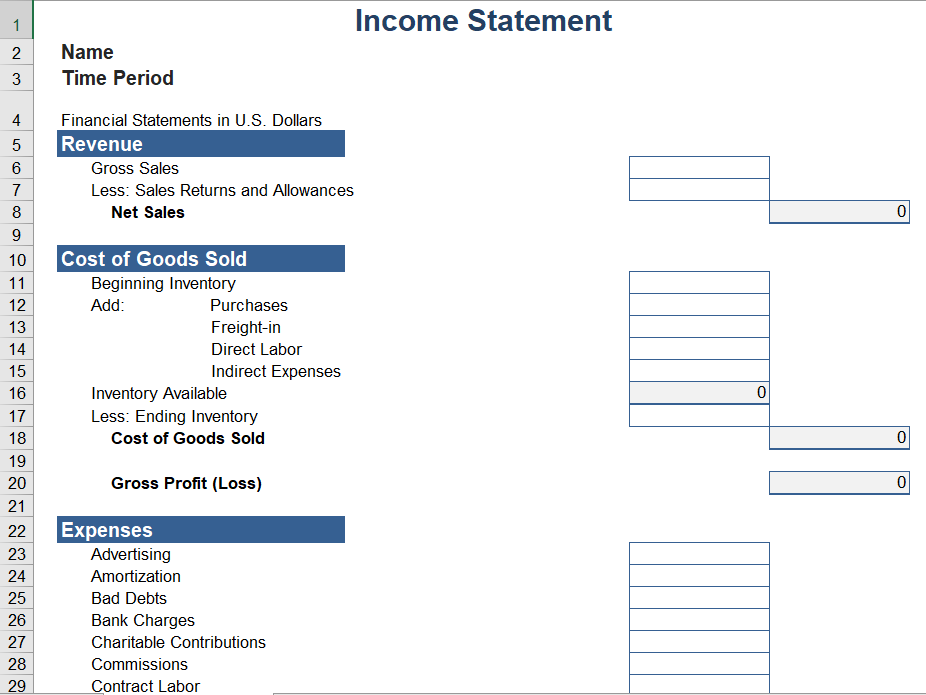

Download Income Statement Excel Template to monitor your incomes sources

The income statement displays information on the economical results of a company’s business. An income statement, also known as a profit and loss statement, provide brief information of a company’s profit or loss for Monthly, Four months, or one year). It registers all revenues for a company as well as the operating costs for the business.

The goal of an income statement is to provide financial information to investors, creditors, shareholders and lenders, or whether the company is profitable during the trading year.

How to Prepare an Income Statement in Excel

This spreadsheet is for the business owner and manager and contains two categories of income statements, each on a separate sheet.

Planned in Two Ways-

The first is a simple single-step Revenue Statement with all revenues and expenses grouped.

The second sheet is for a multi-step income statement that calculates Gross Profit and Operating revenue.

There are many ways to prepare a statement. The examples provided in the sheet are basically for service-oriented companies or retail businesses.

(1) The Single-step income statement collects all of the revenues and expenses, except the income tax expense.

(2) The Multi-step income statement, for instance, breaks out the Gross Income and Operating Income as separate lines.

First, it calculates the Gross Profit by subtracting the Cost of Goods Sold from total Sales. Thereafter it calculates the Operating business income and then arranges the interest expenses and income tax to give the revenue from Continuing Operations.

Operating Income

Operating income is the amount of benefit made from a business operating expenses. It includes the cost of goods sold, cost of sales, cost of products and cost of labour. It is calculated by the Gross Profit minus the total Operating Expenses. Thus, the interest expense and income tax expense are not included as operating expenses, which makes a new term EBIT or “earnings before interest and taxes” – for Operating Income.

Revenue from Continuing Operations

Bottom Line- calculated as the Operating Income minus expense and income tax for instance, plus/minus non-operating revenues, expenses, profit, and losses, if any. Below The Line items are none, then this is the same as the Net Income.

Sales

The sales number presents the measure of the revenue generated by the business. The recorded amount here is the total sales, minus any goods returns or sales discounts.

Revenue

Revenue, or Income, includes your business’s total sales. It also includes funds you receive from selling things or receiving a tax refund.

Revenue is the first thing you must list on your P&L statement. Therefore, it should be a positive number and include any costs you earned from sales.

Net Income

Net income, or net profit, is the main point of the profit and loss statement. The leftover you subtract all of your expenses from your revenue.

If you have a net profit, your company is earning more than it spends or, your expenses overbalance your revenue, you will have a net loss.

Expenses

Business expenses are costs you experience on day-to-day business operations, like insurance, marketing costs, and management. These expenses likely include operating expenses. Operating expenses include things like services, salaries, rent, and wages. So, these expenses keep your business good but do not produce sales. Subtract your expenses from income to build your profit and loss statement.

Importance of a Income Statement

The Goal of the income statement is to present the Business’s performance during a period to the backers and help evaluate the company, which influences the share price.

Profitability

The income statement of a company is updated on regular basis than the other financial documents. Because it provides a clear picture of current profitability, a company’s managers and investors to review it.

Thus, it is important because it clearly defines whether a company is making a profit or loss.

Revenue Updates

The income statement also is important because it explains the different revenues and expenses of a company. Non-business-related sales and investment revenues and expenses are also listed. This gives managers a record of how each section is performing,

Performance

The income statement provides all the shares with a brief of the company’s performance during that period. Beneficial statement for comparing the company analysis with its past year performance and operating in the industry. All the investors in the industry track the company’s stock using the statement to analyze the numbers easily.