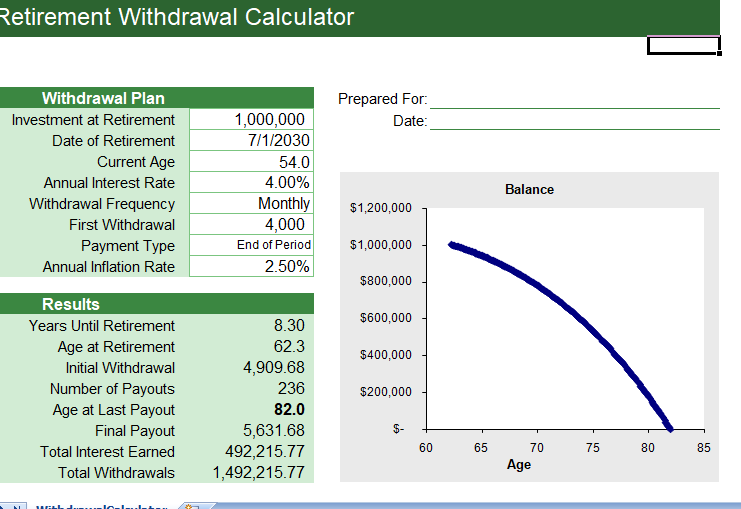

How much of your personal salary do you need to save to reach your retirement goal? That is not a simple question to answer, but that is what this Retirement Withdrawal spreadsheet attempts to solve. It makes quite a few assumptions, and doesn’t include as much detail as you would find in professional financial planning software. But, for a quick estimation it might be useful.

Retirement Withdrawal Calculator Spreadsheet

The most important thing about this spreadsheet to understand that future rates of return, inflation, salary, disasters, your live, and other life events can’t be known for sure. So, if you are going to use this, realize that it is a mathematical exercise and the inputs are chosen. The results are your own responsibility.

Below are some additional explanations that may help you use this calculator.

Rates of Return and Inflation

These are values that just have estimation. You can’t know future rates with certainty. However, one of the unique things about this spreadsheet is that you can enter different rates of return for the accumulation period and retirement period. This is useful because during retirement period, your portfolio is weigh towards lower risk, lower return investments.

Defining Your Retirement Goal

1: Your Salary. Enter a salary you want to live on during retirement in today’s dollars value. This should represent a lifestyle rather than an actual income or withdrawal amount. The payouts during retirement is adjust for inflation (the calculator uses the estimate of the inflation rate to calculate the “inflation-adjusted salary”). If you expect to receive income during retirement, the amount withdrawn from your nest egg is reduced to account.

2: Years to Pay Out. The number of years you want retirement nest egg to last is the second aspect of your retirement goal.

Current Savings Contributions

The amount that you will save is based on a percentage of your salary. That way, your salary increases, the amount that you will save will also increase.

Your annual savings contribution in the spreadsheet are not limit to just 401k contributions. However, if you specify an Employer Match, the spreadsheet assumes you are first contributing to a 401k, and then any savings beyond the 401k limits are kept in another accounts.

The labels and comments associated with the Employer Match should be more clear. For this spreadsheet, if you enter 50% as the Employer Match and 7% as the Max Employee % of Contribution, this should interpret as “50% match up to an employee contribution of 67%.” This means that the company stops matching the rest of your contribution if you contribute more than 7% of your salary.

Social Security

This spreadsheet doesn’t include social security calculations. Instead, you can also use Other Retirement Income section to include estimates of other income like social security. The social security administration provides a Retirement Estimator that you can use to get an idea of what your social security benefits might be.

Taxes

This calculator does not take into account taxes. That doesn’t mean taxes are not important to be consider. In fact, taxes can have a HUGE impact on savings. When using this calculator, assume that you are making all the correct tax-related decisions that may apply to your specific situation.