The sales invoice is the most common register in the business world. It is an important record for both the seller and the client. Essentially used in the management and bookkeeping of any business.

An invoice is a business register issued any time a sale takes place. For instance, Doctors issue invoices after a patient’s appointment, and companies issue invoices when a client places an order.

However, A sales invoice is an accounting document that registers a business transaction. Invoices provide the business with a record of the services they’ve provided to a client, when the services were offered and how much money the client owes the business management. Generally, a sales invoice includes an explanation of the service provided, the amount owed, and the deadline for wages. Moreover, Sales invoices are crucial to small-business bookkeeping because they enable you to record transactions for sales purposes.

So, we have created a simple, free and Handy Spreadsheet for small-business sales purposes.

How to Create Sales Invoice in EXCEL

Sales invoices are handy registers that tell your clients what they bought from you, or when they placed their order. The invoices also help the business manager to track profits—and ensure they’re paying the IRS the right amount come tax.

So whether you sell products (like Clothes) or services (like Wedding management), invoices are among the important ways to make sure you get paid. Let’s categorize them below.

Paid back fully and in time, starts with distribution of clear and accurate invoices to your clients.

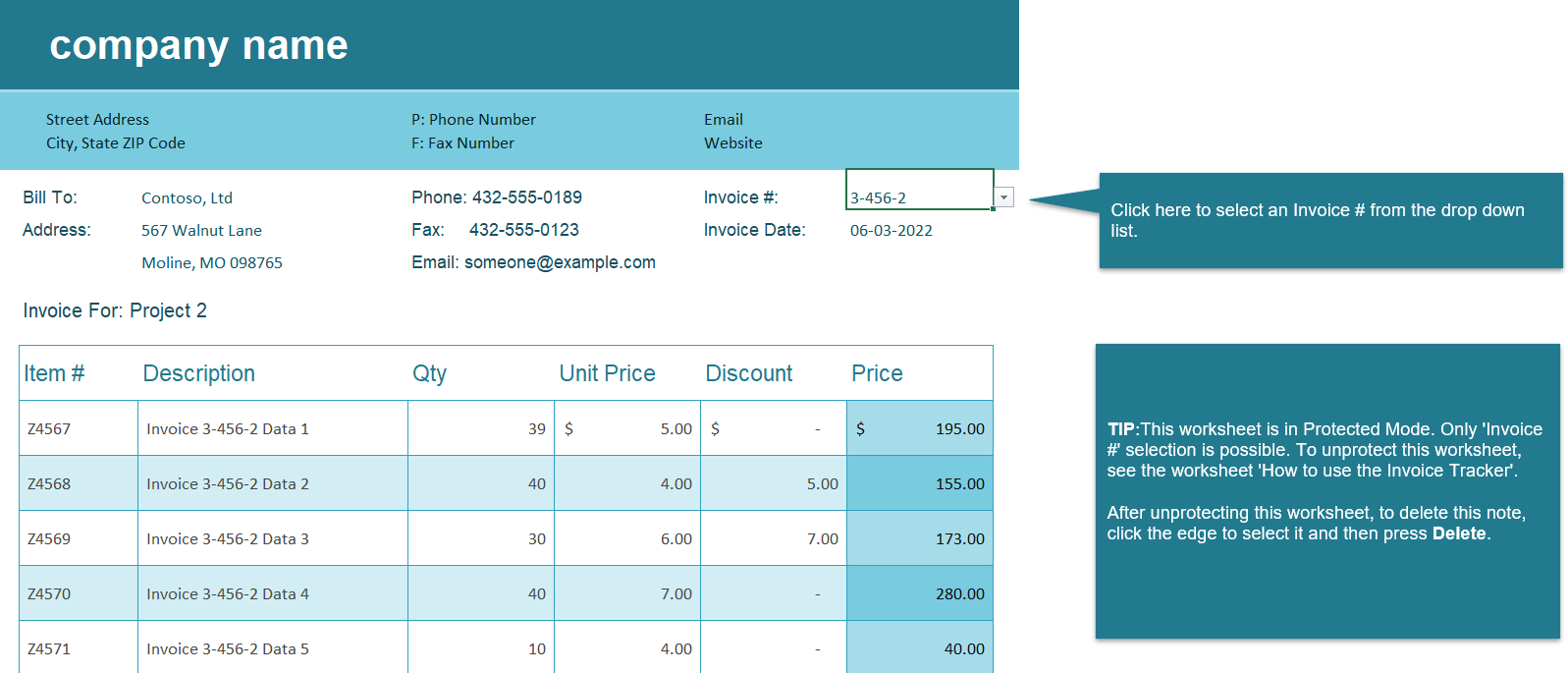

Our templates usually come with premade instructions that guide you through what each section of the register needs to include. Simply, the design can be easily personalized with your colors, logo, and preferred font.

The Columns Includes-

Edit and Customize your Invoice Template

An invoice template should always include:

Customers-

Company or Organization name, and contact information

Client name and contact details

Invoice Main-

Invoice Date

Project Description

Tax Rate

Amount Deposit

Invoice Total

Invoice Details-

Description of Products and Items

Quality

Price and Discount

Invoice issue date

Payment due date

Unique invoice number

Payment terms

Any taxes or discounts

The total amount due

Subtotal for every product

Finally, the last part is to save the invoice details. A popup will appear and ask you to name the invoice and to choose the type of format to save it in.

IMPORTANCE OF SALES INVOICE

The uses of a sales invoice are directed within the information they contain. It is a proof of purchase for both parties and can be a means of protection for the consumer, and they contain detailed pricing information about the items purchased. Simply, making it easier for the buyer to understand the transaction and charges.

- Accurate Bookkeeping

- Sources for Tax Returns

- Legal Protection

- Inventory Management Tool

- Business Details and Data

- List the services and products you provide

- Provide Payment Terms and Due Dates

- Total Amount you owe

Help you pay the right amount in taxes.

Provides an accurate record of your business’s income.

Track how much inventory to keep in stock by detailing how many goods you’ve shipped.

Protect your IRS audit or customer complaints about services rendered. Because It always pays to have physical evidence.