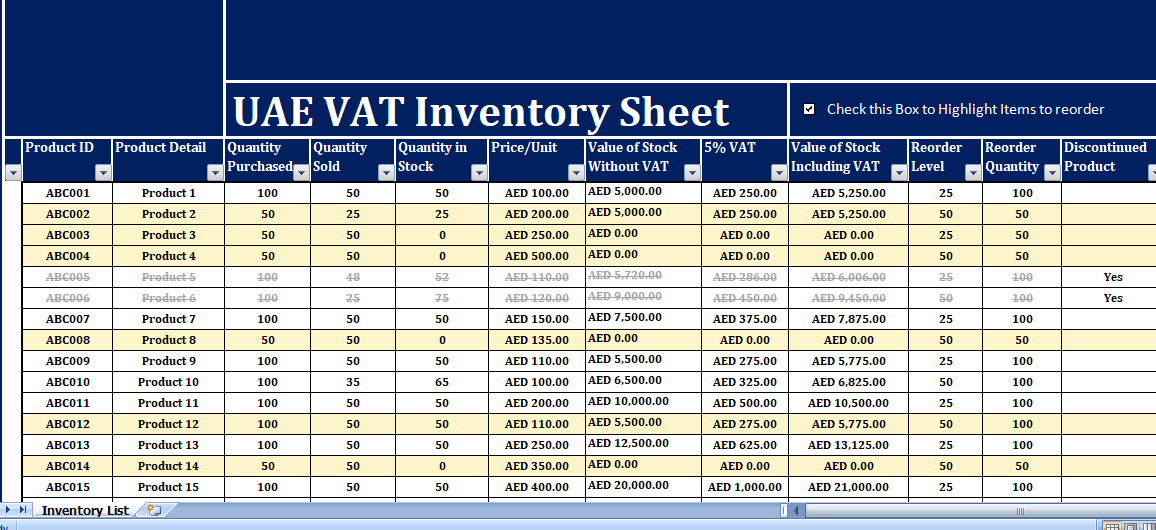

It is mandatory for every business to maintain Inventory to keep record on its purchase and sales process. Different countries have different inventory management systems protocol. Today we will discuss UAE VAT Inventory Management.

UAE VAT Inventory Management Template is a sheet that keeps records of purchase and sales of products taking place in a business.

It also provides information about current status of products in hand, the purchase price per unit, and the value of stock in hand, etc.

Furthermore, this template assists you in knowing the sales pattern of products, through which you can know the best performing products and maintain stock levels accordingly.

It also helps to know the exact stock of each product. Thus, helping you to understand when and which products to be re-order.

UAE VAT Inventory Management Template can be useful to all kinds of business. Business such as retail, wholesale, and especially e-commerce businesses.

We have create an Excel Template for UAE VAT Inventory Management using excel table function and predefine formulas.

Content for UAE VAT Inventory Management Excel Template

Inventory Management Template consists of 3 sections: Header Section, Inventory Section, and Value of Stock Section

Header Section

The header section consists of Company name and the header of the sheet “VAT Inventory Management Excel Template”.

Inventory Section

This section consist of following subheadings:

Product ID: You can predefine the product id for your products.

Product Detail: In addition to the above you can describe your product name here also.

Quantity Purchased: Enter quantity purchase for the product.

Quantity Sold: Enter sales of products against its respective cell. This will give you exact inventory status of the product.

Quantity in Stock: Quantity in stock has predefine formula. The formula apply here is Purchase – Sales = Quantity In Stock

Value of Stock Section

Price/Unit: Mention Price per Unit here to calculate value of the stock without VAT.

Value of Stock Without VAT: Value of Stock without VAT also has predefine formula. The formula apply here is Stock in Hand X Price per unit.

5% VAT: This cell will calculate only the amount of 5 % VAT. Formula: So, Value of Stock without VAT X 5%.

Value of Stock Including VAT: Moreover, Prior to the implementation of the VAT, Value of stock = Price/Unit X Stock in Hand. Now it is Value of Stock = Value of Stock without VAT + Amount of 5 % VAT.

Reorder Level: Furthermore, Reorder level means a limit of the product below which if the stock goes the sheet must provide indications.

Define a level for Reorder. Also, It will highlight the row if a product stock is below that limit it. So, we can reorder the product to prevent the unavailability of goods.

As discussed earlier, there is a checkbox in the header section. If checkbox is check, the product below the reorder level will automatically highlight.

Reorder Quantity: Reorder quantity is number of products to be ordered.

Discontinued Product: Mostly, it happens that there are some products whose sale has stop and we don’t buy them.