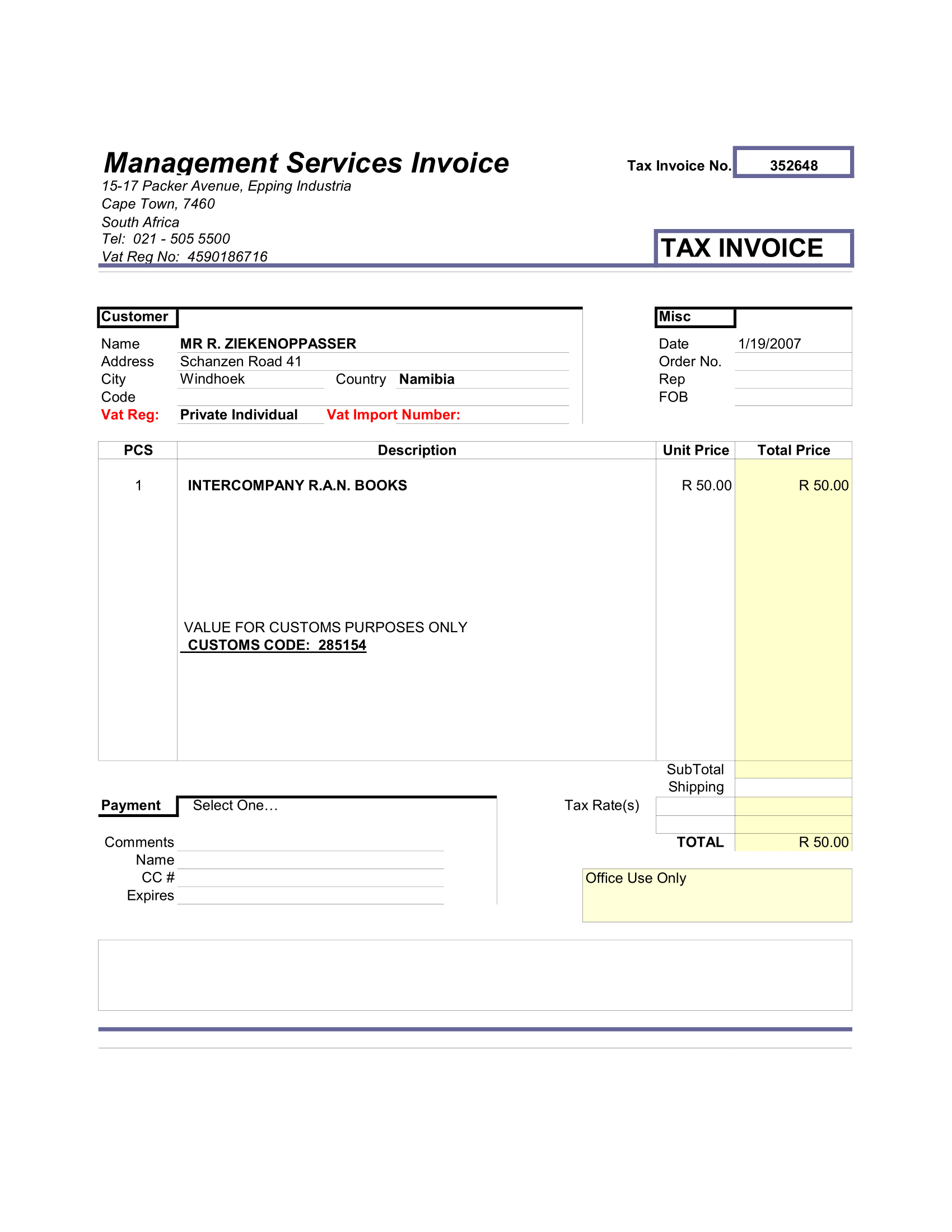

UAE VAT Multiple Tax Invoice is used for goods or services of multiple tax rates taxable(5%), nil(0%) rated or exempt all in one invoice. Usually, traders deal with all kinds of goods and services. Some are taxable and some are non-taxable.

UAE has implement VAT with effect from 1st January 2018. Businesses that fall under the category are preparing for VAT.

We have created the UAE VAT Multiple Tax Invoice in Excel in predefine formulas. Businesses making supplies of goods or services or both can use template to issue an invoice to their customers.

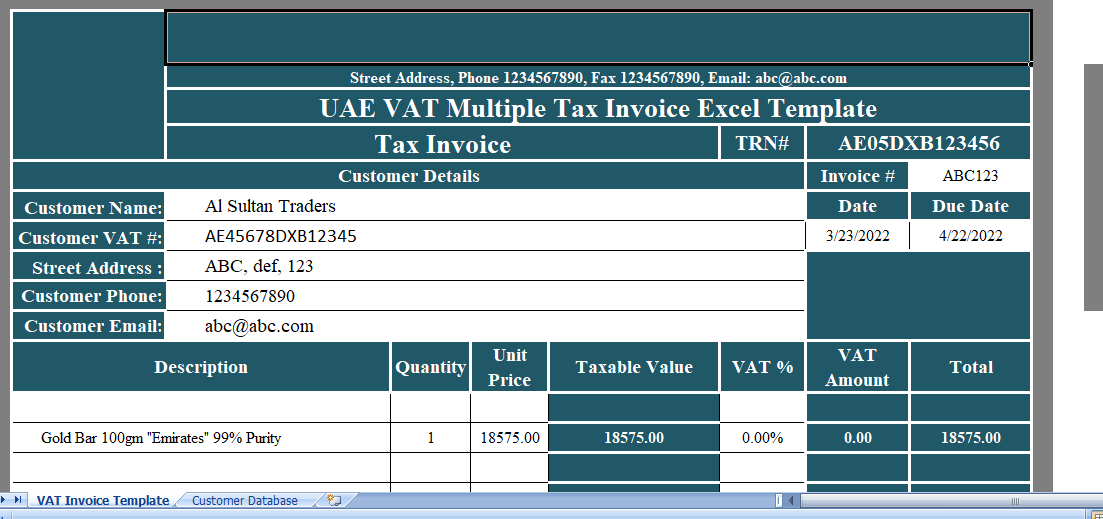

Content of UAE VAT Multiple Tax Invoice Template

UAE VAT Multiple Tax Invoice template has 2 sheets:

- UAE VAT Multiple Tax Invoice

- Customer Database

The customer database contains relevant details of customers like company name, address, contact details, and VAT numbers, etc. Just put the names and details once.

Customer Database link to the UAE VAT Multiple Tax Invoice template. You can fetch all customer information on the invoice with the help from dropdown list.

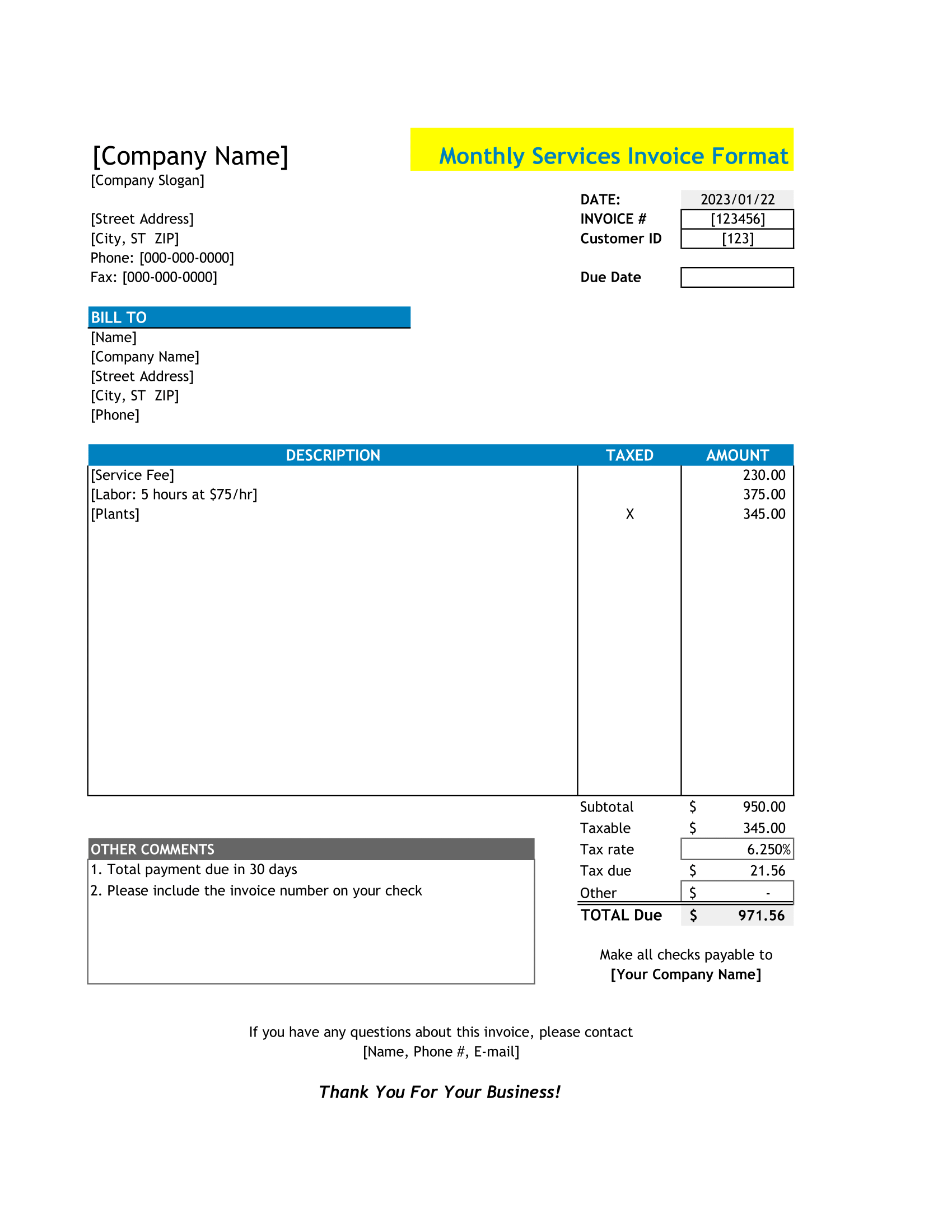

The UAE VAT Multiple Tax Invoice consists of 4 sections:

- Supplier’s Details

- Customer’s Details

- Product Details

- Billing Summary and Other Details

1. Supplier’s Details

Though, This section consists of supplier’s details like company name, company logo, company address, TRN number, invoice title as “Tax Invoice” etc.

However, It is mandatory to mention your TRN (Tax Registration Number/VAT Number) on the invoice.

2. Customer Details

Subsequently, Customer’s details include name, VAT/TRN number, address, phone number, email address, etc of the customer.

In addition this section on the right-hand side consists of Invoice number, Date and bill Due Date.

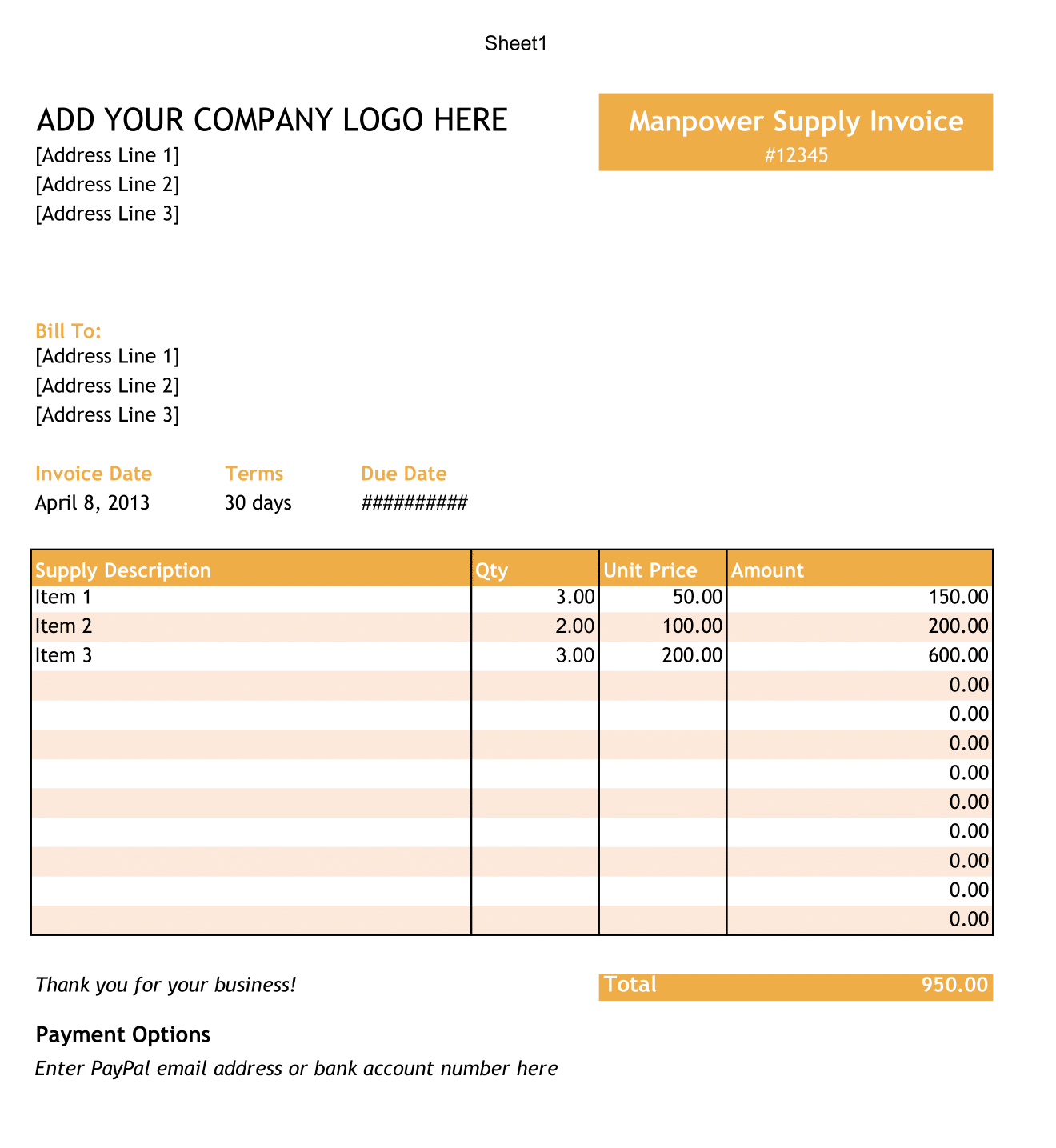

3. Product Details

Usually, product details consist of the product description, quantity, unit price, amount. As here are multiple tax rate items, the tax percentage is mention after the taxable value.

So, The formulas are as below:

- Taxable Value = Quantity X Unit Price

- VAT Amount = Taxable Value X VAT Percentage

- Total = Taxable Value + VAT Amount

However, the column totals for taxable value, VAT amount and Total are given. These totals are use in the billing summary section.

4. Billing Summary and Other Details

Moreover, In billing summary and other details section, there are miscellaneous items like “Amount in Words”, Terms & Conditions, Business greeting, space for company seal and authorized signatory and the billing summary.

Billing Summary is as below:

Total Taxable Value + Total VAT Amount – Discounts(if applicable) = Invoice Amount.

Above all, In the discounts section if the discount is in percentage then enter the percentage in the white box beside discount cell. If it is an amount, then enter the amount manually.