Creating a monthly expense budget is one of the most basic steps you can take to manage your housing money. And to make sure that you stay on track to meet your financial goals. Before creating a budget, though, you need to have an idea of what your monthly expenses are. Similarly, make sure that your expenses don’t exceed your monthly income so that you can pay all your bills and debts and save some money, too.

So, A monthly expense is a personal budget used for your monthly income and monthly expenses to decide the balance of savings, for instance, income is higher than expenses or debt when income is higher than expenses.

A monthly expense budget isn’t much different from a personal budget other than it specifies the timeframe of the budget.

If you’re still trying to figure out what a budget is, then use our free templates.

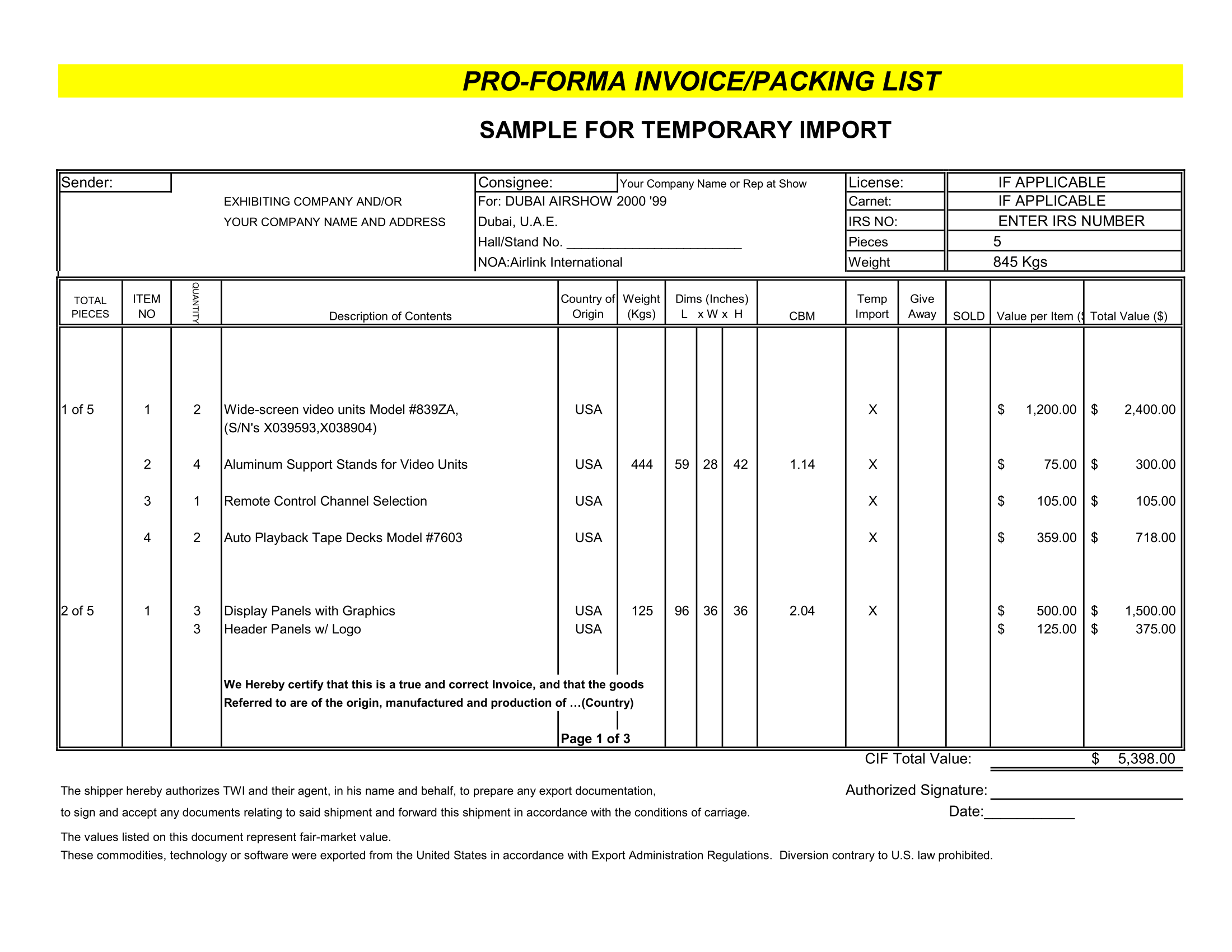

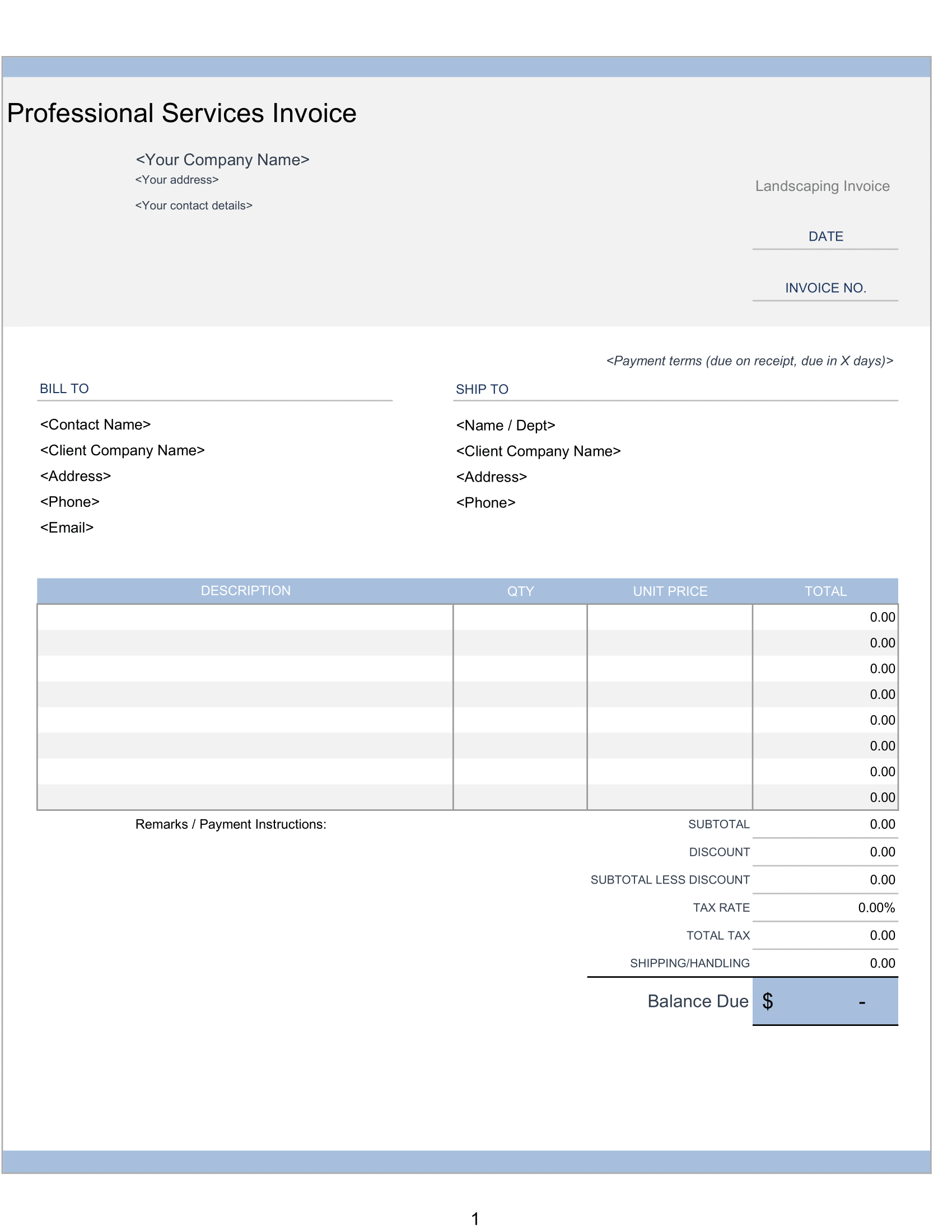

How to Create Monthly Expenses in EXCEL

Our Excel Monthly Expense budget spreadsheet is easy to customize and free.

For a family or a person, budgeting is about saving money or decreasing a family deficit. In this article, We will show you how to use a budget template from Excel, and how to make or customize a monthly expense template in Excel.

The Steps Include-

- Calculate your Net Income.

- List your Monthly Expense.

- Determine Constant and Variable expenses.

- Determine the average monthly cost for each expense.

- Make some adjustments.

Record your net income- Any money you plan to get during that month.

Money-Start budgeting with Every Dollar today.

Write down each normal payment for you and your spouse—and don’t forget to add extra money coming your way through a side hustle.

If you’ve got an irregular income, calculate the lowest estimate of the budget that you normally make in this spot. Similarly, You can adjust it later in the month.

This is the first step in creating a monthly expense housing budget is to identify the amount of money you have coming in.

Track your spending

Set your goals

Make a plan

Keep checking the amount

Record your Expenses

Now you have to plan for the money coming in, and the money going out. It’s time to list your expenses. Firstly, open up your online bank account or look at your bank statement to help you evaluate your expenses.

Start by covering your Four Walls like- food, utilities, shelter, and transportation. These are called fixed expenses because they stay the same every month example mortgage or rent and Others change up, like groceries.

Next, list all other monthly expenses about insurance, debt, savings, entertainment, and any personal spending. Start with your fixed expenses. After that use your online bank account or those bank statements to estimate planned amounts.

Summary

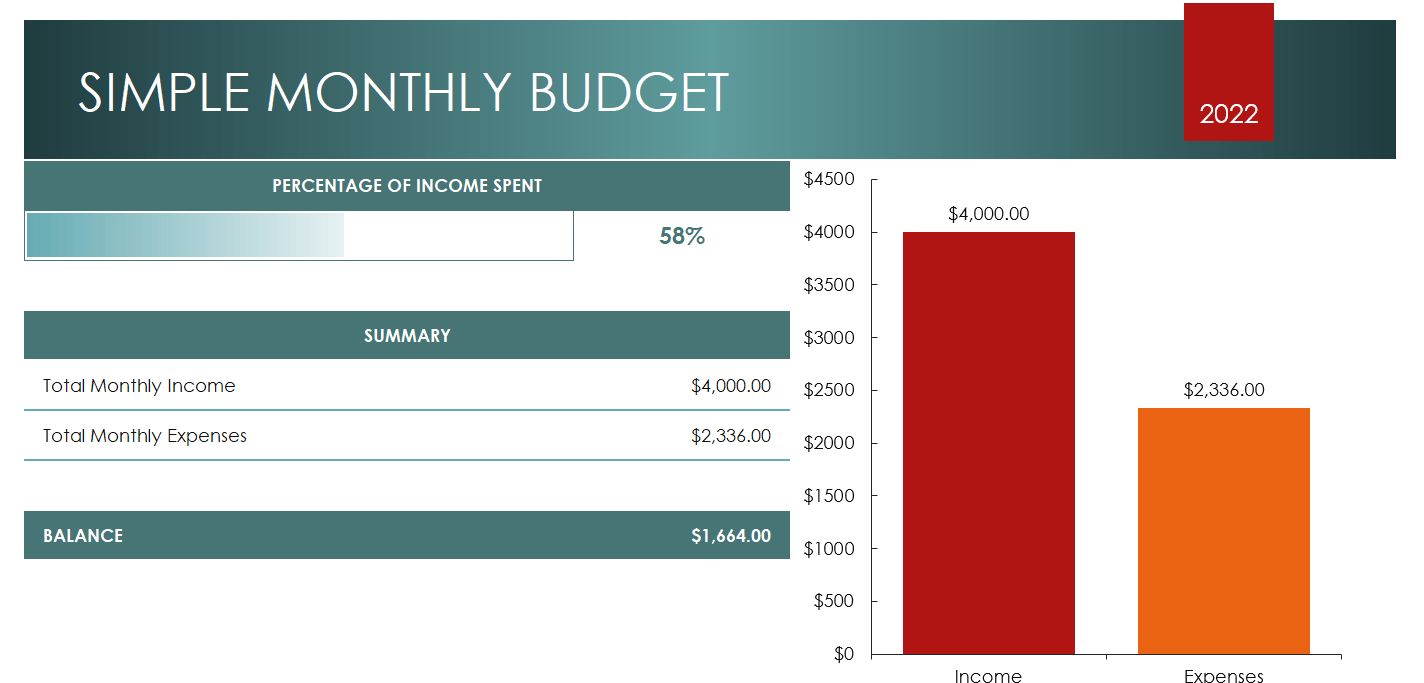

It includes Total Monthly Income Total Monthly Expenses and their Balance Amount.

At last, it Creates a Short Graph Regarding your Income and Expenses.

Importance of Monthly Expenses Budgeting

Since Expense budgeting allows you to create a spending plan for your money, it also ensures that you will always have enough money for the things you need and the things that are important to you.

Because following a budget or spending plan will also keep you out of debt or help you work your way. And a successful monthly expense report and track both past spending and future spending.

- To Analyze your Financial Situation

- Calculate Daily Expenses

- Plan for the Future

- Track Spending

- Remove Debts Paying Pressure