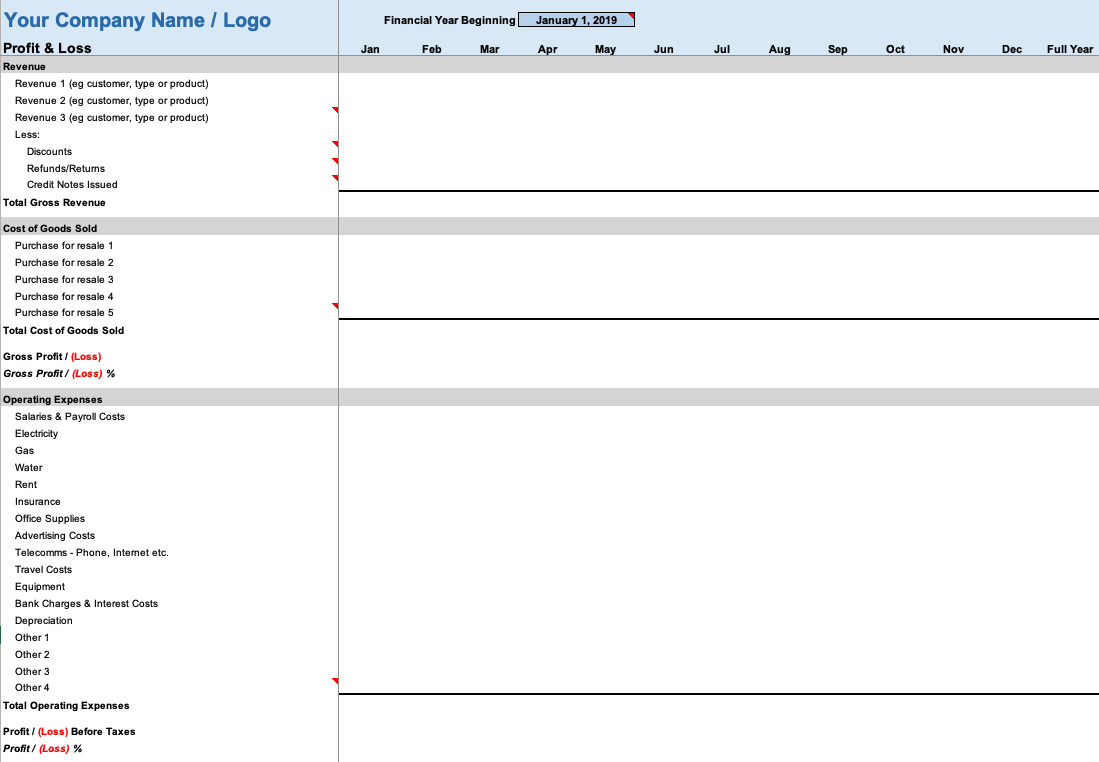

If you’re self-employed and want way to keep track of your finances, this template is for you. Alternatively, if you need profit and loss statement template for a company.

Remember, your statement is different from balance sheet, which is a summary of a business’s assets, liabilities, and capital. If you need balance sheet template too, we’ve got some great templates for you here.

Profit and Loss Statement

A P&L is a financial document that summarizes your business revenues and expenses during specific period of time, usually a month, quarter, or year.

The details you add to your P&L provide information about your business’ capacity to generate profit by increasing revenues, reducing expenses, or both.

You may also the P&L statement go by slightly different names including a statement of profit and loss, statement of operations, income statement, statement of financial results and income and expense statement.

Need of P&L

If you’re a self-employed worker or business owner, a profit and loss statement is an absolute necessity to:

- Reveal your business is profitable or losing money,

- Provide information you need to make sound business decisions, and

- Report financial information to interested parties, including your accountant, tax attorney, investors, and banks.

A profit and loss statement can be used to analyze your business’ financial performance over an entire year.

Using this document, you can learn:

- Your best and worst revenue sources,

- Your most and least profitable months,

- Your ‘Bottom Line’ earnings and overall profit.

Financial Document I Need

This is one of the ‘big three’ financial statements use by accountants and others.

Financial statements are specially prepare documents of a business’s financial activities. They are record either over a time period (e.g. a year) or for a specific point in time (e.g. end of quarter).

The ‘big three’ financial statements are:

- Cash flow statement,

- Balance sheet, and

- P & L.

For some extra clarity, a cash flow statement, unlike income statements, cannot use to prepare your income tax return. That’s because cash flow statements don’t demonstrate ‘net income’ or profitability, as Profit & Loss statement does.

In contrast to your P&L Statement, Cash flow statements:

- Measure your business’ cash flows (the money flowing in and out of your business),

- Show business’ various revenue sources, and,

- Demonstrate how your business uses its cash over a period of time.