All business owners hope that their enterprises will be profitable. So, You invest in your business to watch that investment grow. To know whether or not your business is performing to your expectations. You need to maintain rental property income and expenses accounting records to track its progress.

Net Rental Income

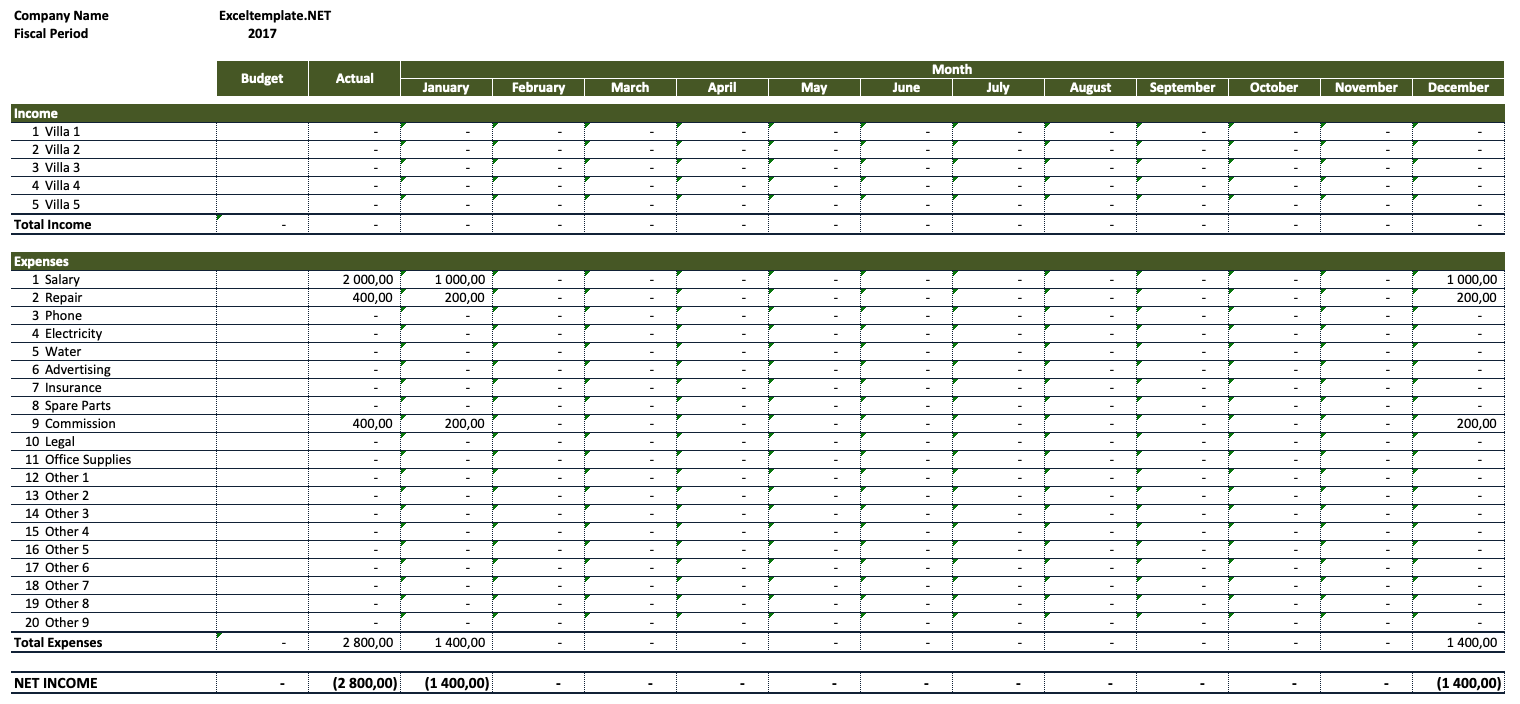

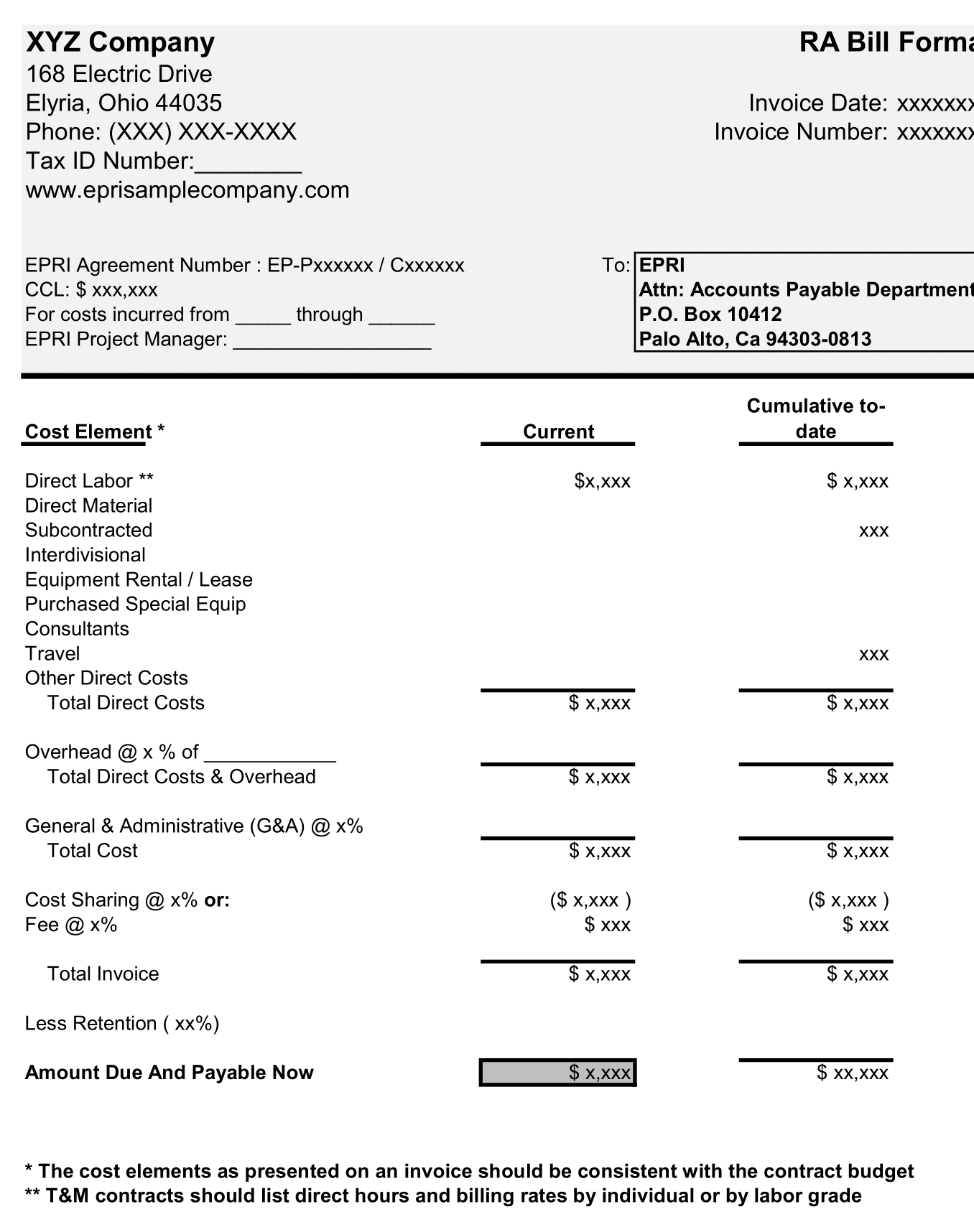

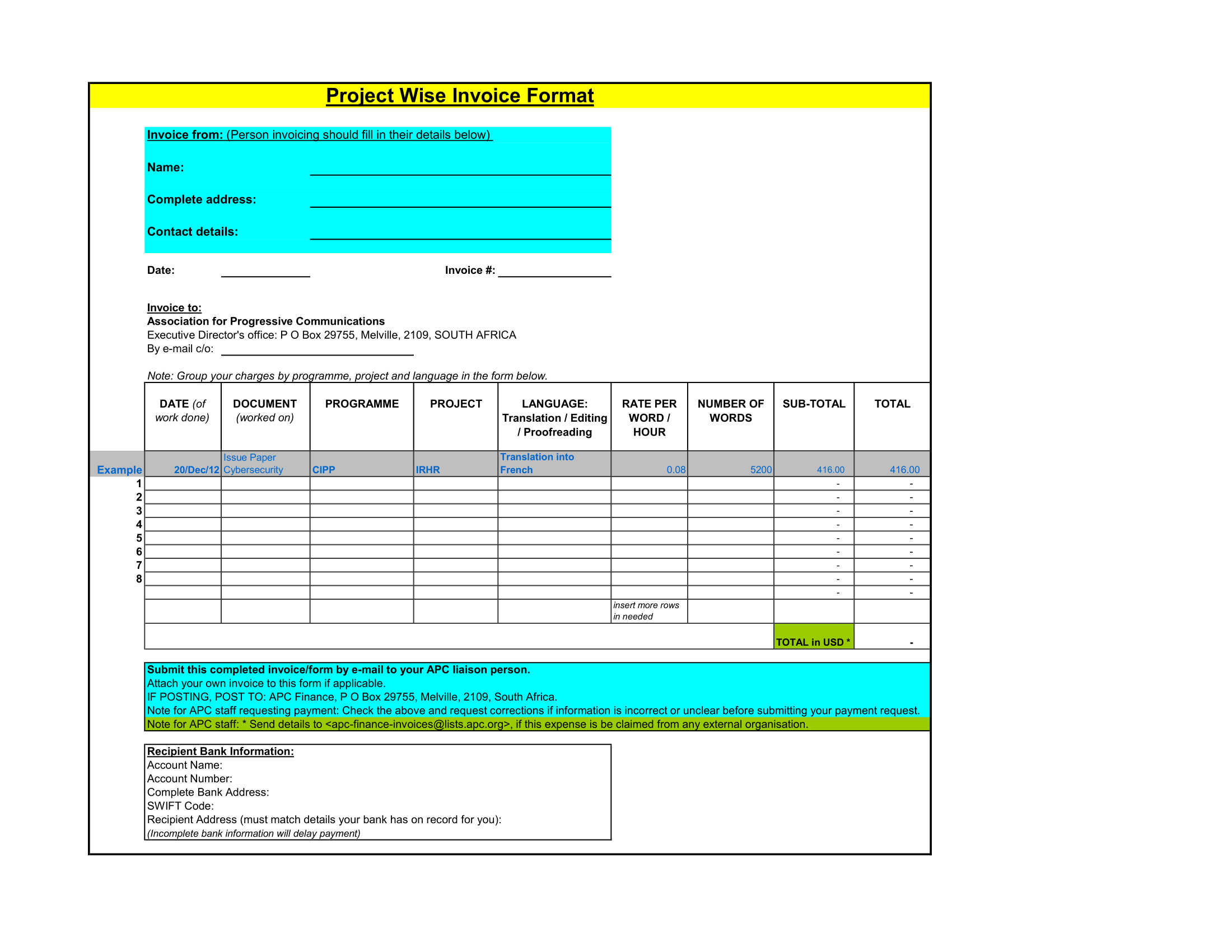

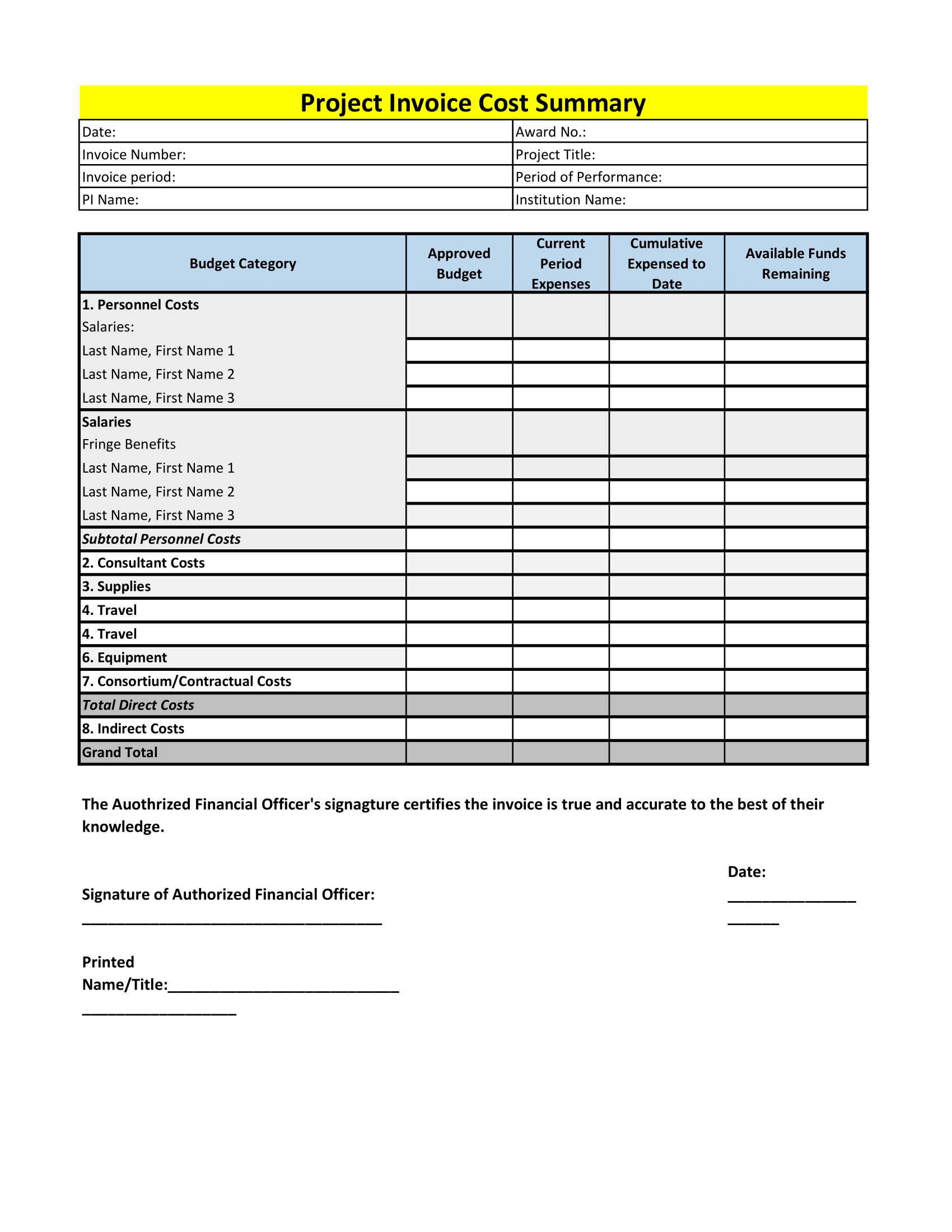

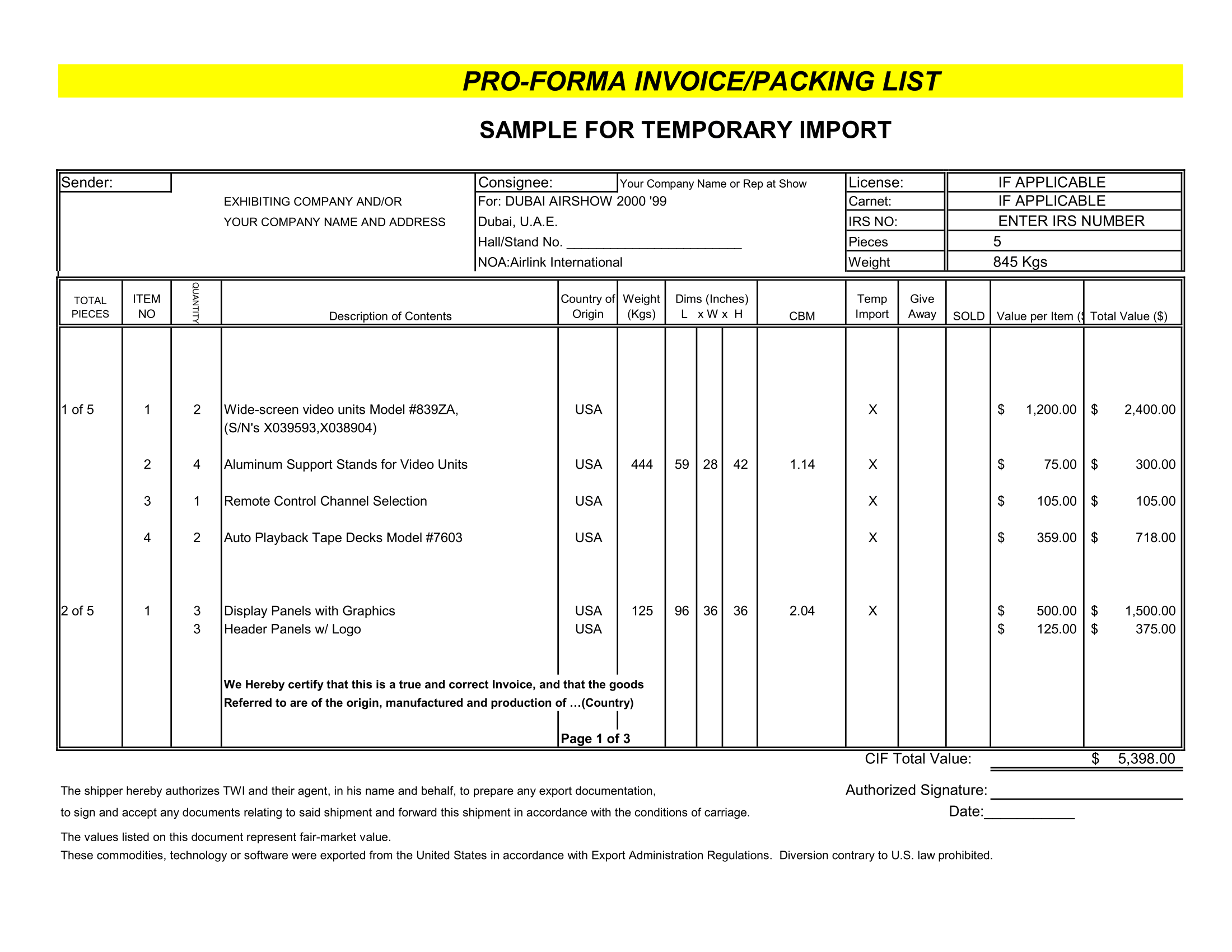

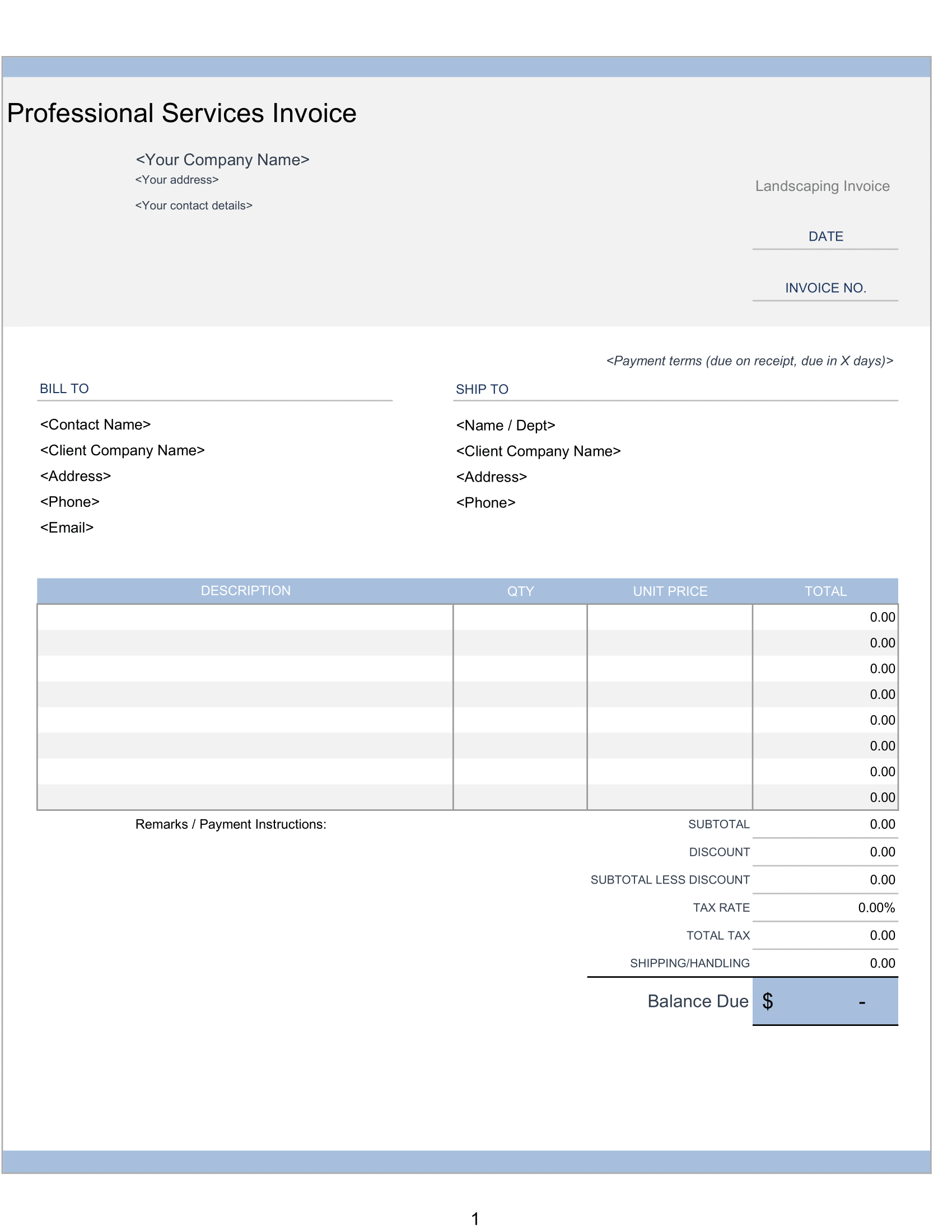

For owners who rent real estate to others, the free Rental Property income and expenses Excel spreadsheet is an excellent rental property accounting tool. It is for tracking and understanding the business’s rental income, expenses, and the net income that results from its business activities.

Rental Property Expenses

To make template easily accessible and customizable, we’ve built it in Excel. To up your financial game and properly track your rental property income and expenses. You only need to download our template, open it, and enter your data.

Template Attributes

First, note that the template is design for businesses renting either commercial or residential properties to others. The business may rent out its own real estate as well as manage real properties for others. But, the worksheet does not account for real estate purchases or sales. Also on rental property expenses.

The spreadsheet is easily adaptable to other types of rental businesses also. However, for the purposes of making examples and explanations, we’ll constrain its use for tracking activities associated with rental real estate.

Rental Income Expenses

The template is easily complete. It is useful for the business’s owner or its property manager to quickly estimate income and/or profitability of either a single property. Of all properties owned or managed by the enterprise.

The spreadsheet is flexible. Although not design to serve as the sole source of accounting information for the business. It can modify to include any information you feel you need for your rental property bookkeeping.

By proper use of this spreadsheet, the owner or their manager can follow the financial progress of the business as it moves through a twelve-month fiscal year. For this purposes, we’ve assumed that the business’s fiscal and tax year begins on January 1st and ends on December 31st. But the template can be adjusted for any twelve-month period desired.

Appropriate Use

As mentioned above, this template is very useful for expense tracking, rental income tracking. As well as tracking of the rental property profits or rental property losses that results from its business activities.

However, keep in mind that it wouldn’t be appropriate to use an Expense Worksheet in every situation. Profit and Loss Statements, Cash Flow summaries, and Loan and Debt calculators all have their place in managing a successful business.

Calculations for income tax, taxable income, tax deductions, the business’s tax rate, and all other tax-related matters should be sourced from the appropriate financial statements or accounting software to assure accurate tax preparation of the business’s tax return and its supporting tax forms.

Conclusion

Moreover, The Rental Property Income and Expense template provides you, the business owner, with valuable and timely information. Using it diligently will help you keep aware of your business’s financial health and progress, and allow you to better plan for your future.