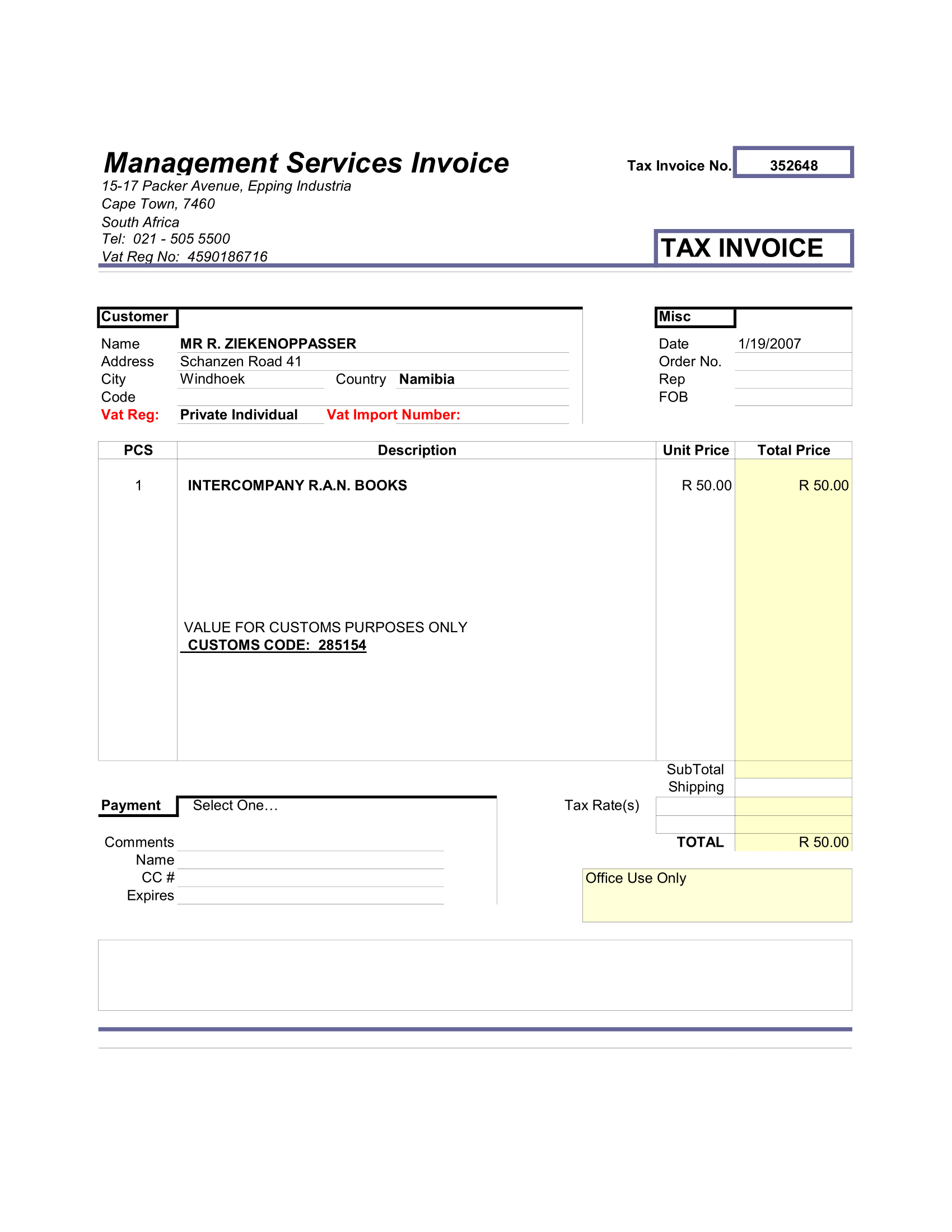

Company Cash Flow Planner spreadsheet is to plan more detail about your company cash flow. It fits small business companies who manage their tight cash flow where their expenses depends upon their income. This spreadsheet should complement your cash flow budget spreadsheet. Cash flow budget spreadsheet usually doesn’t have details on exact income and expenses dates. You may see its balance is positive but in reality you have to spend your money before getting paid at each end of particular month.

Cash Flow Planner in Quickbooks

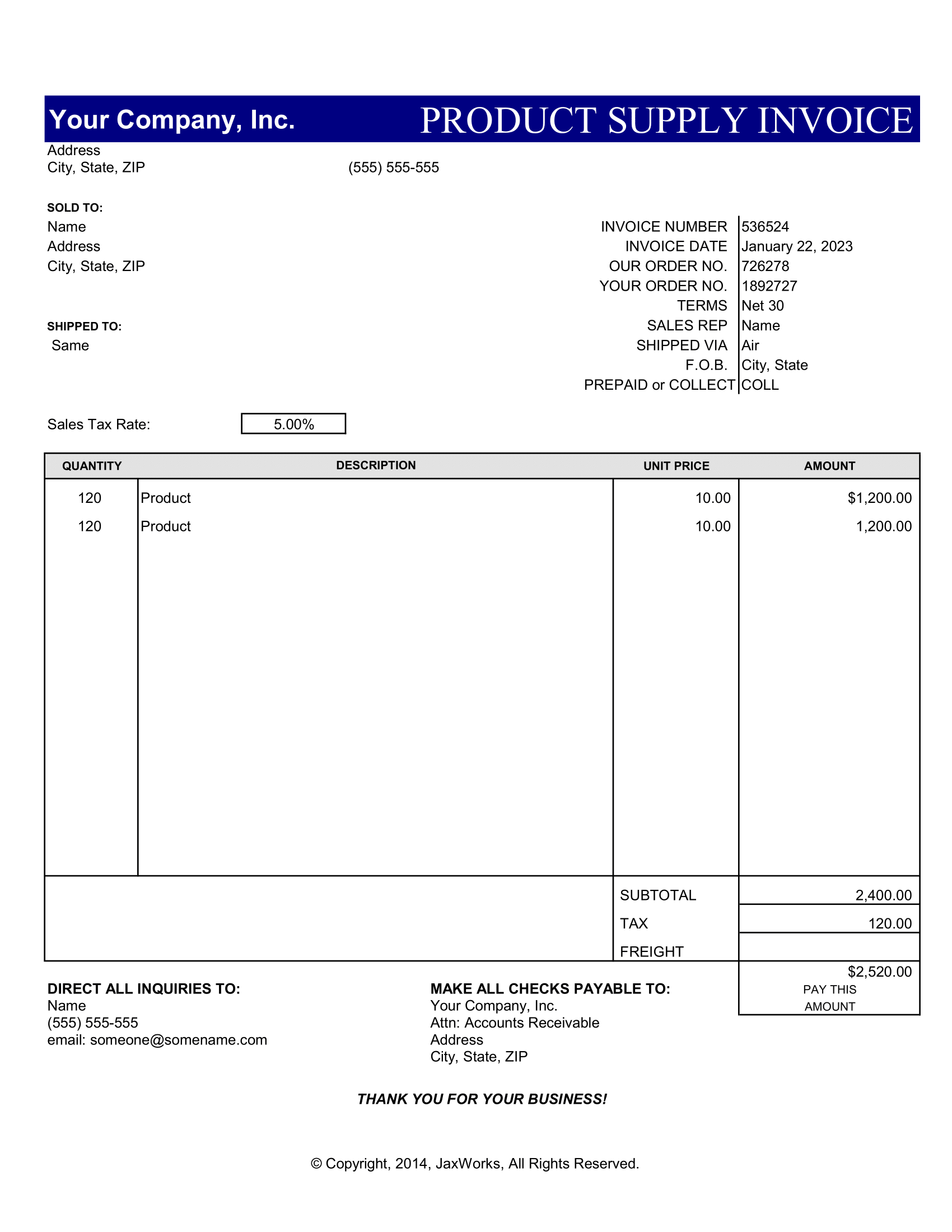

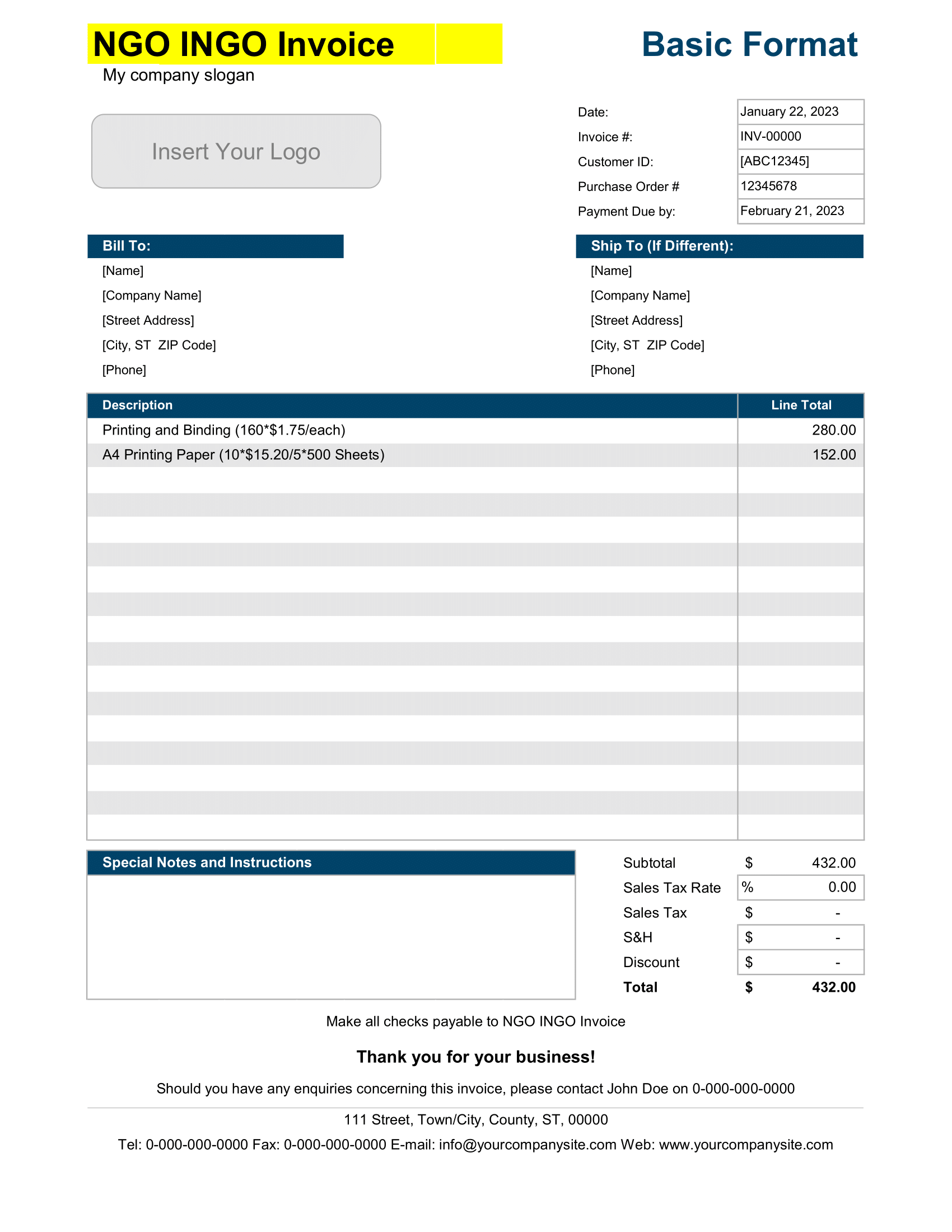

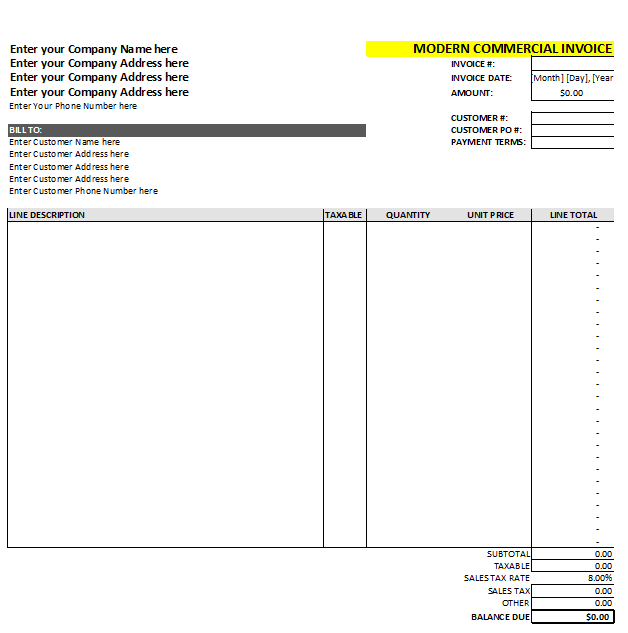

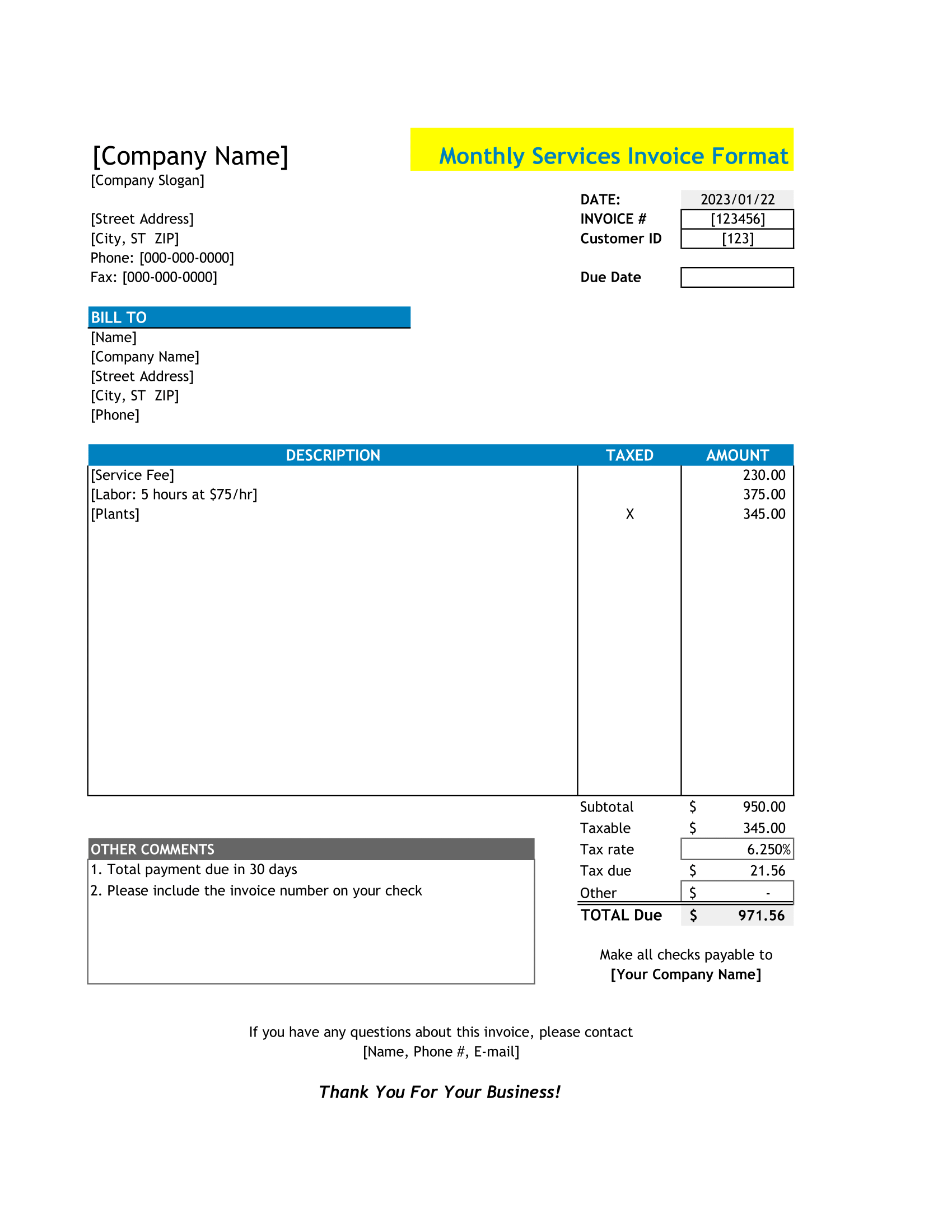

This company cash flow planner spreadsheet will solve your payment timing issue. You can break your income and expenses down into dates and days. You can put exact invoice and purchase order payment dates as well as other regular expenses like salaries, office rentals, etc. With exact dates and days, you can push your customers to pay it on time or set earlier due dates. You can negotiate payment with your suppliers as well.

Moneyflow Planner

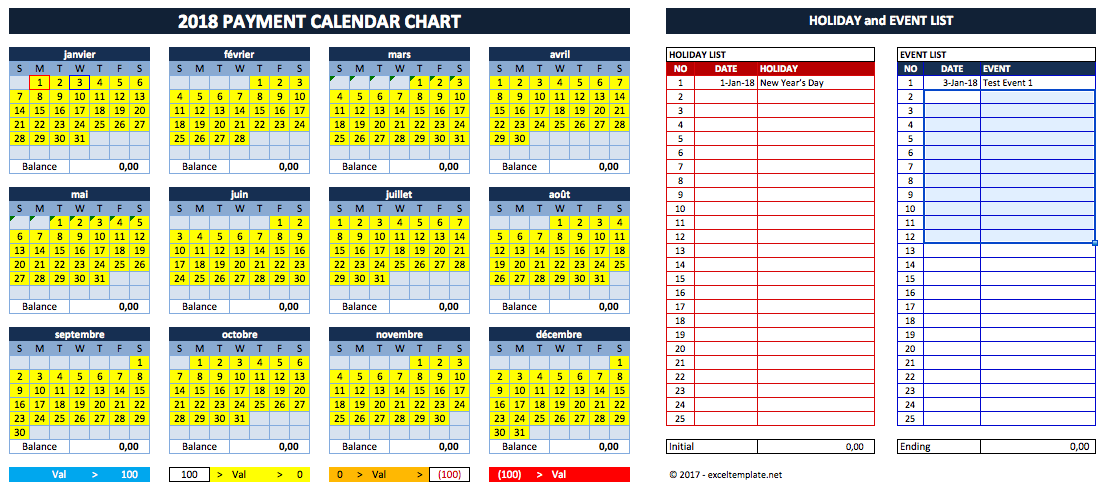

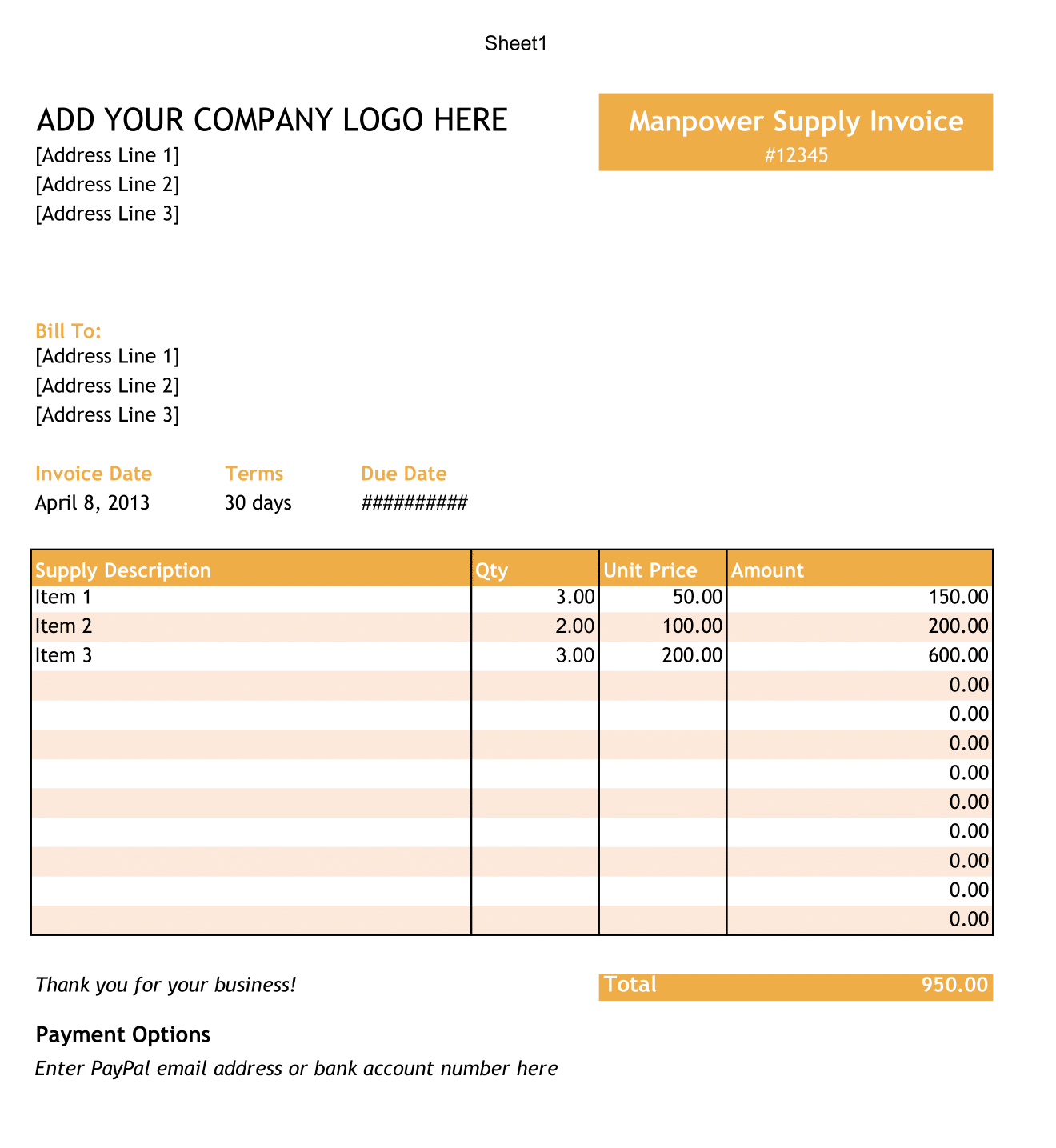

This spreadsheet has monthly and weekly cash flow summary in calendar style. You can set your threshold values to see your company’s financial situations daily. Also, if your company has weekly positive balance policy, you can organize all of your payment easily.

With recurring dates and days features, you don’t have to type your recurring income and expenses each week or month. You type them once, and excel formula will help you distribute it to whole months automatically. To complement that feature, you can put exception dates and days for particular transaction. For example, your customer pay your invoice 3 times within 3 months, you can separate it by typing different dates and amount on those particular dates. You can apply it for your company expense. In addition, you can set it on weekly basis as well. For example, if you have to pay your part time employees weekly, you may put recurring payment days, like Friday and move it earlier if national holiday falls on Friday.

This company cash flow planner spreadsheet fits company that :

- has tight cash flow situation

- needs to manage recurring income and expense

- wants to see their monthly and weekly financial profile

HOW TO USE CASH FLOW PLANNER SPREADSHEET

To use this spreadsheet, you can start by setting the company financial year period in Payment Planner worksheet to prepare all tables for one full year. You can separate your recurring transaction in Monthly and Weekly tables.

This worksheet where you can put your income and expenses details. All data in this worksheet will be sorted and placed in particular dates in Weekly worksheet. There are maximum 30 items in each date column. As a result, you can see summary of all transactions in calendar view model where you can see your cash flow performance in blue, red, orange and yellow colors. You can see your company’s cash flow performance in weekly tables next to monthly calendar table. There are 53 weeks. Amount from dates before and after current year period will not calculate although you might see it in Weekly worksheet. You can always fine tune your transaction inputs in payment planner worksheet.

In conclusion, there are three big parts where you can work and review your company’s financial transactions. Those are :

- Income and expenses entry data area to put all of the company financial transactions. You can input maximum 200 transaction item per income/expenses table.

- Five weeks financial transaction view. You can see maximum 30 rows per date/day.

- Daily, weekly and monthly cash flow summary.

Monthly personal cash flow planner will organize transaction in monthly calendar view. All shown worksheets are fully editable.