If you are considering contributing to a Traditional Vs Roth IRA , you may have already heard that the main difference is whether the contributions made are pre-tax or after tax. You should have one of the main considerations is whether you think your income tax bracket during retirement will be higher or lower than your current tax bracket.

Another important difference between a Traditional Vs Roth IRA is that if you need to have access to your money, it is easier to pull some money out of Roth because you are not penalized when you withdraw your principal from your Roth IRA.

ROTH Conversion

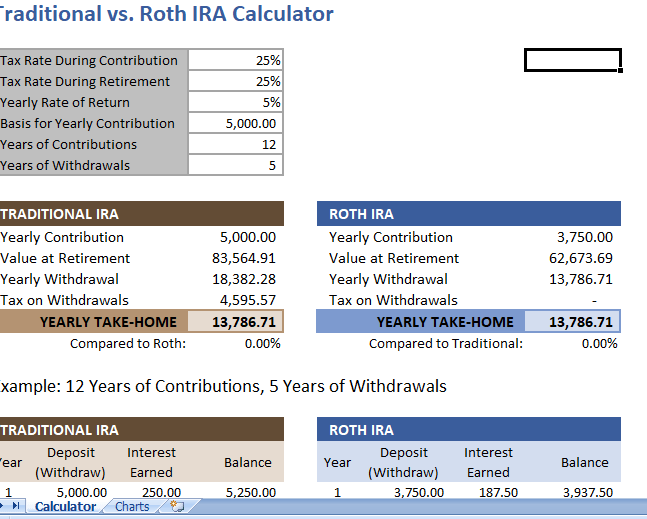

This calculator is meant to compare the difference between Traditional and Roth IRA accounts based on your tax rates.

The DIFFERENCE between the Yearly Take-Home depends only on the difference in the income tax rates before and after retirement. It’s one thing say that, but you can analyze the formulas for yourself to see how it works.

How Does The Calculator Work?

Pre-Tax (Traditional) vs. After-Tax (Roth) Contributions from salary

The Basis for Yearly Contribution amount represents your pre-tax income that you plan to contribute.

Investments Grow Tax-Free Within Each Type of Account

One of the main advantages of BOTH account types is that the money is sitting in your account. You don’t have to pay tax on dividends or capital gains or interest earned. This is usually an advantage. It also means that if there is market crash, there is no tax advantage to selling stocks in your accounts at a loss.

Yearly Withdrawal During Retirement

For the retirement phase, we made the assumption that the full amount for the year may withdraw at the beginning of the year. Although this affects the amount of interest earned. The purpose of this calculator is to simplify the process of comparing the difference.

Tax on Withdrawals

Traditional IRA: You pay income tax on the FULL amount of the withdrawals during retirement. That is why the general rule of thumb is to use a Traditional IRA. If you think you will be in a lower tax rate during retirement.

Open Roth IRA: You pay NO tax on withdrawals during retirement, not even on the capital gains or interest earned.

It Boils Down To

I personally think that the ability to withdraw needed principal from the Roth for an emergency is a big advantage to the Roth. However, if we ignore this types of issues and look only at the basic math. Moreover the difference between the Traditional and Roth IRA boils down to just the difference in tax rates before and after retirement.