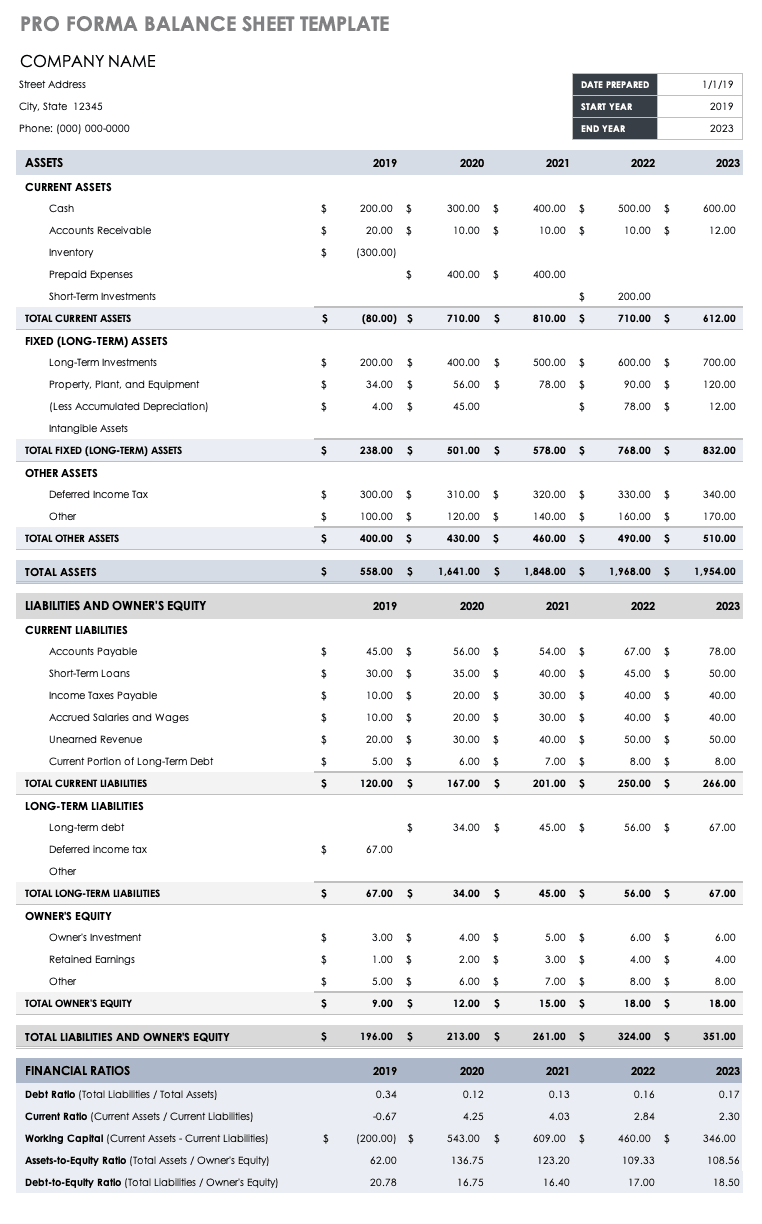

Use these free Pro forma balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Moreover, Small businesses can use this sheet template to project account balances for assets, liabilities, and equity for a designated period. So, Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

How to Create a Pro-Forma Balance Sheet

- Firstly, Short Term Assets. The first two items will be your current cash assets and your accounts receivable. …

- Secondly, Long Term Assets. …

- Thirdly, Total Assets. …

- Fourthly, Liabilities. …

- Lastly, Final Tabulation

Is a pro forma the same as a balance sheet?

This is similar to a historical balance sheet, but it represents a future projection. Pro forma balance sheets are used to project how the business will be managing its assets in the future.

Benefits of creating a pro forma

Therefore, Financial models built on pro form projections contribute to the achievement of corporate goals if they: 1) test the goals of the plans; 2) furnish findings that are readily understandable; and 3) provide time, quality, and cost advantages over other methods.

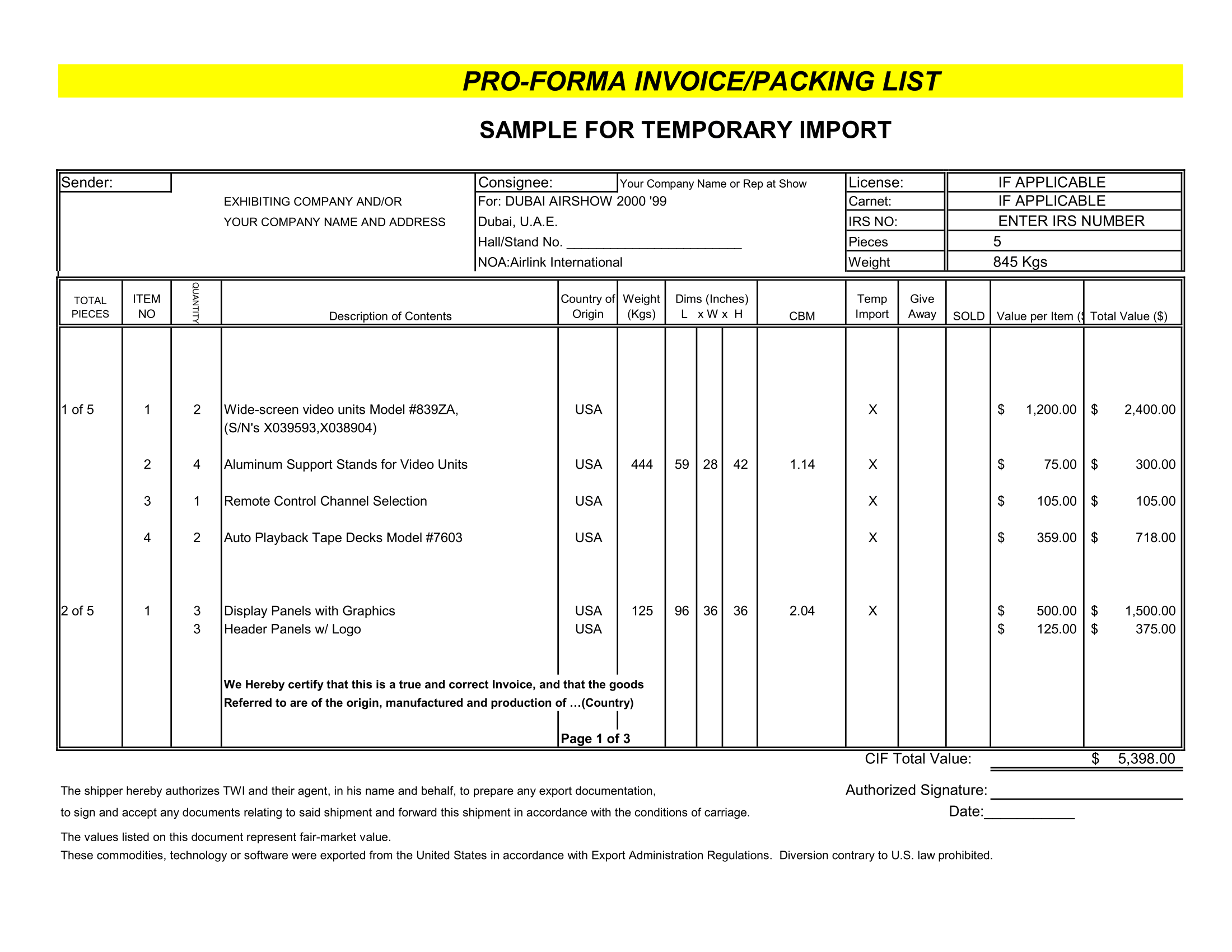

Pro Forma Balance Sheet Example

Before creating your own pro forma balance sheet, take a look at our pro forma balance sheet sample:

So, Sample Business Plan Financials: Bob’s Rent-A-Bike

| Balance Sheets, Bob’s Rent-A-Bike | Starting | Pro forma | Pro forma | Pro forma | Pro forma | ||

| May 31 Year 1 | June 20 Year 1 | May 31 Year 2 | May 31 Year 3 | May 31 Year 4 | |||

| (interim period | |||||||

| to show max | |||||||

| Assets | cash need date) | ||||||

| Current Assets | |||||||

| Cash | 1000 | 1600 | 15672 | 35548 | 67160 | ||

| Inventory, Supplies | 200 | 500 | 800 | 1000 | 1200 | ||

| Total Current Assets | 1200 | 2100 | 16472 | 36548 | 68360 | ||

| Long-Term Assets | |||||||

| Depreciable Assets | 1500 | 7500 | 7500 | 12500 | 15500 | ||

| Accumulated Dep. (SL 60 mos) | 0 | 0 | 1500 | 4000 | 7100 | ||

| Net Long-Term Assets | 1500 | 7500 | 6000 | 8500 | 8400 | ||

| Total Assets | 2700 | 9600 | 22472 | 45048 | 76760 | ||

| -========== | -========== | -========== | -=========== | -========== | |||

| Liabilities & Equity | |||||||

| Current Liabilities | |||||||

| Accounts Payable | 200 | 600 | 1000 | 1300 | 1600 | ||

| Short-Term Debt | 0 | 0 | 0 | 0 | 0 | ||

| Total Current Liabilities | 200 | 600 | 1000 | 1300 | 1600 | ||

| Equity | |||||||

| Owner’s Paid-in Capital | 2500 | 2500 | 2500 | 2500 | 2500 | ||

| Owner’s Share Retained Earnings | -500 | 5736 | 16874 | 32580 | |||

| Investor’s Paid-in Capital | 7500 | 7500 | 7500 | 7500 | |||

| Investor’s Share Retained Earnings | -500 | 5736 | 16874 | 32580 | |||

| Total Equity | 2500 | 9000 | 21472 | 43748 | 75160 | ||

| Total Liabilities & Equity | 2700 | 9600 | 22472 | 45048 | 76760 | ||

| -========== | -========== | -========== | -========== | -========== | |||

| By June 20 Year 1 Pro Forma Expenditures and Investments: | |||||||

| Bicycle Assets | 7500 | ||||||

| Parts | 500 | ||||||

| Ads, etc. | 1000 | ||||||

| Total | 9000 | ||||||

| Less Accounts Payable | 600 | ||||||

| Projected Cash Usage | 8400 |