Download our payroll calculator excel template to effortlessly calculate employee-wise monthly paychecks, taxes, and more!

Managing payroll is a crucial and time-consuming aspect of any business. With numerous factors to consider, such as salary information, taxes, and attendance, it’s essential to have a reliable tool to handle these calculations efficiently. This is where our payroll calculator excel template comes in. This user-friendly template is designed to simplify the payroll process, making it easier for you to manage and calculate employee paychecks accurately.

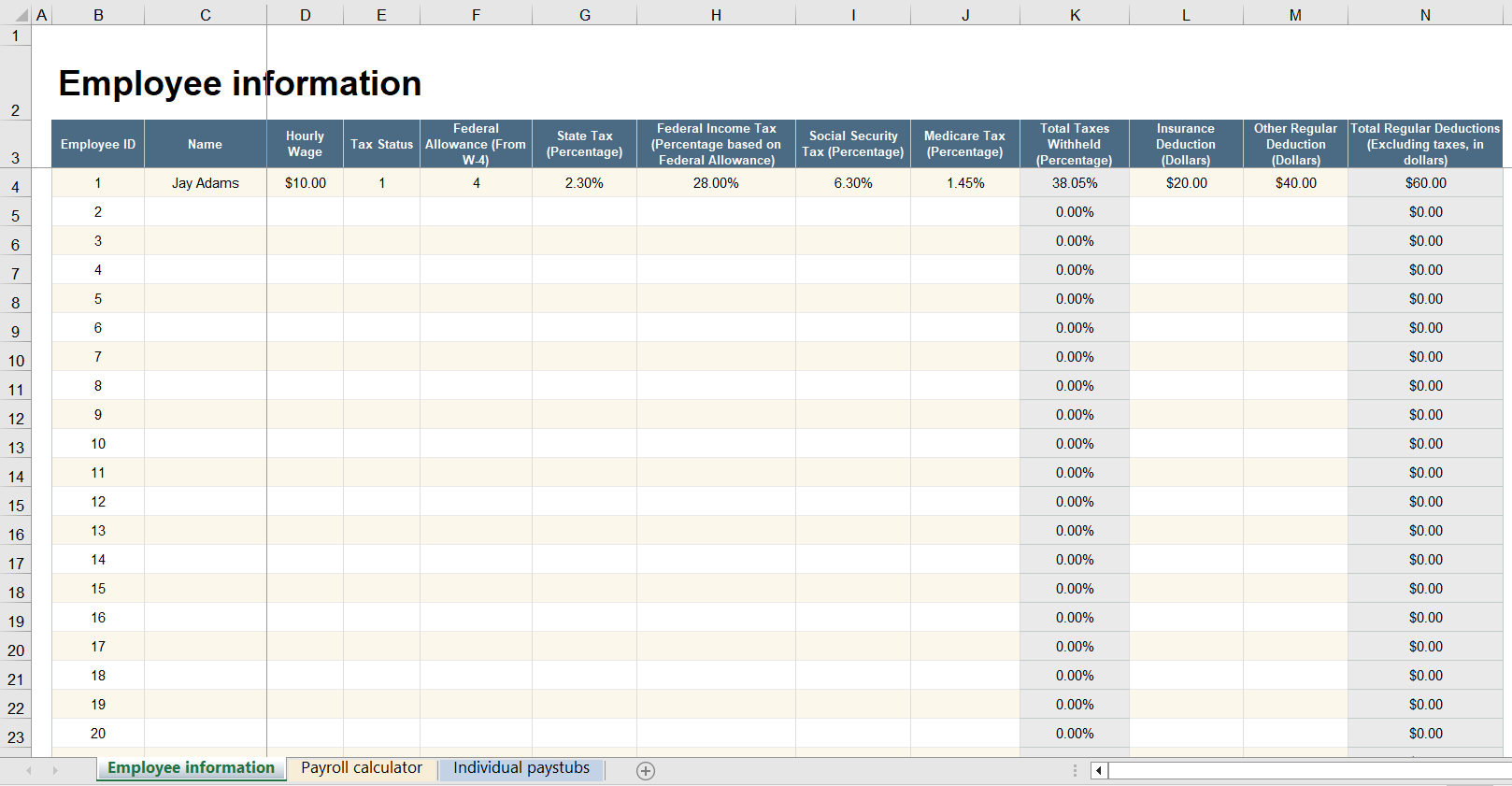

In this blog post, we’ll discuss the various features of our payroll calculator excel template, including the three different sheets it contains – salary information and computation of employee tax computation sheet, payroll calculator sheet, and individual payroll slip calculation. We’ll also explain how to use this easy-to-use template with inbuilt formulas to streamline your payroll management.

Features of Our Payroll Calculator Excel Template

-

Salary Information and Employee Tax Computation Sheet

This first sheet of the template is designed to store essential employee information such as name, employee ID, designation, monthly salary, and tax exemptions. It also calculates each employee’s tax liability based on their salary and exemptions. The inbuilt formulas do all the calculations for you, ensuring accurate tax computations and reducing the risk of errors.

-

Payroll Calculator Or Paycheck Calculator Sheet

The second sheet in the template focuses on calculating the payroll based on actual attendance. Here, you can input each employee’s total working days, leaves taken, and overtime hours. The template will then calculate the employee’s gross pay, deductions, and net pay based on this information. This sheet allows you to view the payroll summary for all your employees in a single place, making it easier to review and analyze.

-

Individual Paycheck Calculator for Paycheck slip

The third sheet in the template is designed to generate individual payroll slips for each employee. This sheet automatically imports the relevant data from the previous two sheets, such as salary details, tax computations, and attendance-based calculations. It also provides a detailed breakdown of the employee’s gross pay, deductions, and net pay, making it easy for you to generate and distribute payroll slips to your employees.

How to Use Our Payroll Calculator Excel Template

Using our payroll calculator excel template is simple and straightforward. Follow these steps to get started:

- Download the template and open it in Microsoft Excel.

- Begin by entering the required employee information and tax details in the ‘Salary Information and Employee Tax Computation Sheet.’

- Next, input attendance details such as total working days, leaves, and overtime hours in the ‘Payroll Calculator Sheet.’

- Once all the data has been entered, the template will automatically generate the payroll summary and individual payroll slips.

- Review the payroll summary and individual payroll slips for accuracy.

- Distribute the payroll slips to your employees.

Conclusion

Our payroll calculator excel template is a valuable tool for any business looking to simplify and streamline their payroll process. With its inbuilt formulas and user-friendly design, it takes the stress out of payroll management and helps you focus on what really matters – growing your business. Download our payroll calculator excel template today and experience the convenience and efficiency it brings to your payroll process.