Tracking your company’s income and expenses on a profit and loss form can give you a realistic image of company’s bottom line. It can help you better understand your cash flow, look for categories where you can reduce your costs, and focus on categories of profit.

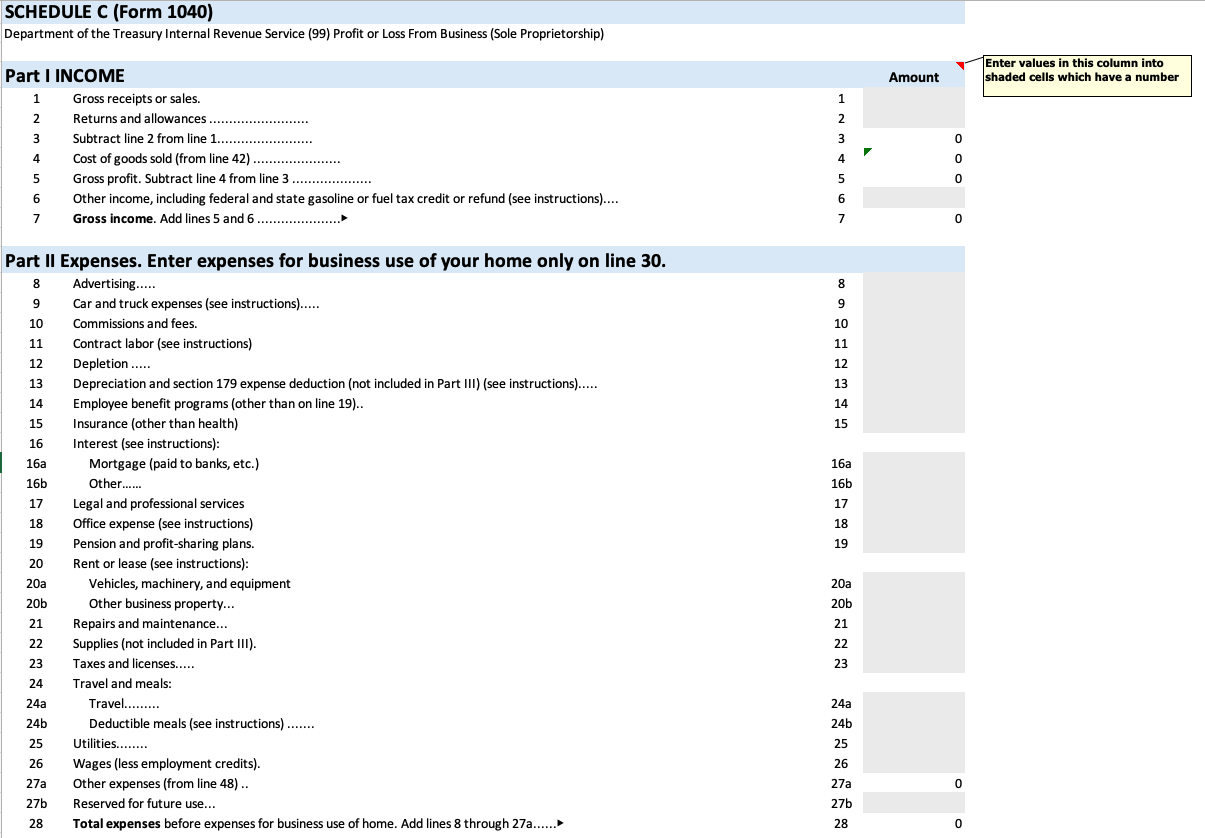

Profit and Loss Form Spreadsheet

There are several well-known names for this form. It’s known as profit and loss statement, a P&L, or an income statement. Regardless of what you call it, a profit and loss form shows financial state of a company over a period of time. It summarizes the income and expenses of a business, and gives a clear summary of business finances.

Components of Profit and Loss Forms

There isn’t a required profit and loss template that every company must use, so components of this varies depending on a company’s needs. However, most profit and loss statements break down into certain categories. Often these forms include the following information:

- Gross receipts

- Gross income

- Cost of labor

- Returns and allowances

- Net profit (or loss)

- Cost of goods sold

Profit and Loss Template

This free Excel template contains a profit and loss form. It is modeled from the Department of the Treasury Internal Revenue Service (99).

Once you download the form, you are ready to track your own income and expenses. You will need to refer other financial documents to complete this form. You will need your:

- Balance sheet,

- Tax return for last year, and

- Any other financial statements with income and expense data.

These forms will help you work through the template.

How to Use the Schedule C (Form 1040)

The form is simple to use. There are two different colors of cells. In gray shaded cells, you enter numbers. The other cells have formulas in them so the numbers you need will automatically populate. Here’s an example. Notice on the left-hand picture that there are zeroes next to cost of goods sold (from line 42), gross profit, and gross income. But, after values are added to the gray cells, those zeroes turn to the correct number, as the image on the right shows

As you continue entering your income and expense data, the white cells will update on their own. This reduces amount of calculations you have to do manually and can decrease mathematical errors.

The Sections of This Profit and Loss Form

In this particular profit and loss form, there are five sections. They are:

- Income,

- Expenses,

- Cost of Goods Sold,

- Information on Your Vehicle, and

- Other Expenses.