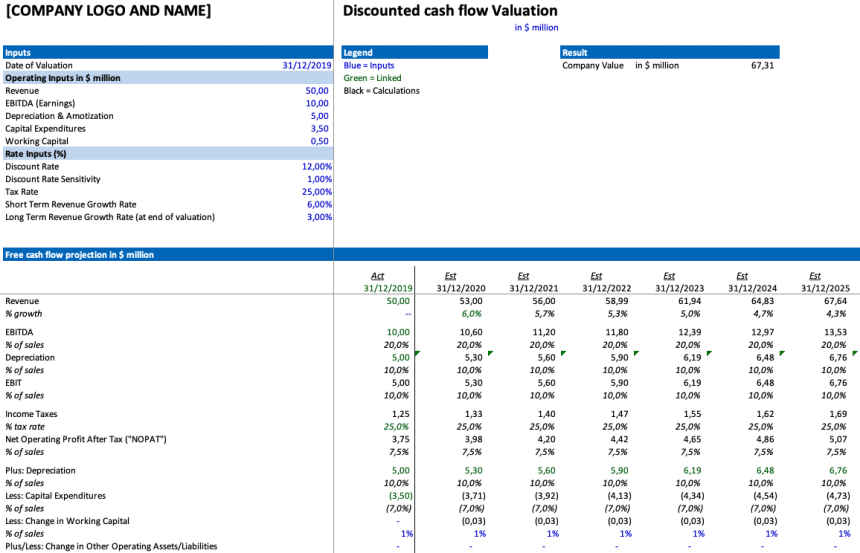

An editable excel template on discounted cash flow (DCF) is a tool that can help individuals and businesses evaluate the present value of an investment based on its expected future cash flows. DCF is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow.

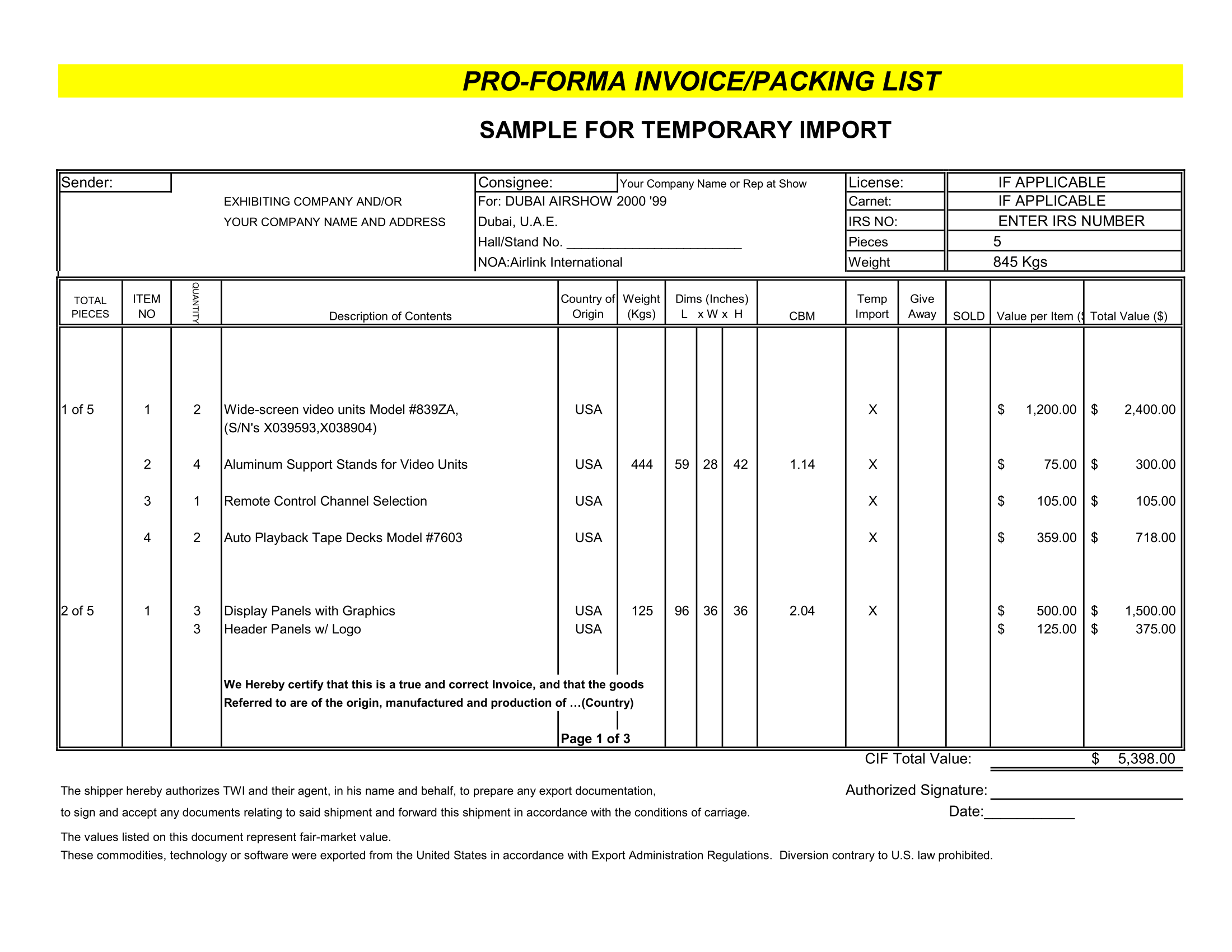

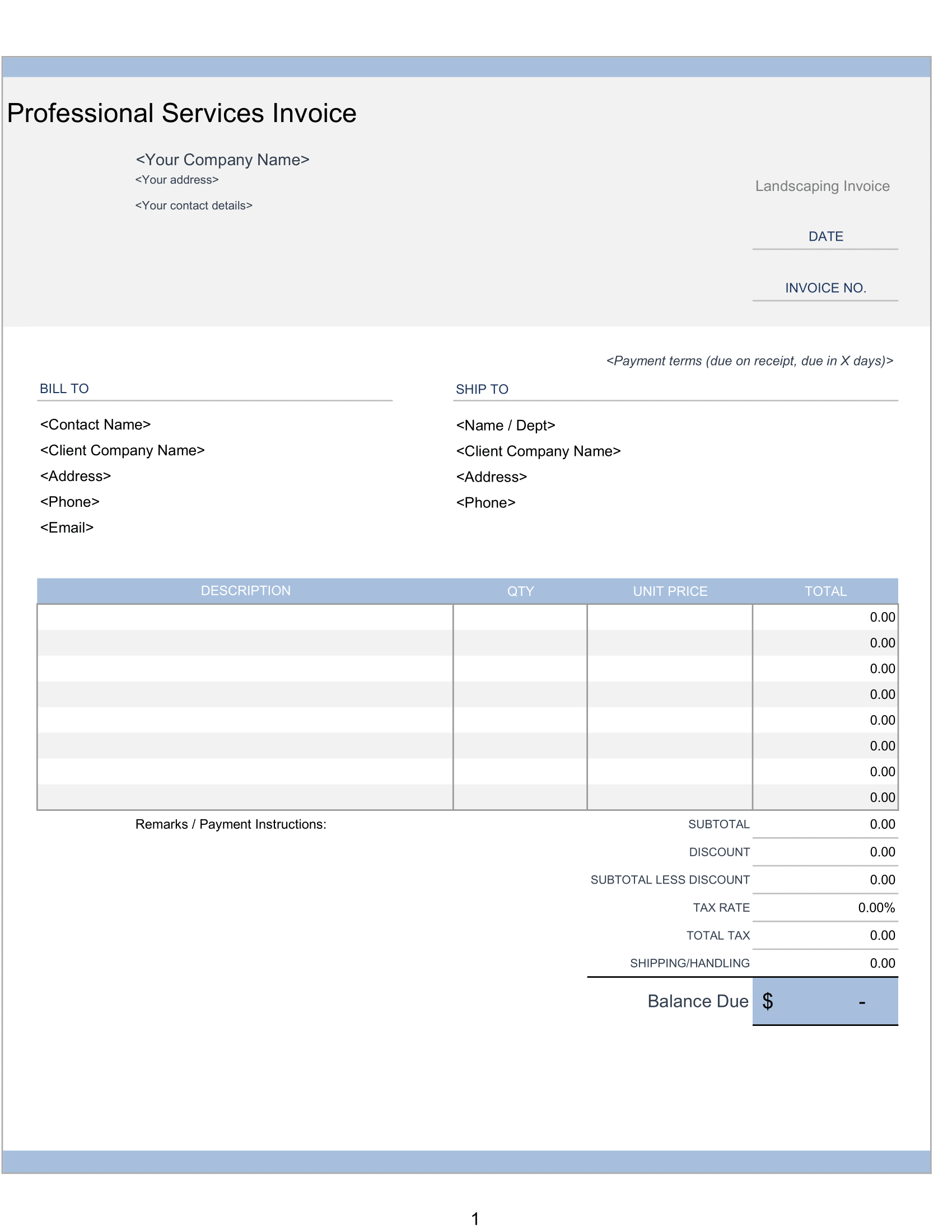

The template includes a DCF formula that allows users to input their own data, including the expected cash flows, the discount rate or cost of capital, the number of years under projection, and the terminal value. The terminal value represents the total value over the future period and can be calculated using one of several methods, such as an exit multiple, perpetual growth rate, or no growth formula.

In addition to the DCF formula, the template also include a sensitivity analysis feature that allows users to see how changes in certain variables, such as the discount rate or expected cash flows, impact the overall valuation. This can help users understand the uncertainty surrounding their investment and make more informed decisions.

An editable excel template on discounted cash flow can be a useful tool for anyone looking to evaluate the present value of an investment based on its expected future cash flows. By inputting their own data and using the template’s built-in formulas and features, users can quickly and easily perform a DCF analysis and make more informed investment decisions

What is Discounted Cash Flow Valuation?

Discounted cash flows allows you to value your holdings based on cash flows to be generated over the future period. These cash flows are then discounted using discount rate, termed ‘cost of capital,’ to arrive at the present value of investment.

Also, The reason behind discounting the cash flows is that the value of $1 to be earned in future may not be the same as the value today.

The value calculated through this method is then compared to the cost of investment today to evaluate whether same is profitable or not. Higher value in comparison to its cost of acquisition denotes a profitable opportunity can be materialized by the investor.

Elements of Discounted Cash Flow Analysis

The elements that are part of net present value (NPV formula) are:

- Cash flows over the future period: This represents the income earned in cash on any given security or investment. It is in form of interest, dividend, or profit.

- Discount rate or cost of capital: This is require rate of return that an average investor expects to receive from the investment. Moreover, The same is also refer to as the weight average cost of capital. To learn more about the discount rate.

- Number of years under projection: Hence, Cash flows earned are discount at the cost of capital for the period to which it relates. Usually the period may be monthly, quarterly or yearly depending upon the frequency of cash flows.

- Terminal Value: Cash flows from an investment may run for an infinite period (theoretically). Also, An investor can not always correctly determine the period for which he will keep on receiving the cash flows. The concept of terminal value is use to solve this.

Thus, A single value is estimate at the end of 5 or 10 years which is the representative of the total value over the future period. So, The same is also discount at the cost of capital to arrive at the net present value (NPV).

There are multiple formulas to calculate the terminal value. The top methods are:

- Exit multiple (EBITDA or sales or PE multiple),

- Perpetual growth rate, and

- No growth formula.

How to Use The Template

Moreover, You can execute your own DCF valuation model by inserting some basic data into the template. In this article, we break down the entire procedure into simple steps.

Thus, To use the template, you will need to replace data that is in blue with your own information.

Conclusion

Although the method is widely use by investors, sometimes it may produce misleading figures. Thus, It may happen in the case where the company sells its assets to inflate the cash flows, while the actual earnings of the company may be zero or negligible.

On the other hand, if you use it wisely, especially by considering each minor detail that is use in the calculation of cash flows, the method is consider as the most reliable valuation model.