A registered supplier has to issue a GST Credit Note format to his customer when:

- The taxable value or the tax charged in the original invoice exceeds the taxable value or tax payable in accordance with such supply. In simple terms, if the previously issued invoice is over billed.

- The goods are returned by the customer against respective invoice.

Credit Note under GST

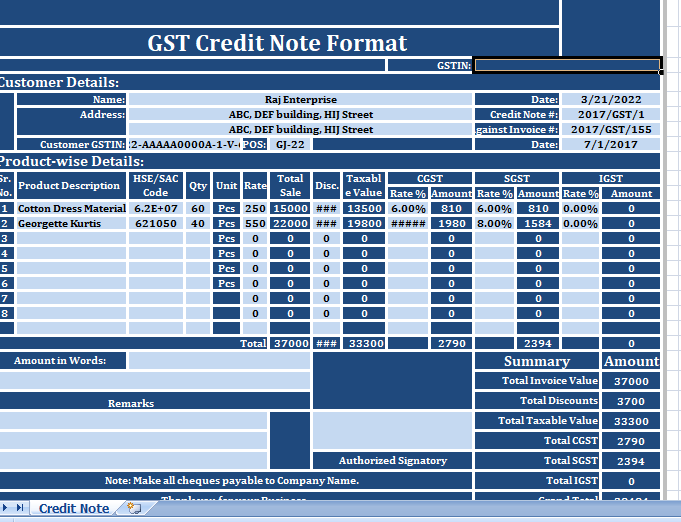

We have created GST Credit Note in Excel following the guidelines provided by the Government. Enter your company name, address, logo and start issuing the credit note.

It is helpful to issue the credit note to your clients against discrepancies in invoices issued earlier with relevant CGST, SGST, and IGST Computations.

It is very useful for all dealers, distributors, traders, wholesalers, accounts assistant, accountants etc.

Contents of the GST Credit Note Format

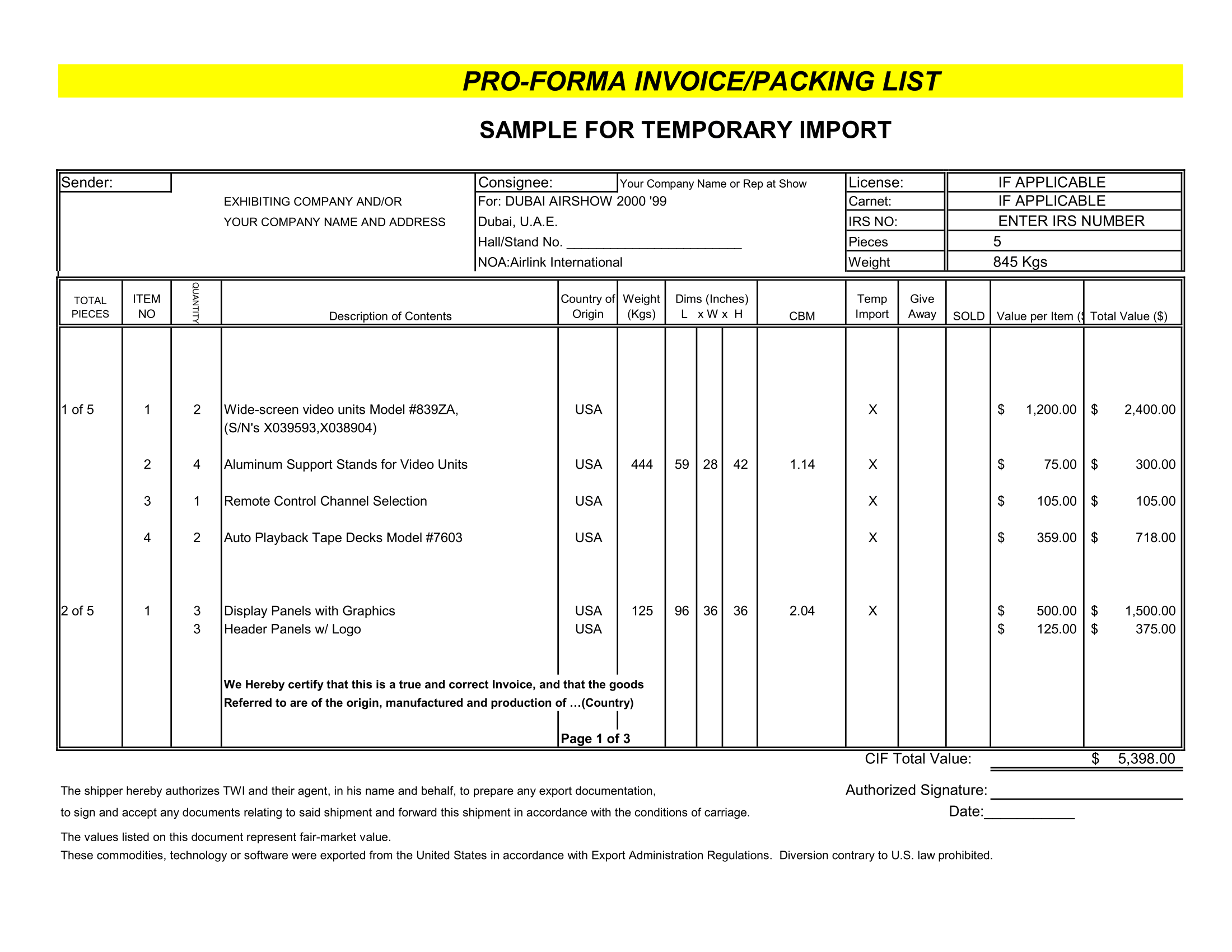

The Credit Note Format Excel Template contains 4 sections

- Header Section.

- Customer Details Section.

- Product and Tax Details Section.

- Summary and Signature Section.

1. Header Section

As usual, header section consists details like the company name, company address, company logo, GSTIN and the document heading “GST Credit Note”.

2. Customer Details Section

Additionally, In this section details of a customer such as the name of the customer, address, GSTIN, Credit Note Number, Place of Supply (POS), the date of issue, the invoice number and the invoice date against which the document is issued.

3. Product Details Section

So, Product and Tax section consists of columns similar to your Tax Invoice mention below:

Sr. No.: Serial number of the products.

Product Description: Product descriptions like color, size, dimensions etc.

HSN/SAC Codes: HSN stands for Harmonized System Nomenclature code of Goods and SAC stands for Services Accounting Code of services.

Moreover, It is mandatory to mention both in your every document under GST regime.

Qty: Also Quantity of goods supplied.

Units: Units.

Rate: Rate of the product.

The Total Sale: Auto calculated column. Total Sale = Quantity X Rate.

Disc.: Discounts if applicable.

Taxable Value: Taxable value of column is auto calculated. The Total Sale – Discount = Taxable Value.

CGST: All the tax columns have 2 subdivisions. Rate of CGST applicable and the amount of CGST. The percentage rate is entered manually. This column is also auto calculate. Taxable Value X Rate of CGST.

SGST and IGST: Similar to CGST, both SGST and IGST have same formats. The respective rates of SGST and IGST are enter manually and the Amount= Taxable Value X Rate of SGST/IGST.

Note: When IGST is applicable, CGST and SGST will not be applicable.

Totals: The total of each column for summary.

4. Summary and Signature Section

However, Summary and signature section consists of billing summary and their computations along with the signature box for authorized signatory, remarks, and business greetings.

Taxable Value = Total Invoice Value – Discounts.

Grand Total = Total Taxable value + CGST + SGST + IGST.