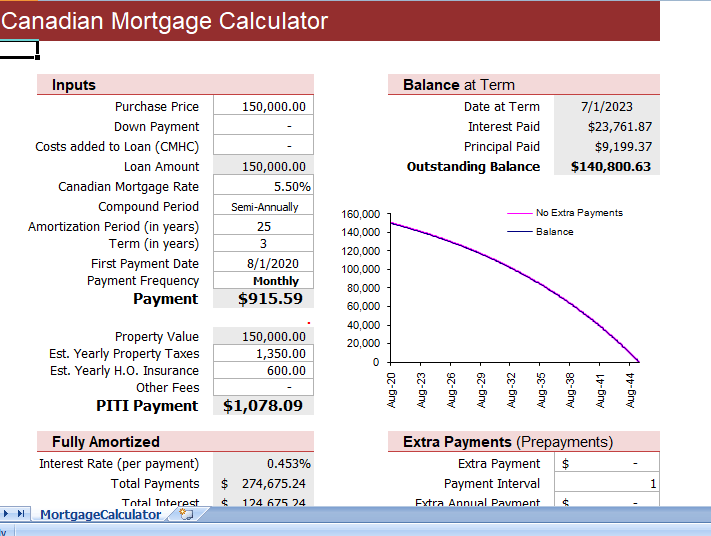

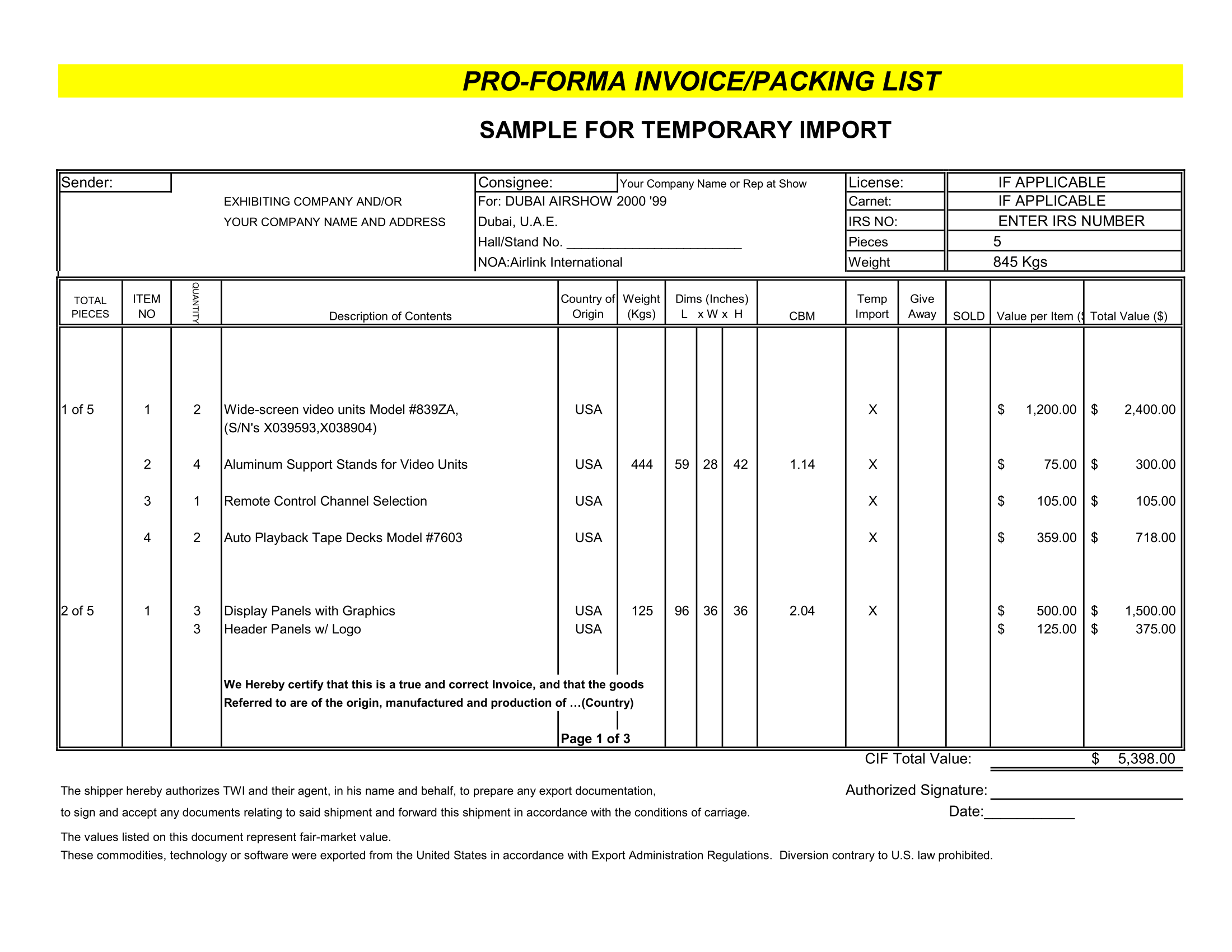

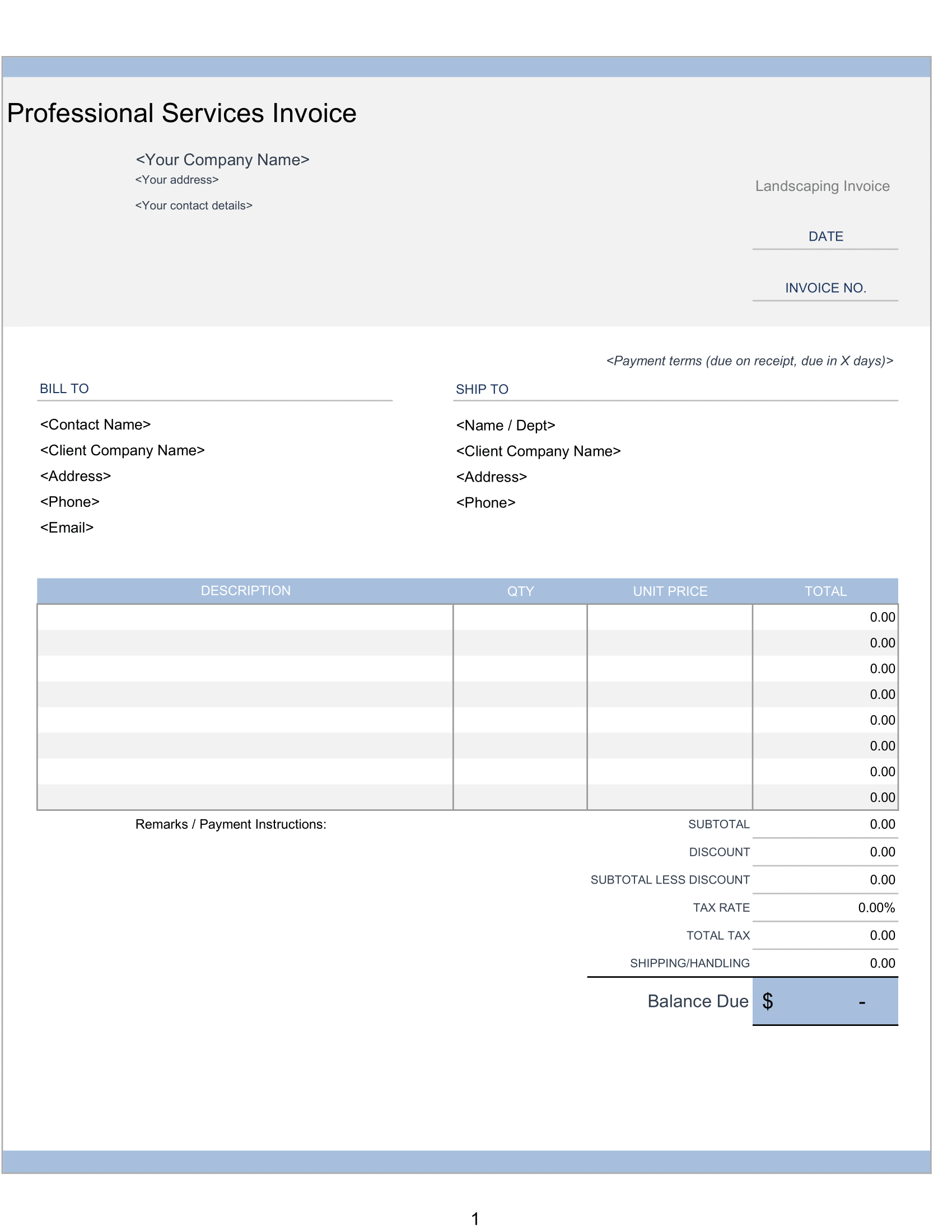

Download feature-packed Canadian mortgage calculator spreadsheet! This Microsoft Excel template lets you choose a compound period (e.g. semi-annual for Canadian mortgages) and also a variety of different payment frequencies (annually, semi-annually, quarterly, bi-monthly, monthly, bi-weekly, and weekly). Moreover, It lets you see how making periodic extra payments can save you money and help pay off your mortgage sooner. You can also calculate outstanding balance at end of a given term.

Canada Mortgage and Housing Corporation

Calculate payment and outstanding balance for a Canadian mortgage using this calculator. It allows you to specify the mortgage term, periodic extra payments, compound period, and payment frequency (including weekly and bi-weekly payments). The amortization schedule lets you add unscheduled additional prepayments.

How to Use the Canadian Mortgage Calculator

The spreadsheet is pretty self explanatory, and many of the cells contain pop-up comments that will provide information about inputs and calculations. Basically, you just enter the values in the white-background cells, and see what happens to the payment, total interest, outstanding balance, etc. To add irregularly scheduled prepayments, enter the numbers in the “Additional Payment” column (yellow cell background).

What is Unique About Canadian Mortgages?

From this I can tell (having never actually lived in Canada), there are two main differences between Canadian and US mortgages:

- The Canadian mortgage rates are quote are base on a semi-annual compound period. The rates for US mortgages assumes a monthly compound period.

- With a Canadian mortgage, your rate usually depends upon Term that you choose (e.g. 6 months, 1 yr, 2 yr, 3 yr, 5 yr, 7 yr, or 10 years). Which is essentially length of time that you are under contract for the specified mortgage rate.

Most Canadian mortgages are portable, which means that if owner moves before five-year term is up. They can choose to apply their old mortgage to new home. Moreover, If it’s a more expensive home, it is also possible to take out a new loan for the difference.

Therefore, A mortgage allows the option of building up a cash account. Thus principal is amortize, the store funds is use as a source to take out cash when needed, and borrowed without charge. So, After use, the amounts are simply added back to the mortgage principal.

There are also options for flexible or skipped payments.

Royal bank of Canada mortgage rates

BMO military mortgage rates

Canada mortgage housing corporation