Loan Amortization is gradual repayment of a debt over a period of time. In order to amortize a loan, your payments must be large enough to pay not only the interest that has accrued but also the principal.

In simple terms, Amortization happens when you pay off debt over time with regular, equal payments. With each monthly/quarterly payments portion of the money goes to the principal amount and other to interest amounts.

Generally, your interest costs are their highest at the beginning of loan. Especially with long-term loans, the majority of each periodic payment is taken as an interest expense. You only pay off a small piece of principle amount.

As time goes on, more and more of payment goes towards your principal (and you pay less in interest each month).

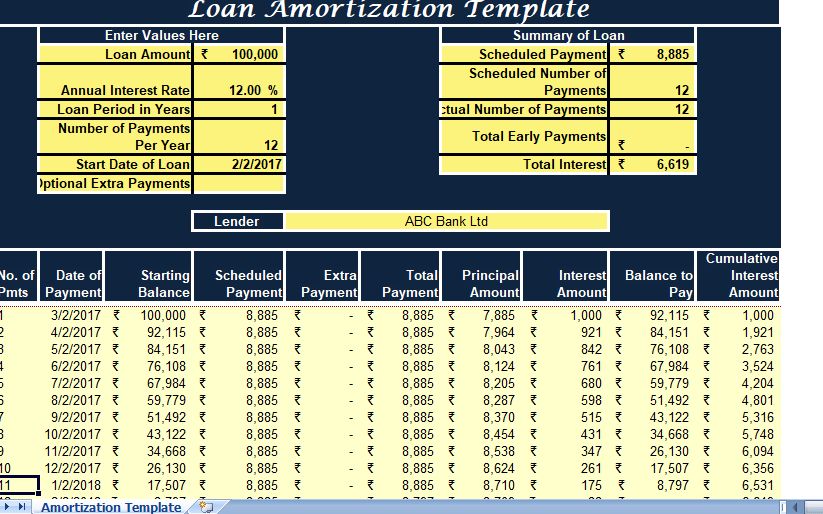

Amortization Schedule

Amortizing a loan usually means establishing series of equal monthly payments. This will provide lender with the following:

- Interest base on each month’s unpaid principal balance, and

- Principal repayments that cause the unpaid principal balance zero at the end of the loan.

Amortization Calculator

The amount of each monthly payment is identical. The interest component of each payment will however be decreasing. The principal component of each payment will be increasing during life of the loan.

An amortization schedule is a table with row for each payment period of an amortized loan.

In other words, a schedule which shows repayment broke down by interest and amortization of the loan balance.

I have create an easy to use Loan Amortization Template with predefine formulas. You need to input your loan amounts and dates and it will calculate everything.

Content of Loan Amortization Template

The first row of sheet consists of heading of the sheet.

This template consists of 2 major sections:

- Data Input Section

- Payment Schedule Section

1. Data Input Section

Moreover, Data input section consists of two columns with predefined formulas. You just need to enter the data in the column on the left side.

So In this section, you will input the Principal amount you want to borrow or you are planning to borrow. Then comes the rate of interest of the lending bank or institutions.

2. The Payment Schedule Section

Thus, This section consists of the payment schedule. It will be displayed once you enter the details in the data input section.

Above all, The payment schedule will automatically display the scheduled dates of repayments, the beginning balance, total payment, interest & principal payments, & end balance for each period.