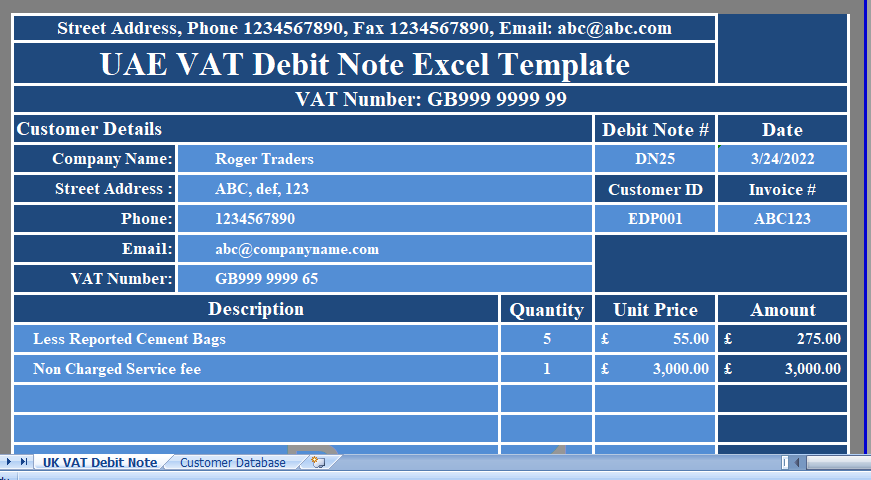

UK VAT Debit Note is an excel template that helps to issue a VAT compliant debit note when the goods delivered are less or tax collected is less.

A Debit Note is a document issue by a vendor when actual supply or taxes collect are less against the original VAT invoice. Debit note increases the tax liability as vendor reports less tax in the original invoice.

Hence, VAT on Sales + VAT Debit Notes = VAT Payable.

As per the UK VAT guidelines, we have create an easy UK VAT Debit Note Excel Template with predefine formulas and formatting. You can issue a VAT compliant debit note to your vendor using this in just a few minutes.

Contents

This template contains 2 sheets: UK VAT Debit Note Template and Vendor Database Sheet.

The Vendor database sheet consists of vendor details such as vendor id, vendor name, vendor address, vendor phone, vendor VAT number, and email address.

The purpose of creating this sheet to save time and simplify your work. You need to update the database sheet only once with vendor details as per the requirement.

Furthermore, a drop-down list is create using the data validation function. When you select the vendor name from the dropdown list, it fetches all the relevant details using the VLOOKUP function.

UK VAT Debit Note Template

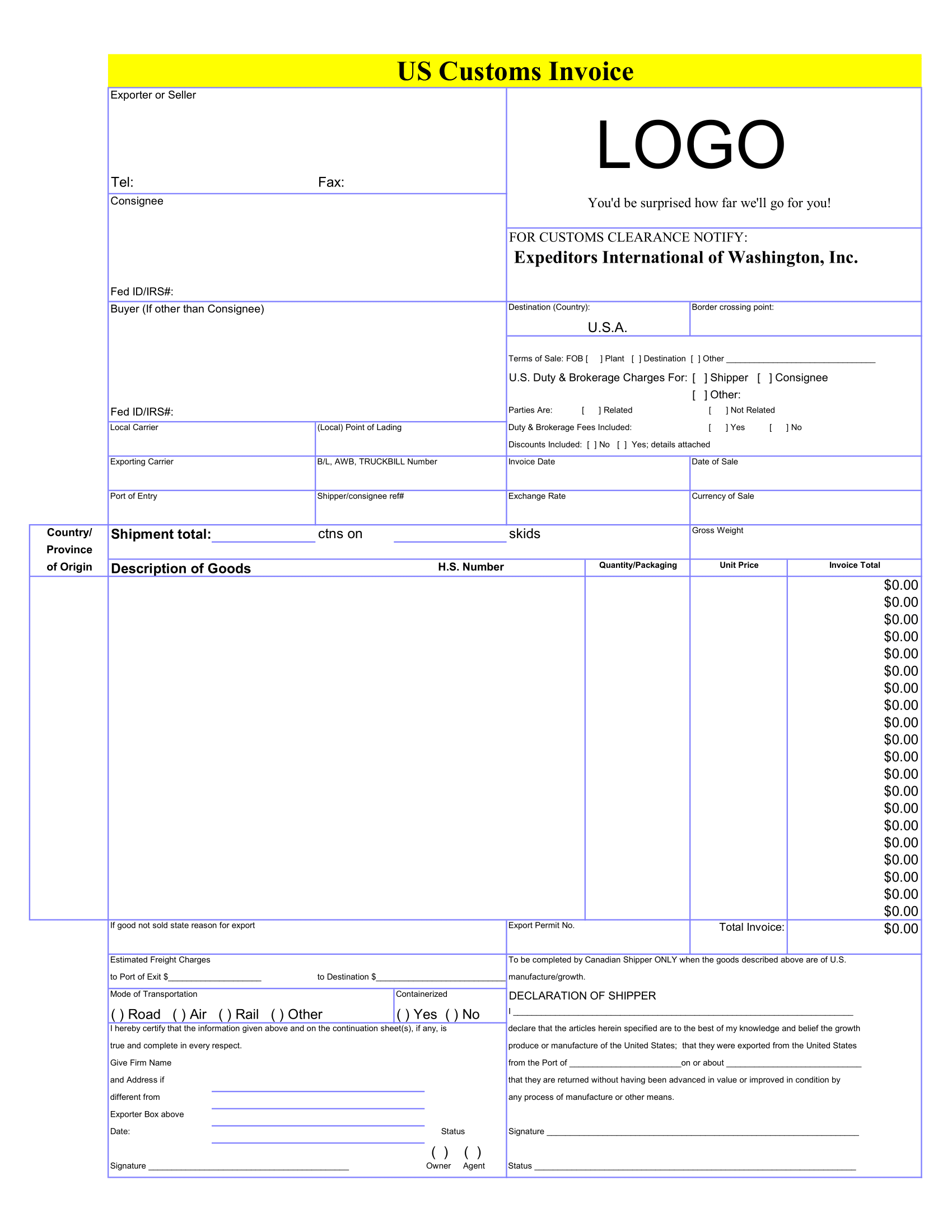

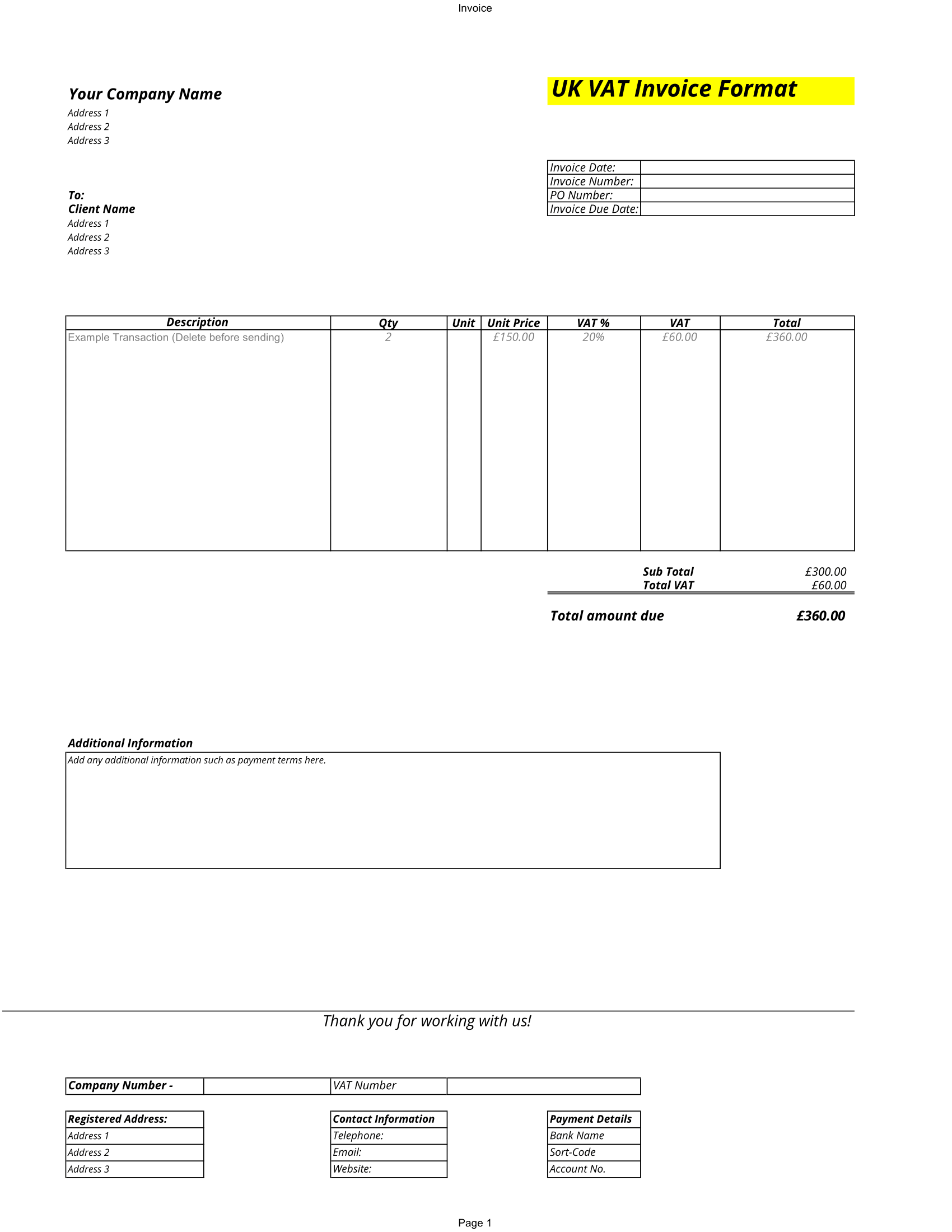

There are 4 sections in the UK VAT Debit Note Template: Header Section, Vendor Section, Debit Note Details Section, and Other Detail Section.

Header Section

The header section consists of the company name, logo, address and VAT number.

Vendor Detail

Vendor detail section consists of the following:

Company Name

Street Address

Phone

Email

VAT Number

Debit Note Number

Date

Vendor ID

Invoice Number

Furthermore, this section is interlinked with data validation and the VLOOKUP function to the database sheet. Just select the name of the vendor and this section is automatically filled.

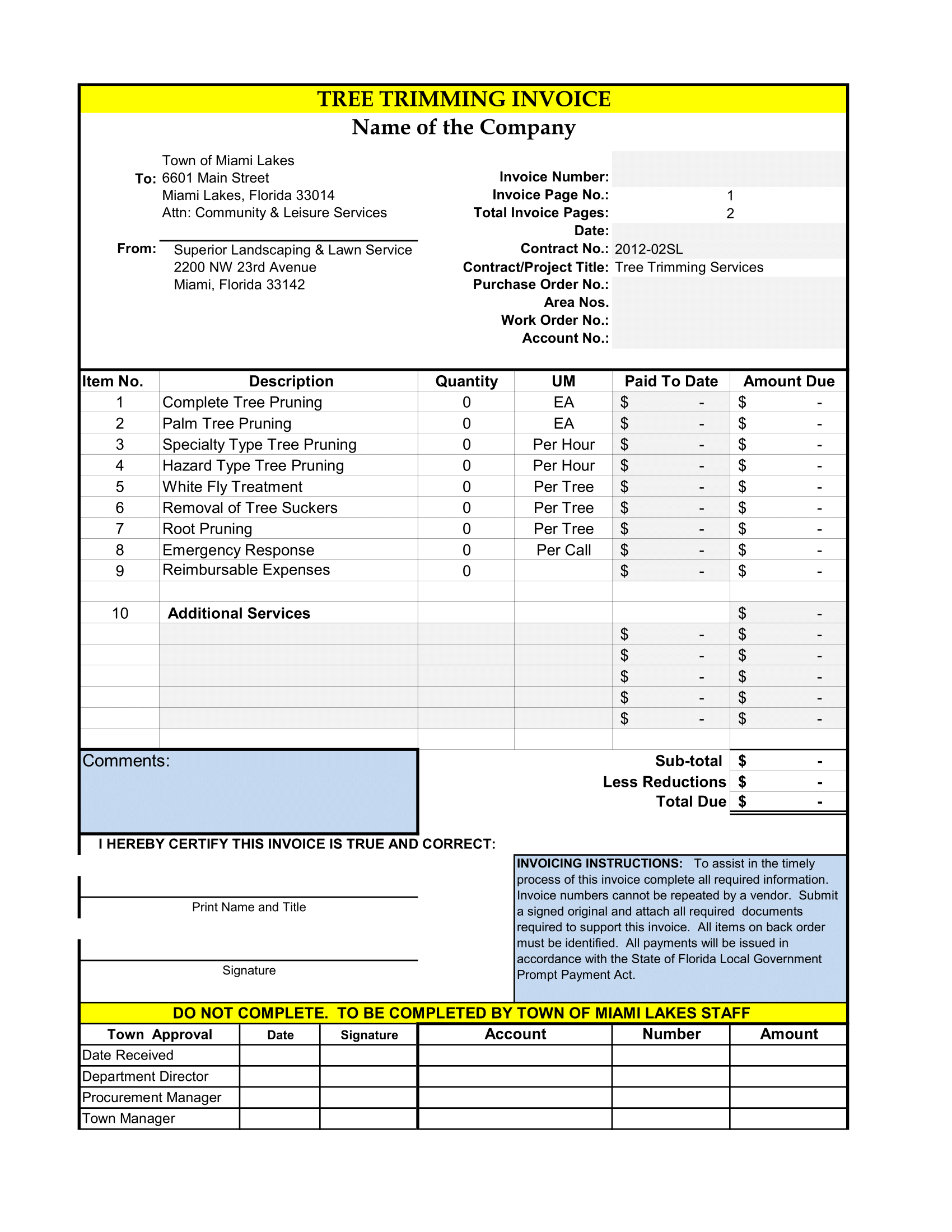

Debit Note Detail

Insert the details of underbilling or unreported tax in this section. This section consists of columns like Description, Quantity, Unit Price and Amount

Quantity X Unit Price = Amount.

Other Details

Other details section consists of invoice summary and other details.

Amount in words: No need to insert anything here. It will automatically convert amount in words using Spell Number GBP.

Terms & Conditions: Insert your debit note terms and conditions.

VAT computation: Insert the VAT percentage manually. The VAT amount is calculated based on the percentage.

Taxable Amount X VAT % = VAT Amount

VAT Amount + Taxable Amount = Final Invoice Amount

Print the invoice and then put your company seal as well get it signed by the authorize signatory.

Your VAT Compliant Debit Note is ready to use. This template is useful to small and medium scale businesses to issue a debit note to their vendors.