A Financial Journal is known as paying out money, particularly from a public or special fund. It also refers to the payment made for a client to a third party, as reimbursement. Disbursement spending leads to cash outflows. If disbursements are greater than income or cash inflows, it increases concern about the shortage of cash. Disbursement journals serve several tasks, such as a source for registering tax write-offs and the categorization of other expenditures.

Therefore, it is good to know how the financial Journal works for two reasons

It is a type of journal that has a similar format for reports within any accounting system with an automated one.

To know how different accounting systems work, so we can find differences that are helping us to understand whatever design we are using.

How to Create a Financial Journal In Excel

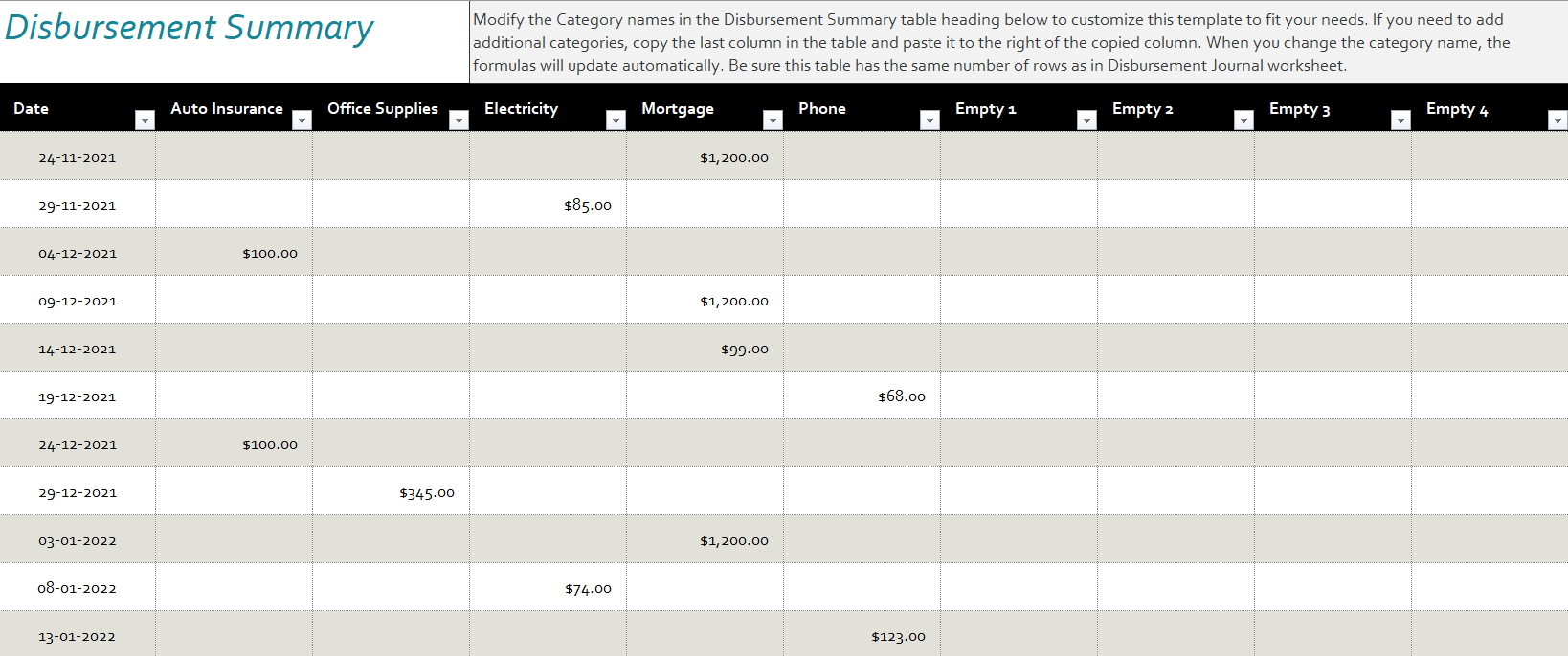

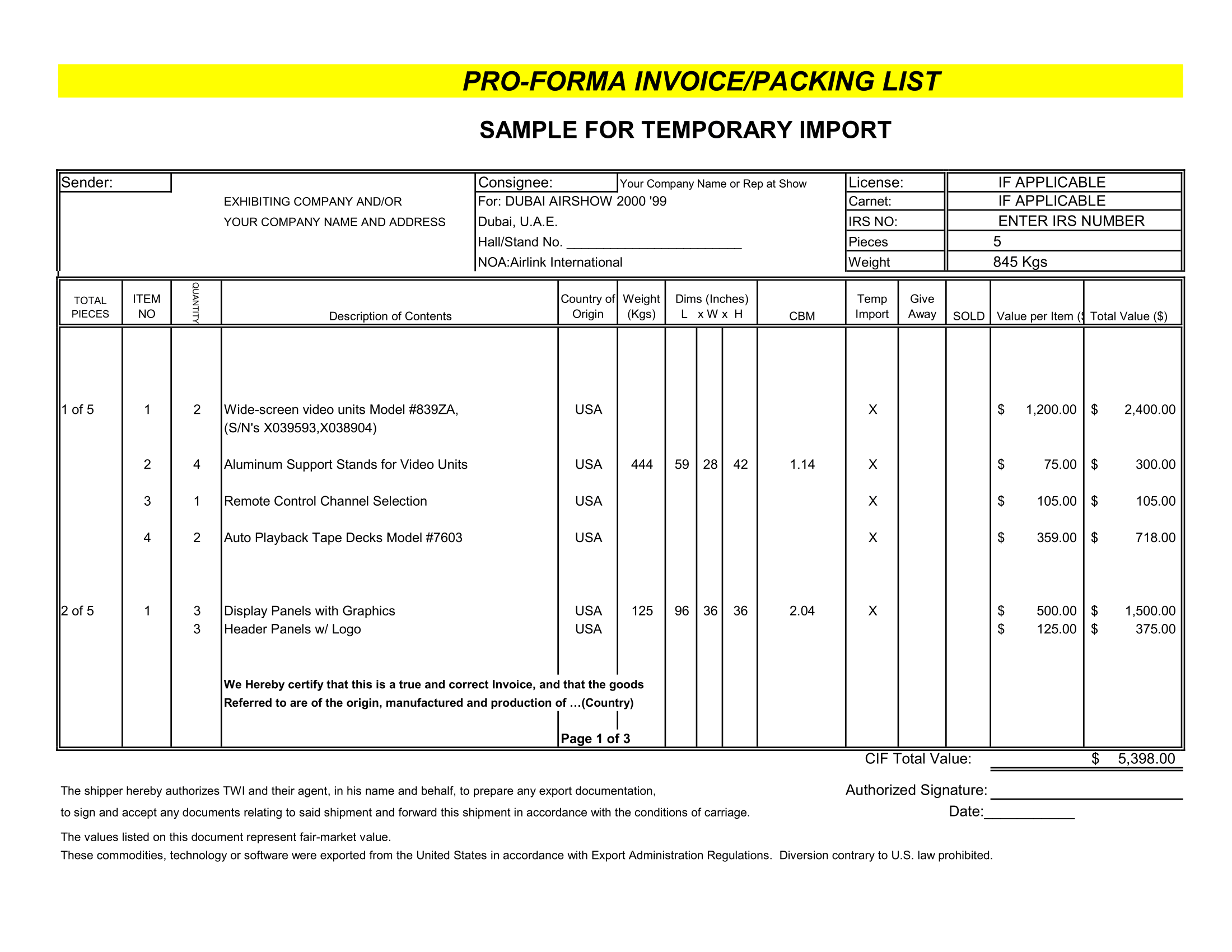

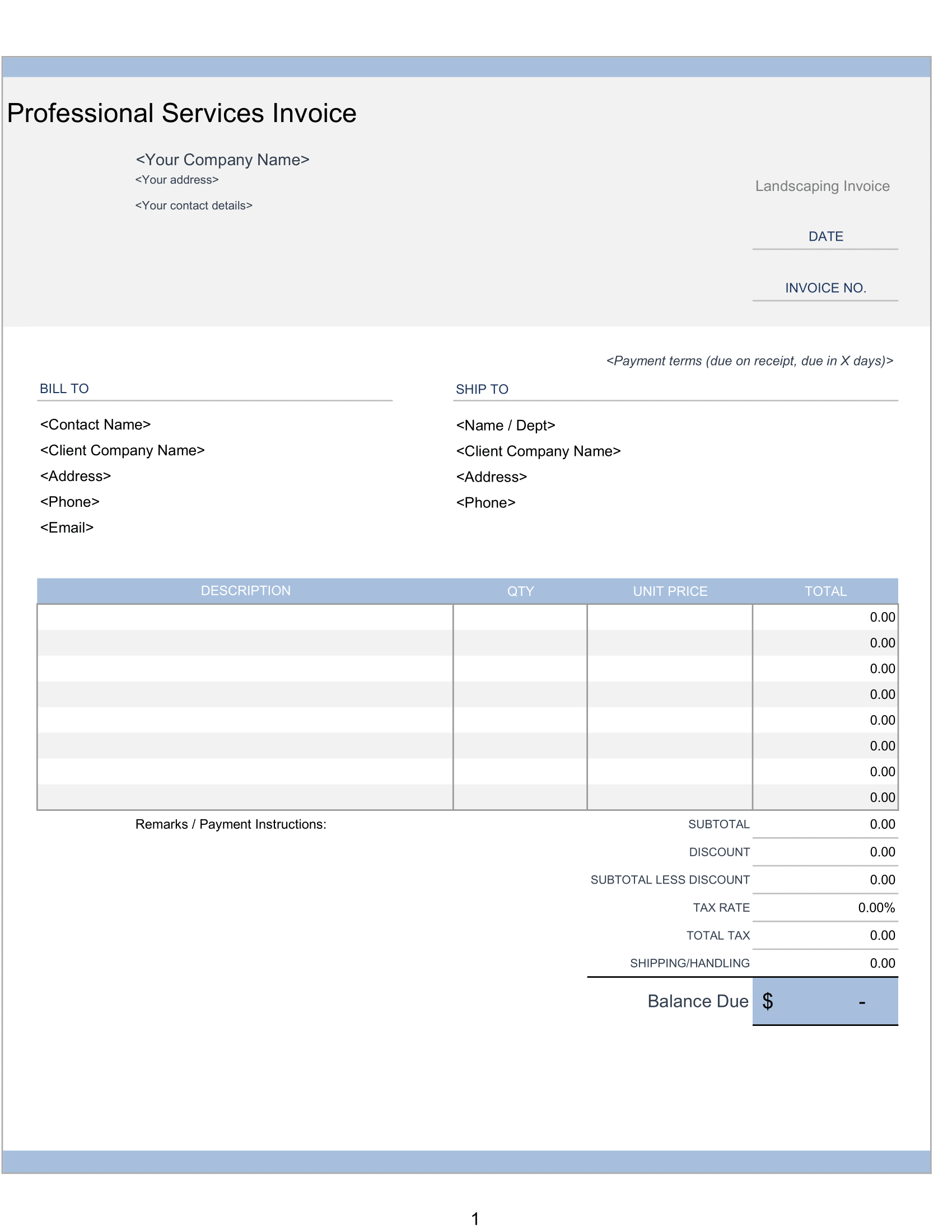

In a Financial Journal, the cash payments are usually classified as payments to accounts payable and payments. This format of a Financial Journal and explanation is provided:

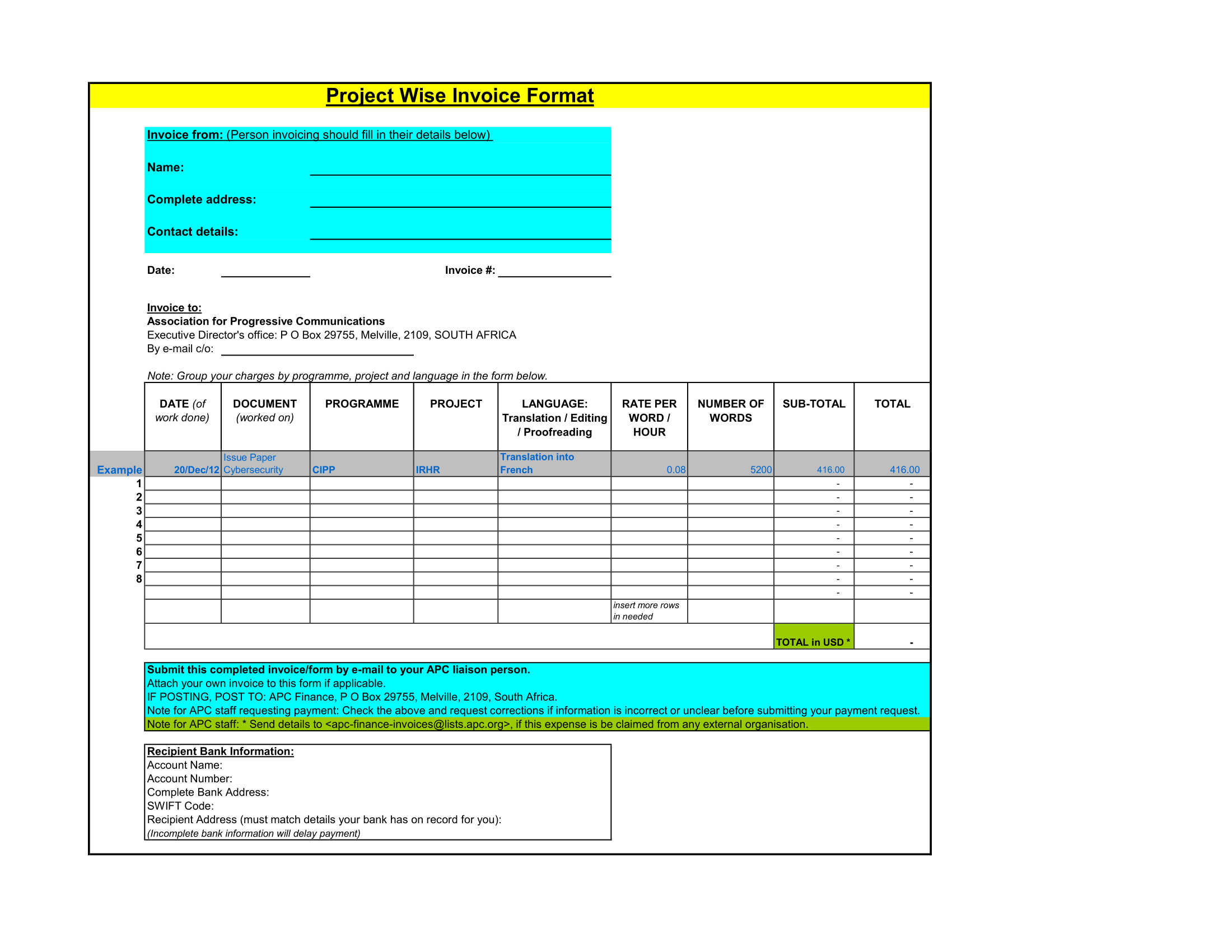

Date column: The date of each money payment

Number column: Check issued by the Organization

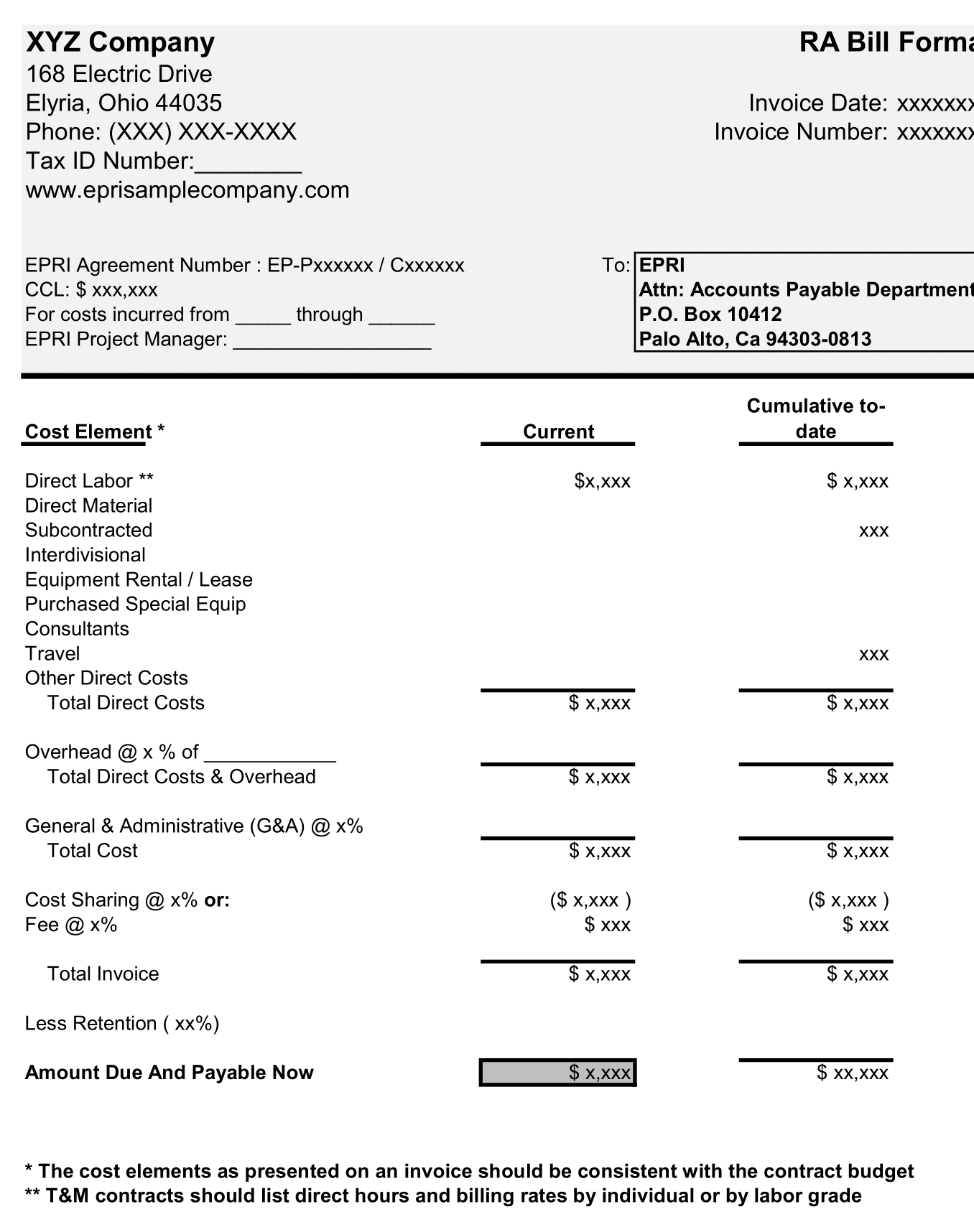

Description column: A description of the transaction indicating the amount to be credited.

Account column: Every money transaction results in a credit to the cash account and a debit to some other account. Used to enter the title of the account for payment of cash.

Cash column: The total of cash salaried is entered in the cash column. This amount must be net of Overall costs.

Categories Column: Mortgage, Electricity and Auto Insurance

Therefore, Accountants record disbursements for the accounting department. Any entry like records the date, payee, purpose of payment, debit or credit amount, as well as the impact on a business’s cash balance.

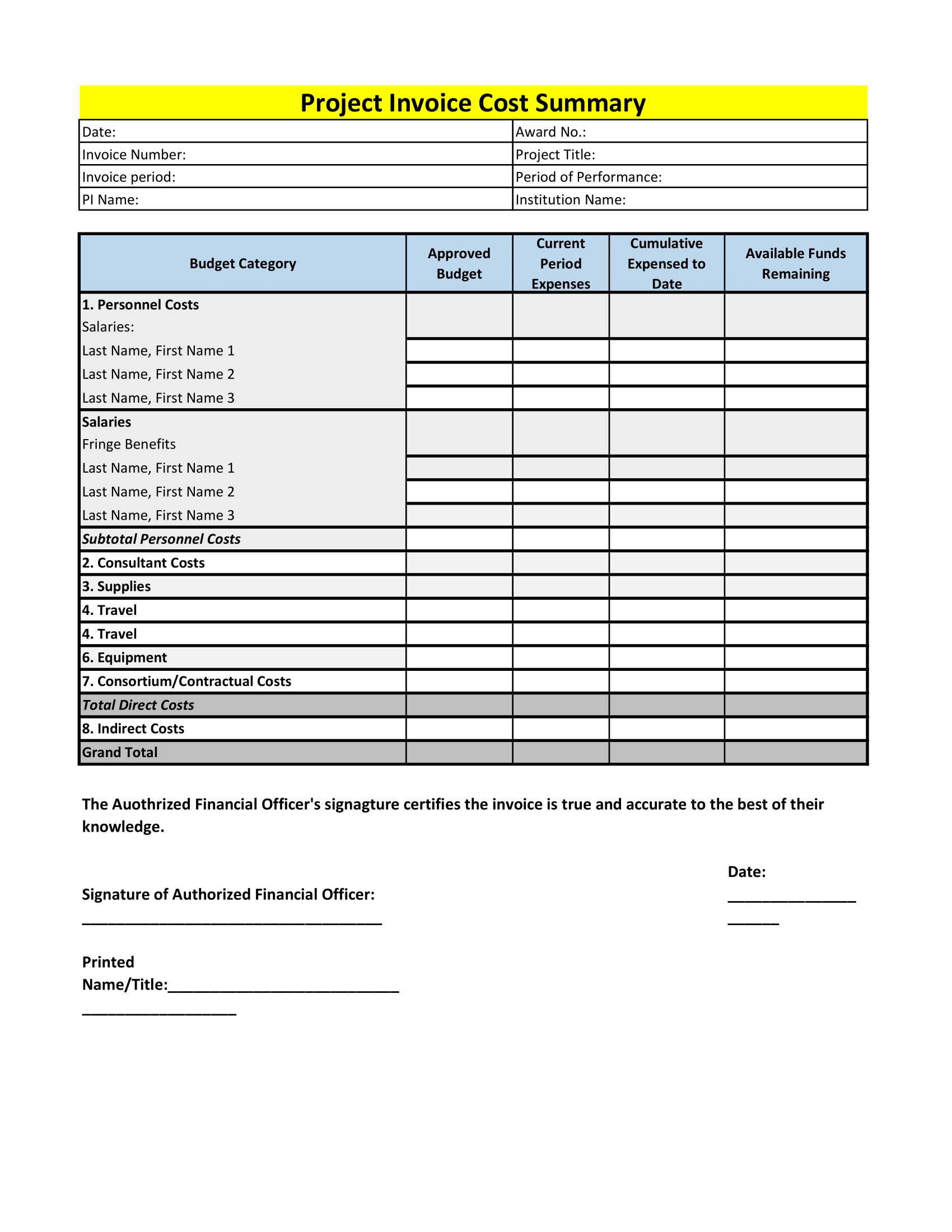

Information Categorize in Financial Journal

The financial journal records all cash outflows of the business. categories like

Assets

Expenses paid

Payments made

Drawings

Loan repayments

GST

The cash payment type columns will depend on the nature of the organization. Some businesses specifically have one column to record the cash amount whereas others need additional columns for accounts, discounts received cash purchases etc.

Example of Financial Journal

Suppose in one month, Company XYZ purchases Equipment from Manufacturer MNP for $10,000 and rents a truck from Rental Trucks for $600. The organization would need to credit its cash balances and debit corresponding accounts.

The amount of the cost recorded under the money credit account and the same total has to be debited from a corresponding account. So, that account could be an Inventory account or any other Balance sheet account. In this case, it has been put in an “other” Description account. However, For a different type of company, a financial journal varies differently.

Uses of a Journal

- Updated from Source Register

- Used to update your Subsidiary Ledgers

- Tools used for update the General Ledgers

- Totals the Subsidiary Ledgers

- Total Debits in the General Ledger

- Make a good Balance For Journal Accounts

- Minimizes the Check Balance

- At the end of accounting the proper information is Transfer

- Easily make a balance between account payable or discount allowed

- Credit entry for the Cash Account

- Maintains and Control the Account for General Ledgers