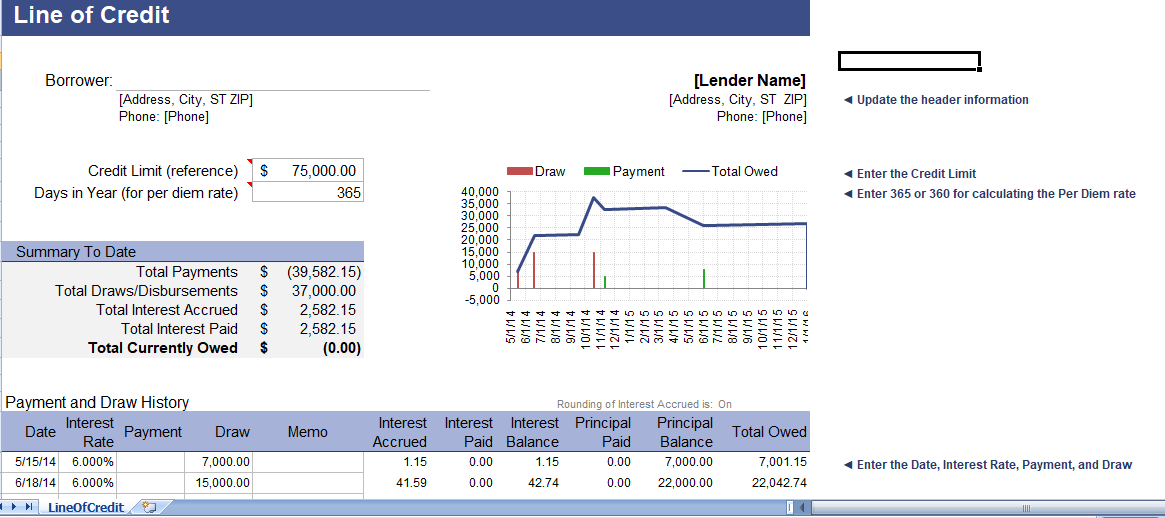

Are a small business owner or small-time lender wanting to track a line of credit? If you have tried our other line of credit calculator. You will find that it is design for estimating costs is fairly general assumptions about when payments and draws are made. Our new Line of Credit Tracker below is design particularly for tracking when payments, draws, and changes in interest rate occur.

Line of credit tracker excel

This line of credit tracker is use to track payments and draws a line of credit that accrues interest daily on the current principal balance.

BETA Version: This spreadsheet can be considered a “beta” version as it has not yet been used enough to guarantee that it is free of errors.

Note to Lenders: If you are using this spreadsheet to service an account that you are offering a client, make sure that the calculations and assumptions match what you have specified in your contract.

Estimating an Interest Reserve:

1. Enter the planned or actual disbursements by including the dates and draw amounts.

2. If your line of credit transitions to a loan at any date, enter the date the loan converts to a standard loan.

3. The Total Interest Accrued amount would then be an estimate of what you need in an Interest Reserve account.

What to do when the interest rate changes:

Any time the interest rate changes, you should enter the date and also a 0 payment. This will update the accrued interest and consequently calculations will use the new rate.

Assumptions built into this spreadsheet

- Interest accrues on a daily basis, like other lines of credit. The Days in Year value should be 365 or 360 depends on how the lender calculates “per diem” interest.

- Interest are calculated using the simple interest formula will not add to the principal balance. The Total Owned is the Principal Balance plus the Unpaid Interest Balance.

- Payments can apply at the end of the previous day. A payment is applicable FIRST to the Interest Accrued and Interest Balance, and then to the Principal.

- The Interest Accrued amount is round to the nearest cent.

- Interest is charge on a Draw on the day it is prepared.

- Principal-Only payments is stimulate by entering a negative draw amount.