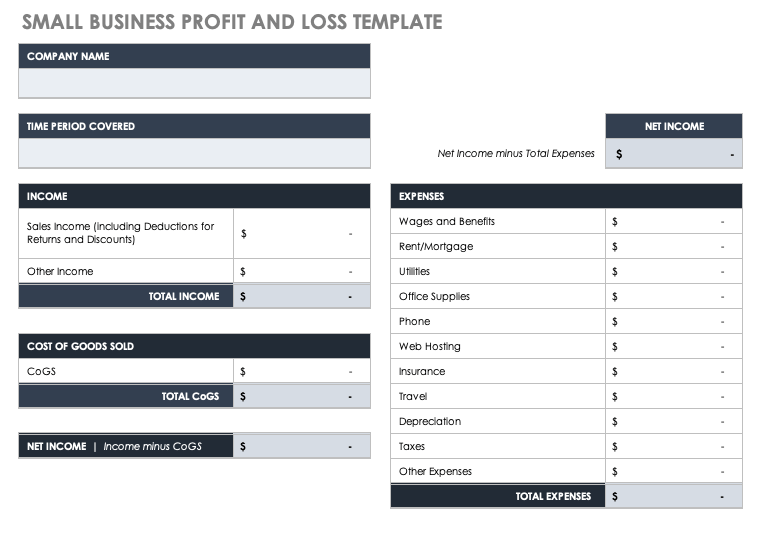

Small business profit and loss statement template is used to project income and expenses for a specific time period. Thus, Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Profit and loss statement for small business

What is a profit and loss statement? A profit and loss statement details a business’s income and expenses over a defined period. So, The P&L is also referred to as an income statement, statement of profit, statement of operations, and a profit and loss report.

How do I create a profit and loss statement for free?

- Choose a Format. Decide which profit and loss template format you’ll use.

- Download the Template. Download your free profit and loss template from FreshBooks in seconds.

- Enter Revenue. Add your revenue numbers in the appropriate field.

- Enter Expenses.

- Calculate Net Income.

- Determine Profitability.

What should be included in a profit and loss statement?

It shows a company’s financial progress during the time period being examined. So, The P & L statement contains uniform categories of sales and expenses. Thus, The categories include net sales, costs of goods sold, gross margin, selling and administrative expense (or operating expense), and net profit.

Do profit and loss statements need to be signed?

The P&L must be prepared and signed by a licensed accounting firm; a borrower prepared P&L is not eligible even if the borrower is an accountant and/or is employed by an accounting firm, and. So, The borrower must sign and date the P&L, and. The P&L must be dated ≤ 60 calendar days prior to the Note date.

Should a small business show a profit?

Once you can show that your business is profitable, you may be able to refinance at lower rates because you’re at a lower risk of default. If you pay down the principal, you’ll pay less interest over the lifetime of the loan, which will save you money.