Salary Arrears Calculator is a ready-to-use template in Excel to calculate month wise salary arrears with salary break-up.

Moreover, with help of this template, you can calculate salary arrears up to 35 years for an employee. Just insert desire amounts and the template will automatically calculate the arrears for you.

What Does It Mean By Salary Arrears?

The word “Arrears” means previous partial or full overdue of payments. Salary Arrears means previous salary dues that an employer pays during current month or year.

In simple terms, salary arrears are the delayed either for differential payment of incremental salary or full payment normal salary after due date.

Reasons for Salary Arrears

Usually, these delays can either be natural or artificial. Natural causes include delay in opening a bank account, payment system failures. Whereas artificial causes include, lawsuits, delayed promotions.

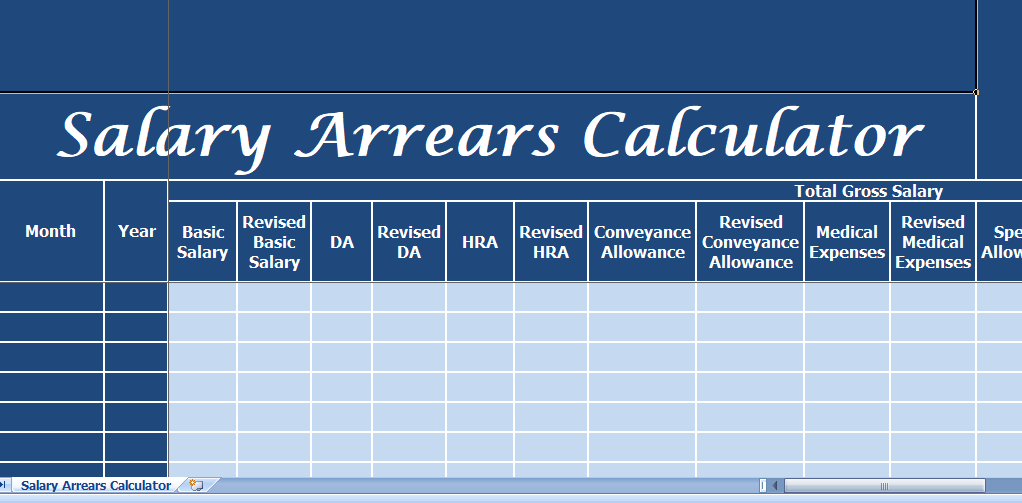

Salary Arrears Calculator Template

Therefore, To simplify process of calculating arrears we have created a simple and easy Salary Arrears Calculator with predefined formulas.

How To Use Salary Arrears Calculator Template?

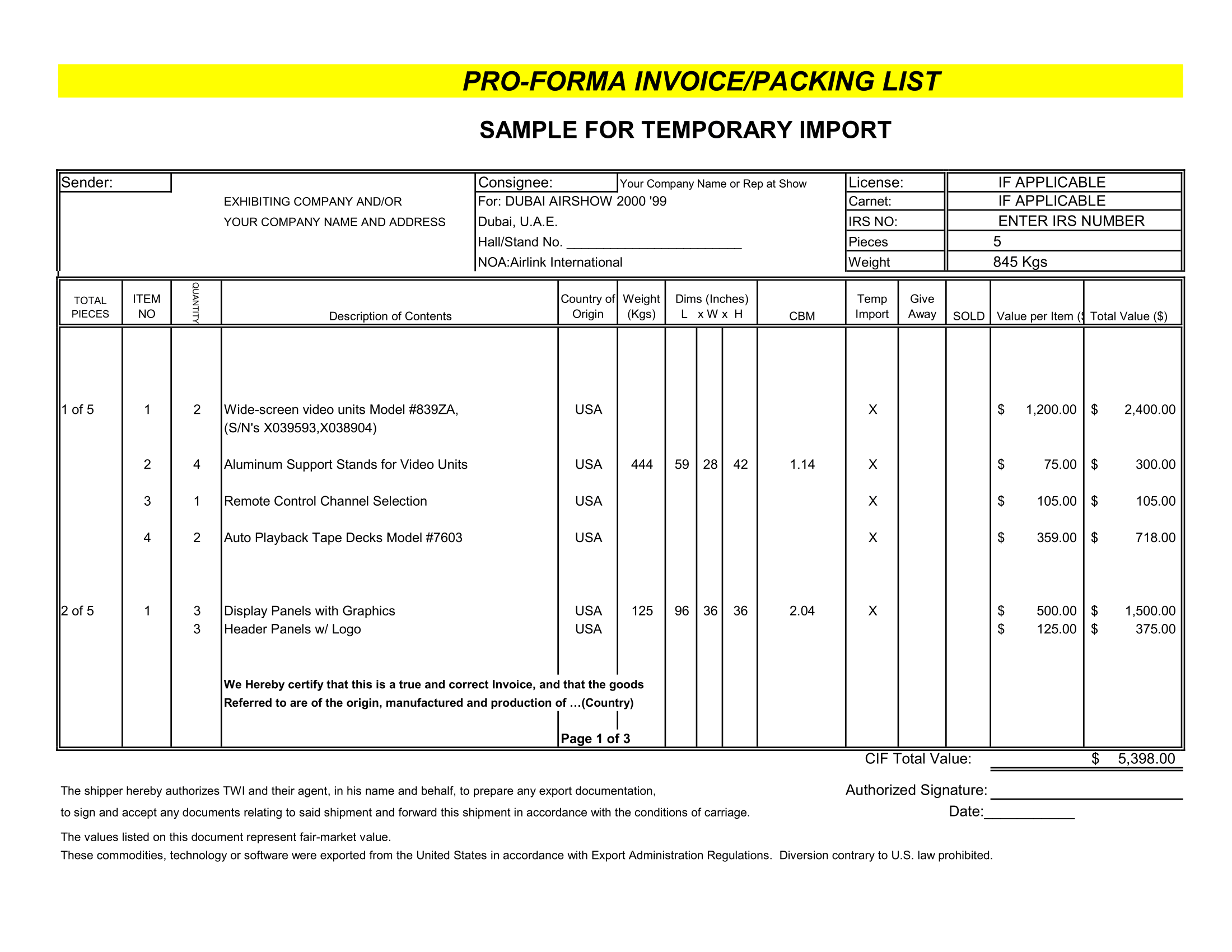

Thus, This template consists of 3 sections: Total Gross Salary, Total Deductions, and the Differential Arrears.

The first 2 columns are for Month and Year. To select month use the drop-down list. All 12 months starting from January to December.

Total Gross Salary Calculation

Gross Salary is total amount of salary without any kind of deductions. Components of gross salary may differ from country to country as well as company to company.

Basic Salary

Dearness Allowance (DA)

House Rent Allowance (HRA)

Conveyance Allowance

Medical Allowances

Special Allowance

Bonus Pay

Travel Allowances

There are 2 columns for each head. One is for inserting actual amount and the second for the revised amount. In the end, there are 2 columns; Total Gross Salary and the Revised Total Gross Salary.

Total Deductions Calculations

Deductions include a contribution to PF, Professional Tax, TDS (Tax Deductions at Source), and Salary Advances (if any).

Similar to gross salary section, this section also has 2 columns for each head. Insert the current amount in the first column and the revised amount in second.

Differential Salary Arrears Calculations

However, The Net payable salary and revised Net salary are calculated using below-given formula:

Net Salary/Revised Net Salary = Total Gross Salary – Total Deductions

Thus, the Net salary is amount payable to the employee/you. Whereas, the Revised Salary is the incremental amount that the company has to pay.

Therefore, difference between these amounts is the salary arrear to be paid by the employer/company to the employee/you.