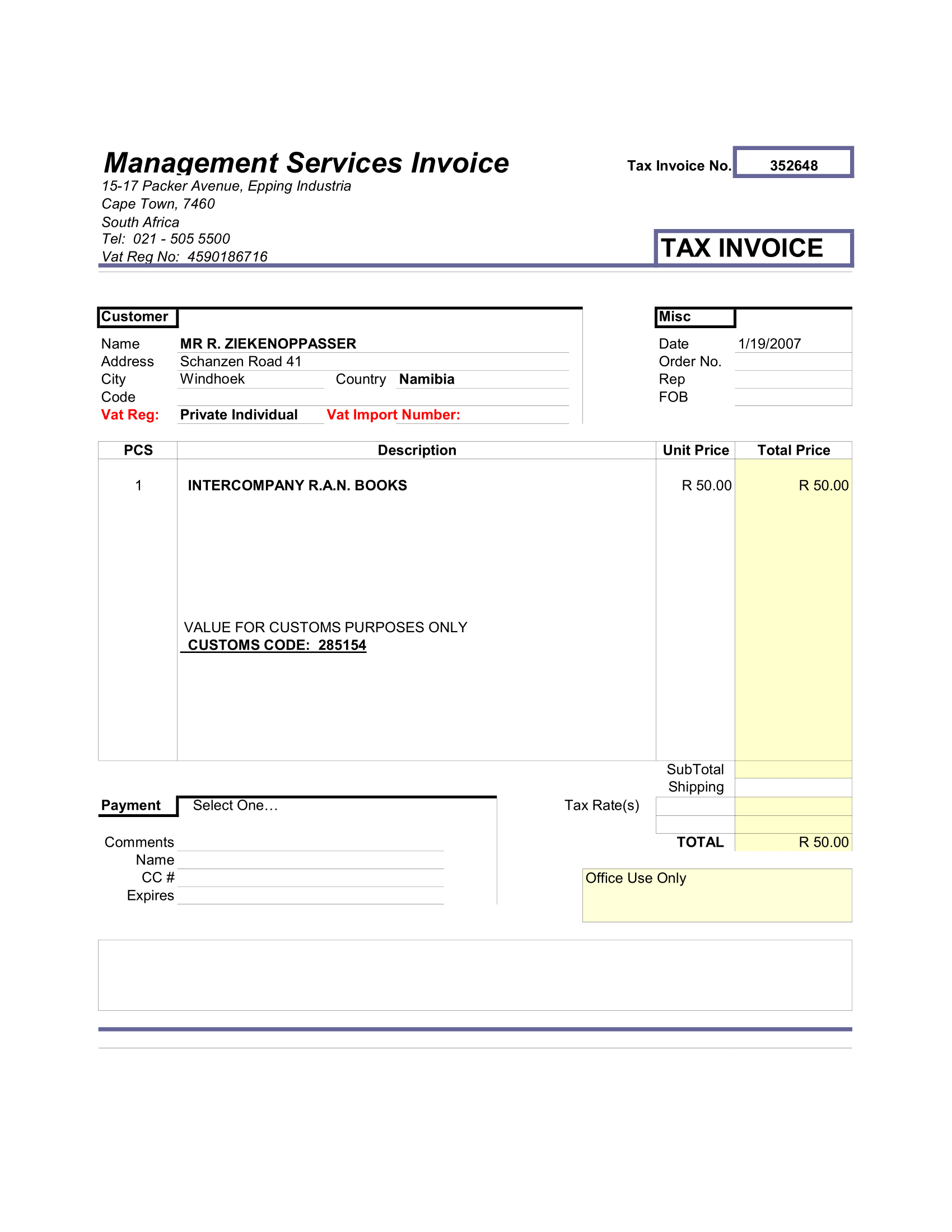

UK VAT Multiple Tax Invoice is ready-to-use excel template to issue an invoice for goods or services having multiple tax rates.

If you have commodities that have different tax rates or exempt all in one invoice.

Usually, traders deal with goods and services of all kinds of VAT. Some of them are taxable and some of them are non-taxable. Such supply is called mixed supply.

The best example is a garment shop. Clothing of adults has standard rate (20%) applicable whereas children’s clothing is on reduce rates (5%).

According to second last guideline, the rate of VAT charge per item must be shown in case the VAT applicability is different on those items.

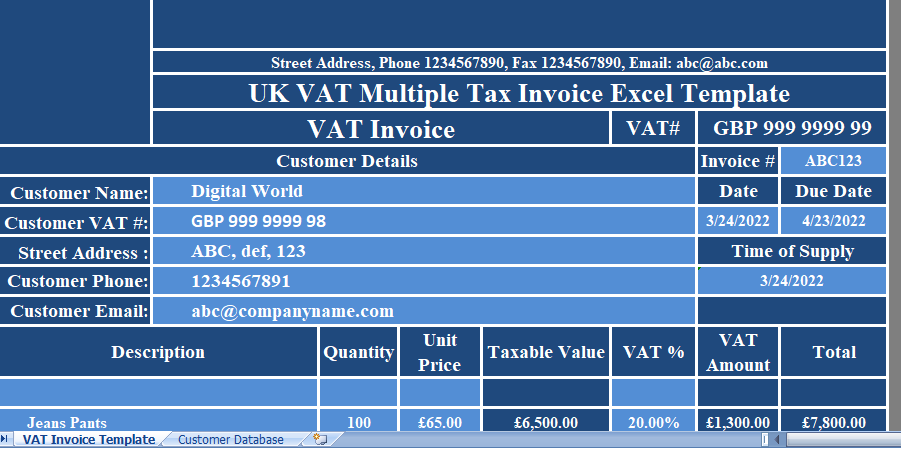

UK VAT Multiple Tax Invoice Excel Template

We have create the UK VAT Multiple Tax Invoice in Excel with predefine formulas and formatting. Business units making mix supply or supplies of goods or services or both can use template to issue an invoice to their customers.

All you need to do is just enter company details in the heading section and start using it.

Contents of UK VAT Multiple Tax Invoice Template

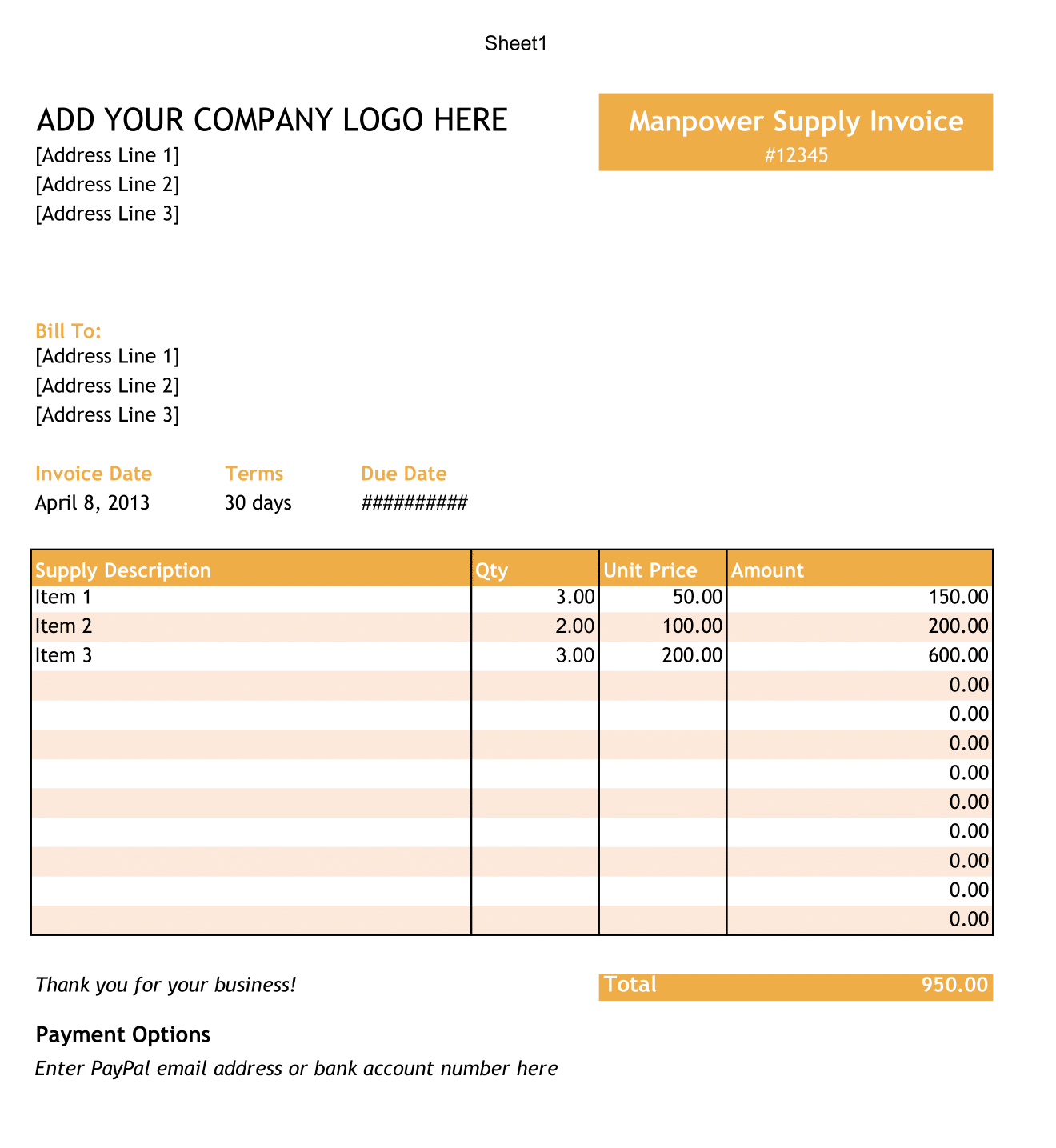

UK VAT Multiple Tax Invoice template consist of 2 sheets: UK VAT Multiple Tax Invoice Template and Customer Database Sheet.

Customer Database Sheet

The customer database consists of relevant details of customers like the company name, address, contact details and VAT numbers, etc. You just need to insert details once in this sheet. Update a new customer whenever is added to your business.

Details in Customer Database sheet is use to create a dropdown list in invoice template. Using the VLOOKUP function, when you select customer name, the invoice automatically fetches all customer information on invoice.

UK VAT Multiple Tax Invoice Template

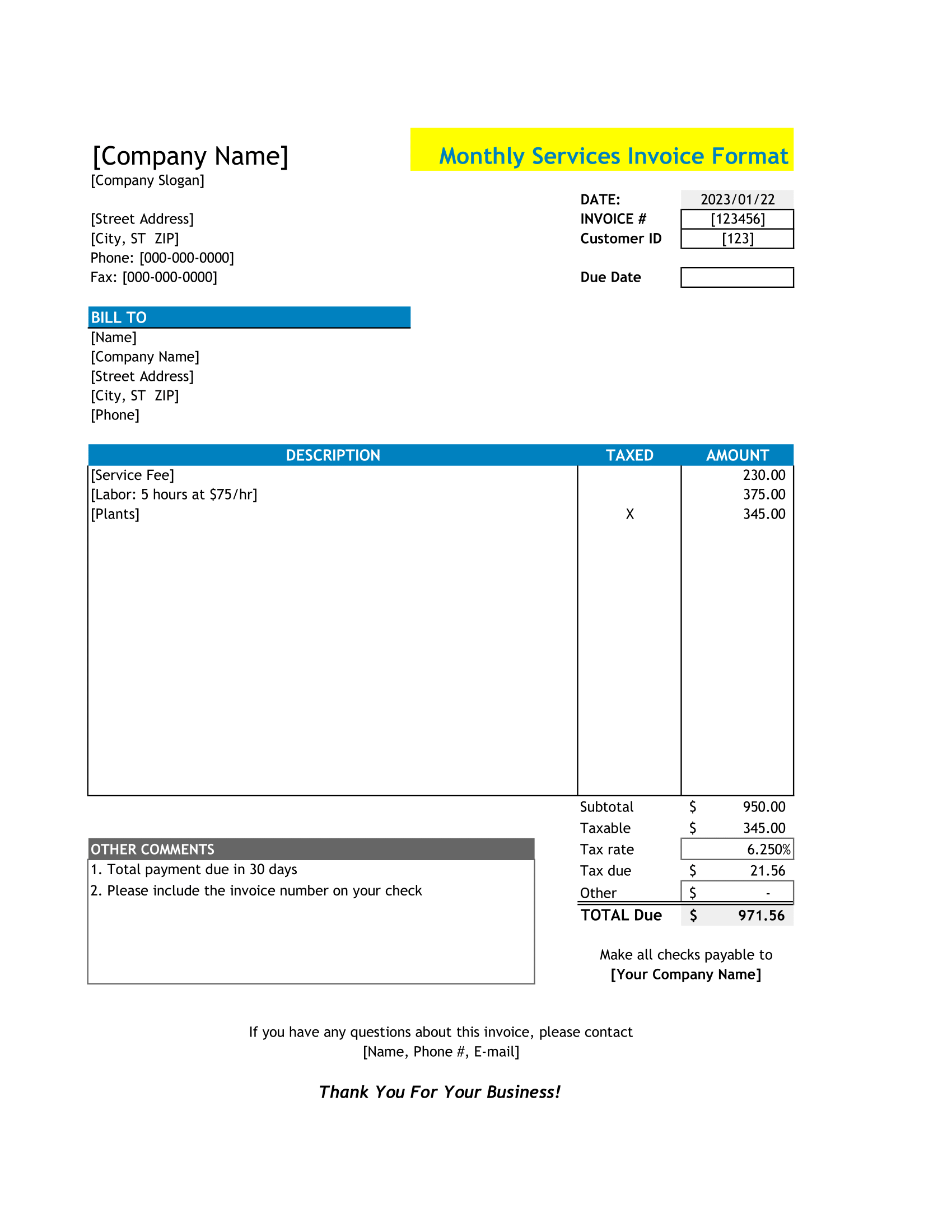

This Invoice Template consists of 4 sections: The company logo, company address, VAT number, invoice title as “VAT Invoice” etc.

It is mandatory to mention your VAT Registration Number in invoice.

Customer Details

Moreover, The customer’s details section includes name, VAT number, address, phone number, email address, etc of your customer.

Furthermore, Select name of the supplier and it will automatically fetch details from the customer database sheet.

In addition, this section on the right-hand side consists of Invoice number, Date, Time o Supply and Bill Due Date.

Bill due date is set for 30 days. In case, the payment made in cash or against invoice then you need to delete data in the cell.

The Time of Supply cell automatically fetches date of the invoice assuming that invoice is issue along with the supply. If it is different then you have to enter it manually.

Product Details

Usually, product details consist of product description, quantity, unit price and amount. This being a multiple tax invoice, a separate column for tax percentage is given after taxable value.

The following method of calculation is used for calculating the values:

Taxable Value = Quantity X Unit Price

VAT Amount = Taxable Value X VAT Percentage

Total = Taxable Value + VAT Amount

Invoice Summary and Other Details

However, Other details include miscellaneous items like “Amount in Words”, Terms & Conditions, Business greeting, space for company seal and authorized signatory along with invoice summary.

Total Taxable Value + Total VAT Amount – Discounts(if applicable) = Invoice Amount.

Moreover, In case of any discounts, insert the percentage of discount in the light blue cell beside discount cell. It will automatically calculate the amount for you. If the discount offered is in terms of direct amount, then enter the amount manually.