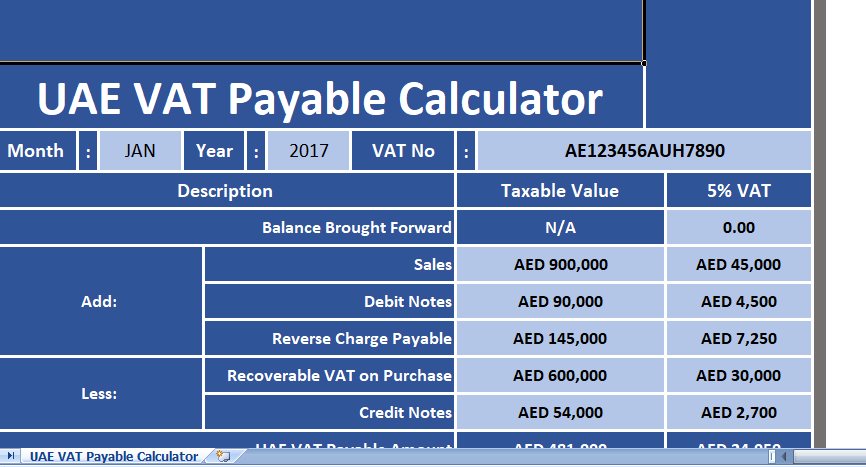

UAE VAT Payable Calculator provides you the exact payable amount of VAT to Federal Tax Authority (FTA).

When you make sales you collect VAT from customers. Credit Notes and Debit Notes issue against invoices are then adjust while calculating VAT payable.

You are entitle to recoverable VAT input on purchases use for taxable supply. So, This recoverable VAT input reduces your tax liability.

In addition to this, as per the UAE VAT Law, you have to pay VAT under reverse charge of some conditions.

Considering all the points we have create an excel template for GCC VAT Payable Calculator. You just need to enter the just the taxable amount and it will automatically calculate the VAT amount along with the exact payable amount to FTA>

Contents of UAE VAT Payable Calculator

The UAE VAT Payable Calculator consists of 3 sections:

- Header Section

- Calculation Section

- VAT Payment Section

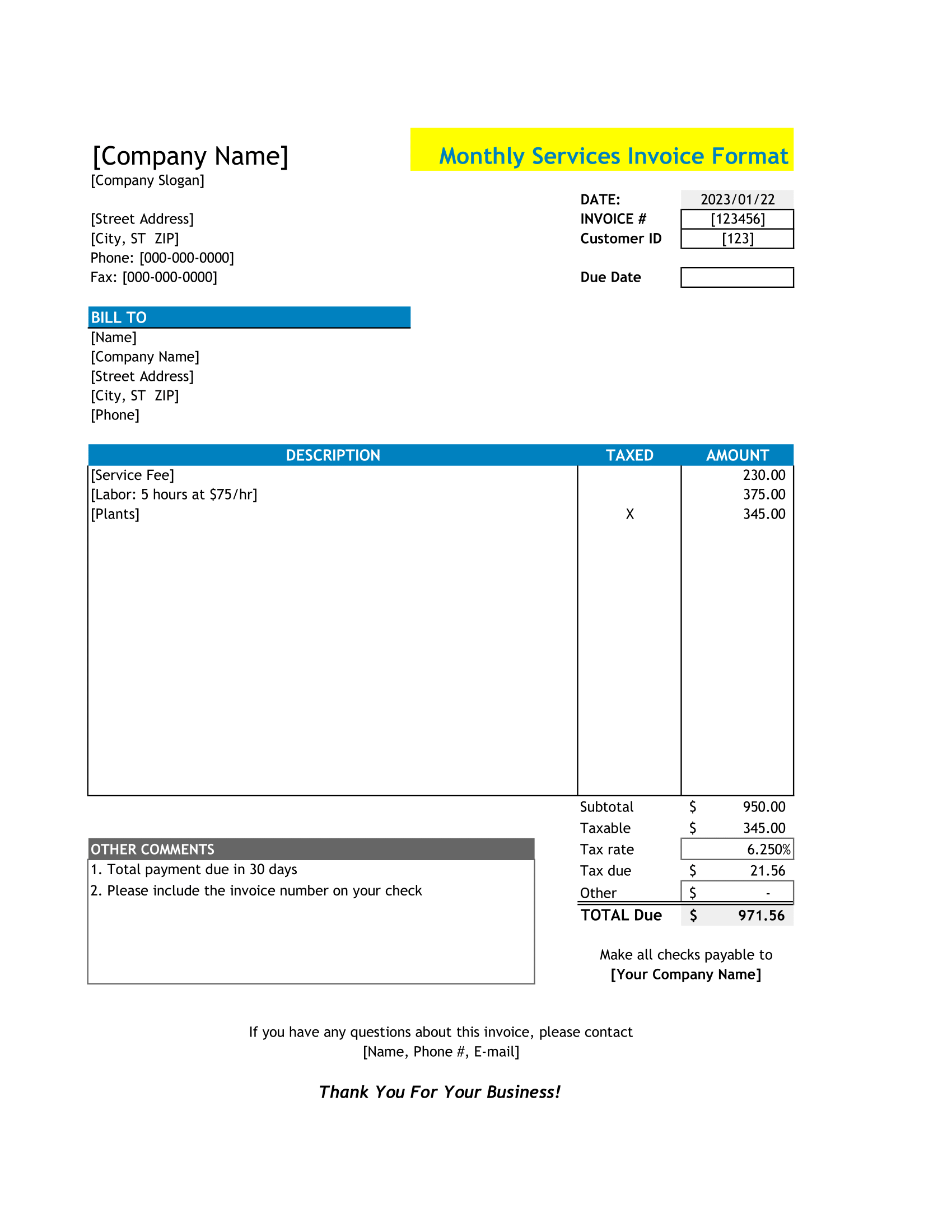

1. Header Section

The header section consists of your company name, company logo, month, year and VAT registration number.

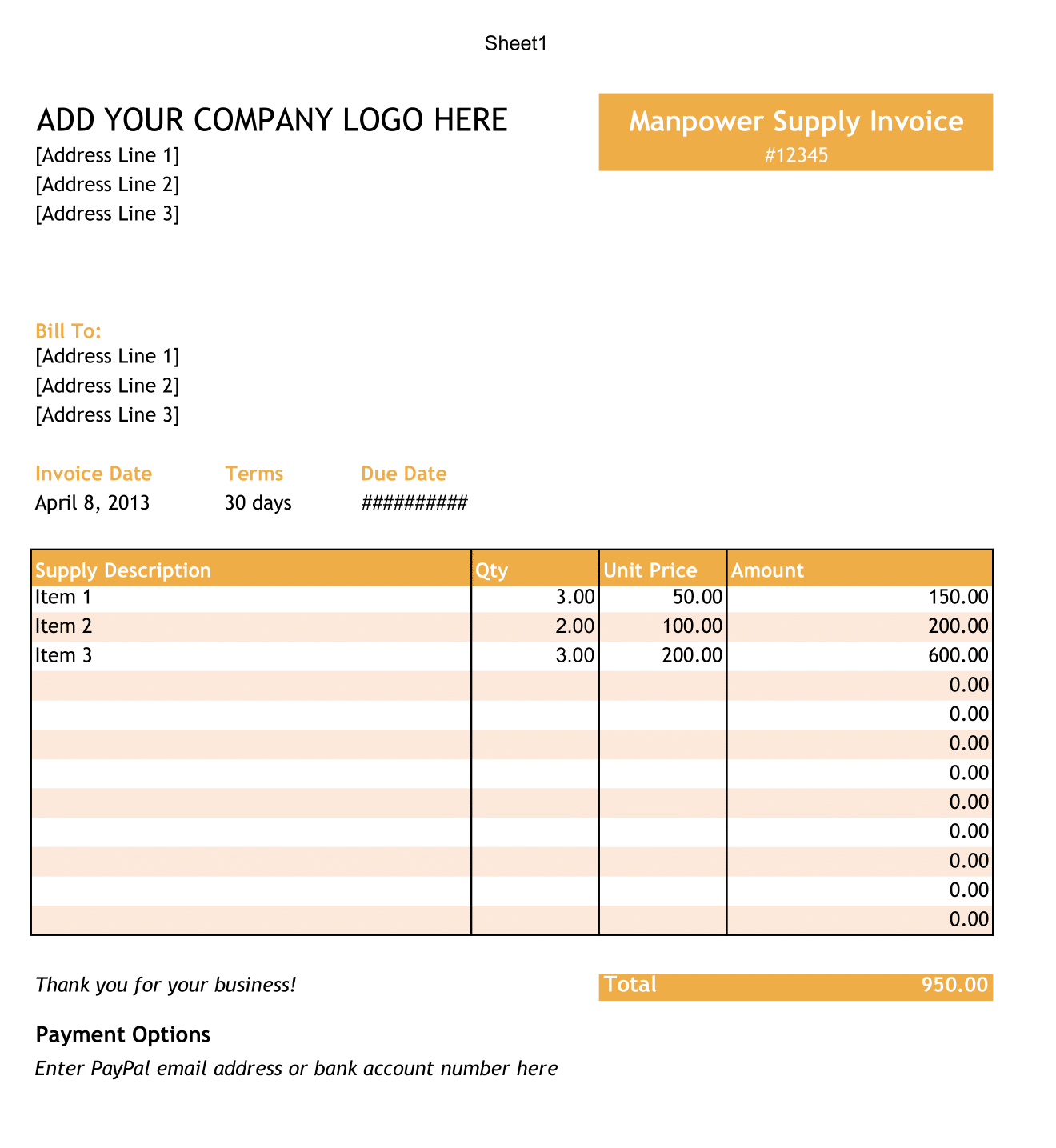

2.Calculation Section

Also, Calculation section consists of 3 columns. Description, Taxable value and 5% VAT amount.

Moreover, A user needs to enter amounts against each description and it will automatically calculate the applicable 5% VAT amount.

Balance Brought Forward: If there is any previous balance of VAT payable or recoverable VAT input then it should be mention here.

VAT payable will be a positive amount and recoverable VAT input will be always be a negative amount.

Sales: Enter the taxable amount remaining after discounts if any in this cell.

Debit Notes: If any debit notes are issue during the month then you will have to mention the total taxable amount of all the debit notes in cell.

Debit notes increase your liability so it increases your taxable value.

Reverse Charge Payable: If you have import any goods or reverse charge is applicable as per law then you have to enter the total taxable value of reverse charge in this cell.

Recoverable VAT Input: According to UAE VAT law, a registered business is entitled to claim VAT paid on purchases used for taxable supply.

Hence, you will have to enter the total taxable value of such purchases in the cell.

Credit Notes: So, If any credit notes are issue during the month you will have to enter the total taxable value of all credit notes in the cell.

Although, Credit notes decrease your liability as it reduces your taxable value.

UAE VAT Payable To FTA: Taking into consideration the UAE VAT Law, the UAE VAT payable to FTA is calculated.

Formula Applied:

Sales + Debit Notes + Reverse Charge Payable – Recoverable VAT Input on Purchase – Credit Notes

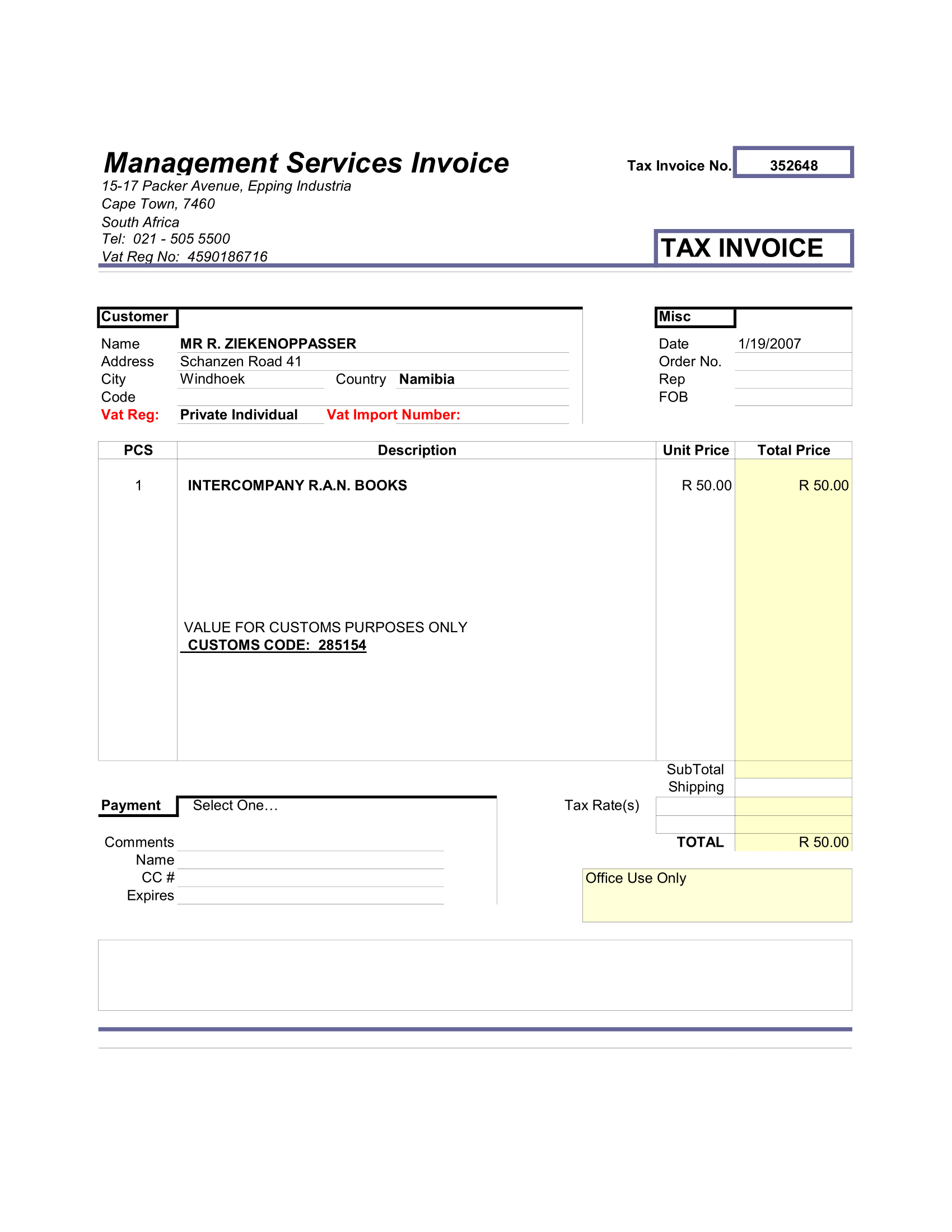

3. VAT Payment Section

VAT Paid: If UAE VAT payable amount a positive amount then you need to pay that amount to FTA.

Balance Carry Forward: Sometimes it happens that your recoverable ITC is greater than the amount payable. In such cases, UAE VAT Payable to FTA will be a negative amount.

Such excess amount can be adjusted in preceding tax periods and thus you can carry forward that amount.