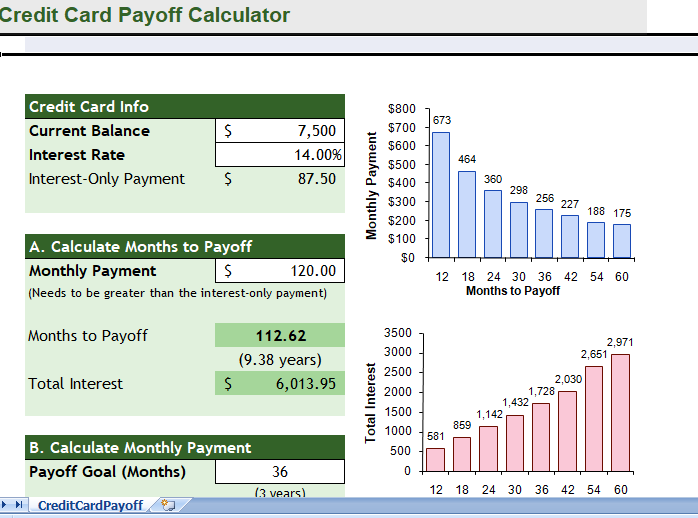

Download free Credit Card Payoff calculator for Microsoft Excel that will calculate the payment required to pay off your credit card in a specified number of years, or calculate how long it takes to pay off your card given a specific monthly payment. You can also use our new calculator, but if you want to see how the formulas work.

Credit card payoff calculator excel

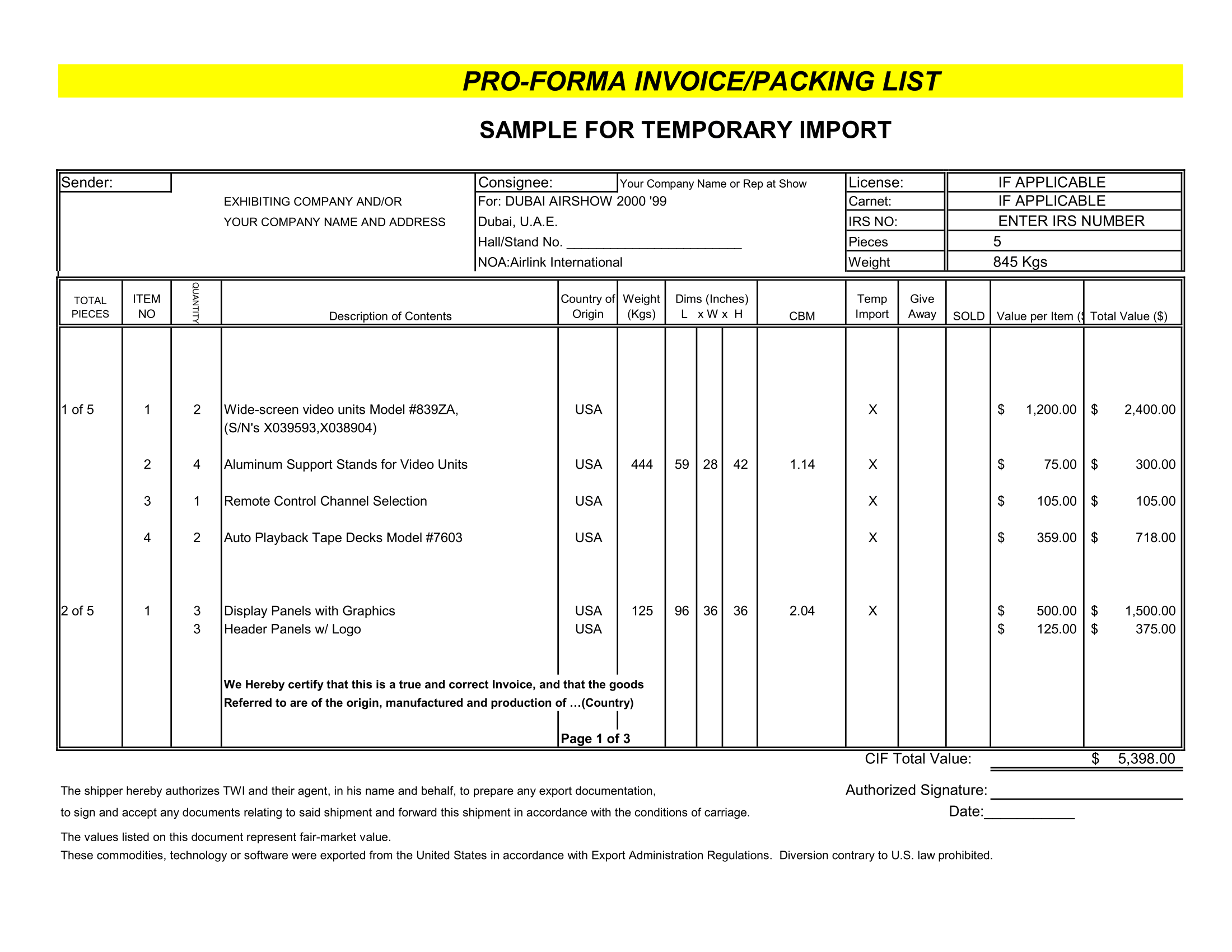

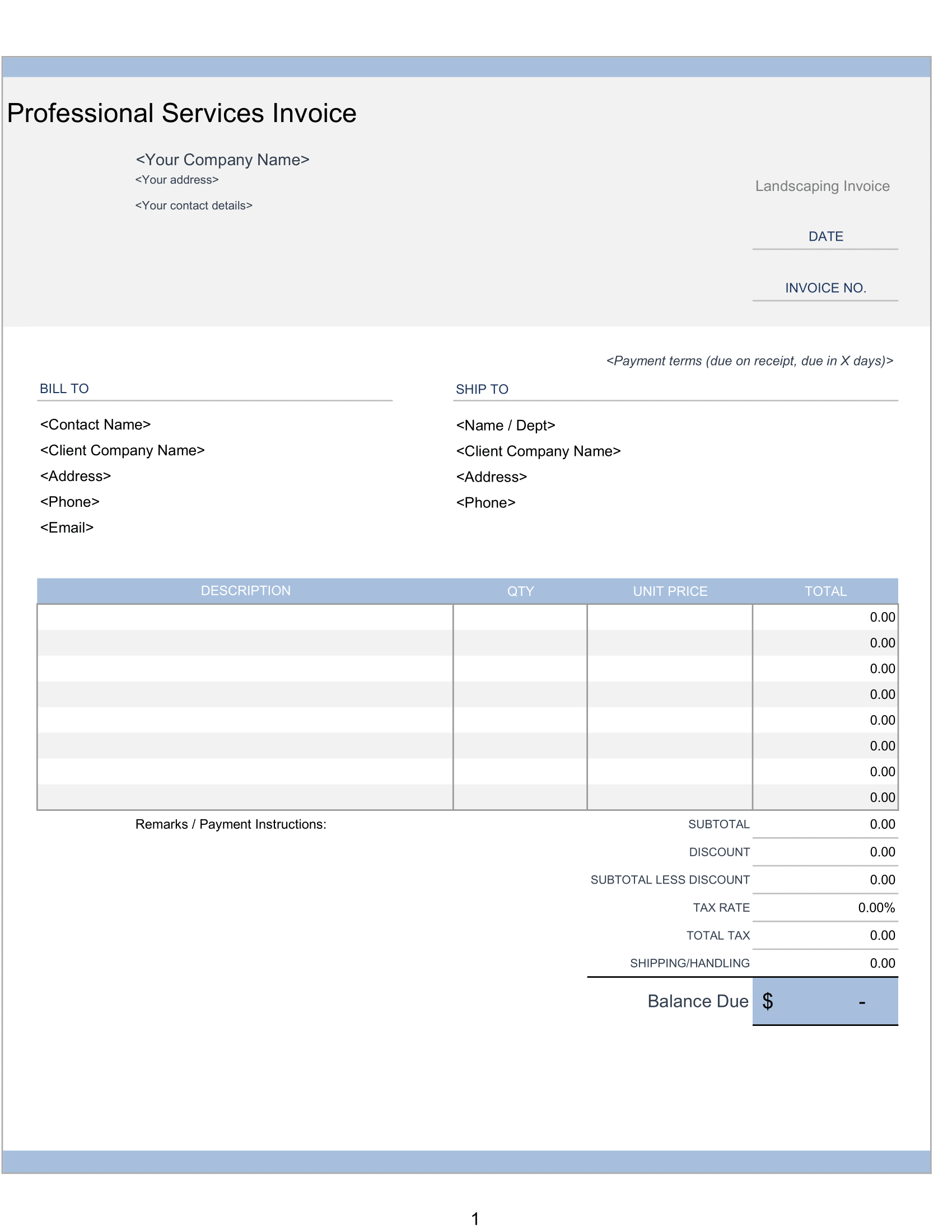

What will it take to complete pay off the balance of a credit card at the current rate of interest? Enter the current balance and interest rate. Then, you can enter a monthly payment to calculate how many months it will take to pay off the credit card, or enter the payoff goal to calculate what your monthly payment to meet the goal.

Pay down credit card calculator

The following details explain how the calculator works:

Current Balance: The calculator assumes you are paying off your unpaid principal. If you are actively using a card, then purchase in the past month usually have a grace period of a month before interest is charge. This calculator does not take into account the grace period for the recent charges.

Interest Rate: Unless you know to do, enter the Annual Percentage Rate (APR). Most APRs will fluctuate over time, and can affect by late payments and other factors, but this calculator just assumes a fixed interest rate.

Interest-Only Payment: This is an estimate of monthly interest due, calculated by multiplying the current balance or by the monthly interest rate. The monthly interest rate is the annual rate divided by 12. Your monthly payment needs to be larger than the interest-only payment, or you can never pay off card.

Monthly Payment: If you want to calculate the Month to Payoff, then you have to enter the monthly payment amount. It is a fixed payment, means it does not change. It is not a minimum credit card payment, which can decrease over time as the balance decreases.

Months to Payoff: If you want to set a goal for when to have your card pay off, enter the number of months instead of monthly payment. The Monthly Payment will be calculated.

Total Interest: This is an estimate of the total interest paid in time the balance is completely paid off and is calculated as Monthly Payment. The total interest is useful for evaluating the cost of debt and comparing different payoff goals. The longer you take to pay off the card, the more interest you will have to pay.

Balance payoff calculator

Are you trying to escape from the oppression of credit card debt? The following steps may not apply to your specific financial situation, but you may want to consider them.

- Lower It! Call your credit card company and ask them to lower your interest rates. If you are considering debt consolidation as a way to lower your rate of interest and zero-out your credit card balances, here is my take on debt consolidation.

- Shred It! Stop using your credit card(s). Shred them if you want to. But if you plan to use them again some day, don’t cancel them, because that can effect your credit rating.

- Budget It! Evaluate your home budget and cash flow to figure out how much monthly payment you can afford. You may need to consider cutting back on spending or working some time. Just remember that the faster you can pay off the cards, the lesser interest you pay in the long run.

- Calculate It! Use the credit card payoff calculator to estimate how long it will take to pay off a card at the present interest rate.

- Pay It! Make your payments religiously, until the balance is zero.

- Sustain It! Just like the tendency to gain weight right after a diet, you may be tempted to wrecked up a balance on your credit card again.