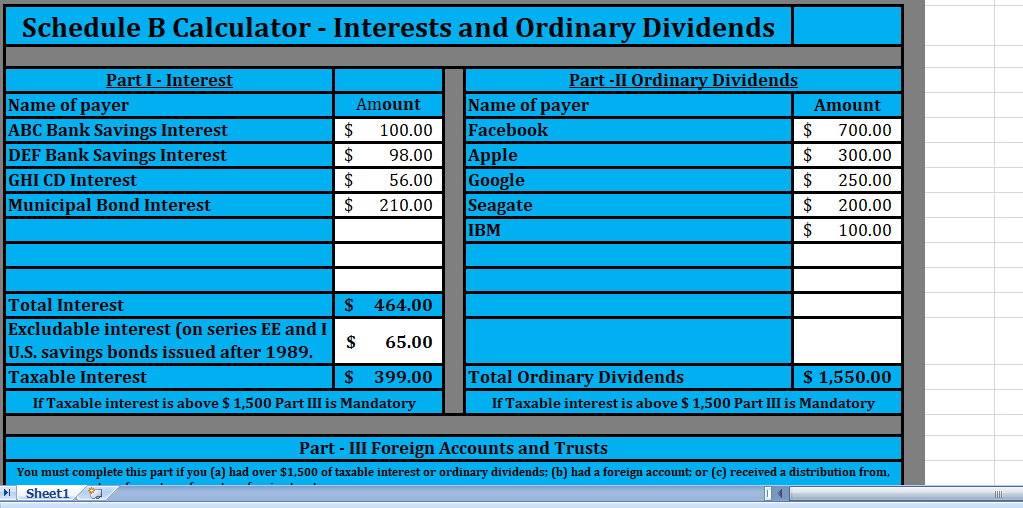

Schedule B Calculator is excel template that consists of calculations of taxable interest and ordinary dividends under Schedule B of Form 1040 and 1040A for the federal income tax.

Interests and dividend incomes received during the tax year are posted in Schedule B.

It is not mandatory to file a Schedule B for taxpayer every year. A taxpayer requires filing the Schedule B only when they receives interest and dividend above a certain threshold.

Who needs to file Schedule B tax form?

According to IRS, you require to file Schedule B (Form 1040A or 1040).For the purpose of ease of understanding and avoiding mistakes, we have created an excel template Schedule B Calculator considering all the points.

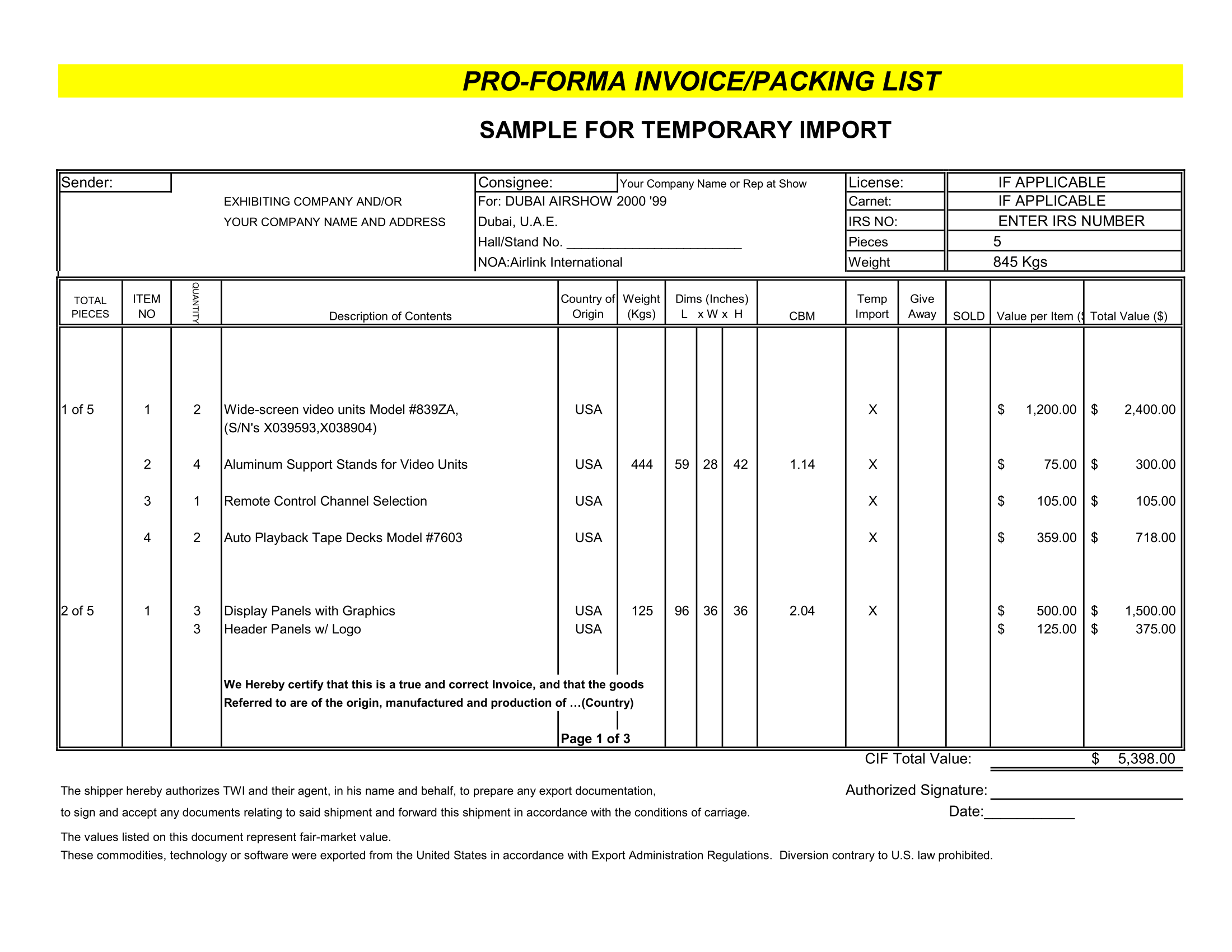

IRS Schedule B Calculator

Moreover, Schedule B consist of 3 sections:

- Interest – Part I

- Ordinary Dividend – Part II

- Foreign Accounts and Trusts – Part III

1. Interests – Part I (Tax Schedule B)

Usually, all types of interest are subject for federal income tax except Interest earned on Series I and EE savings bonds issued after 1989.

Therefore, These interests include interest from bank savings accounts, investment in corporate bonds etc.

1099 provides you a relevant details to fill in Schedule B.

Simply enter the relevant description as well as amounts in respective cells in Part I. It will automatically make subtotals with a predefine formula using the SUM Function.

As Interests earned on Series I and EE savings bond are not subject to federal income tax, it will deduct from the interest amounts.

2. Ordinary Dividends – Part II

Dividends refer to rewards in the form of cash or shares are given by a company to its shareholders. Similar to interests, if total dividends income exceeds a certain threshold, it is mandatory to file Schedule B.

Also, you need to report the dividends along with the name of the company that has paid dividends.

Enter the name of the organization/company paying the dividend and the amounts in Part II. The system will automatically subtotal the amount for you.

3. Foreign Accounts and Trusts – Part III

A taxpayer must complete Part III, if :

(a) has the taxable interest or dividends over $1,500;

(b) has a foreign account

(c) has received a distribution from, or were a grantor or a transferor to, a foreign trust.