Simplify Your Financial Tracking with a Free Editable Excel Accounting Journal Template

Introduction

Maintaining accurate financial records is crucial for small businesses and individuals to ensure their financial stability and growth. An editable Excel template for an accounting journal can be a valuable tool to track and manage financial transactions with ease. In this blog post, we will discuss the key features of an accounting journal template and how it can help you stay on top of your finances.

Key Features of an Editable Excel Accounting Journal Template

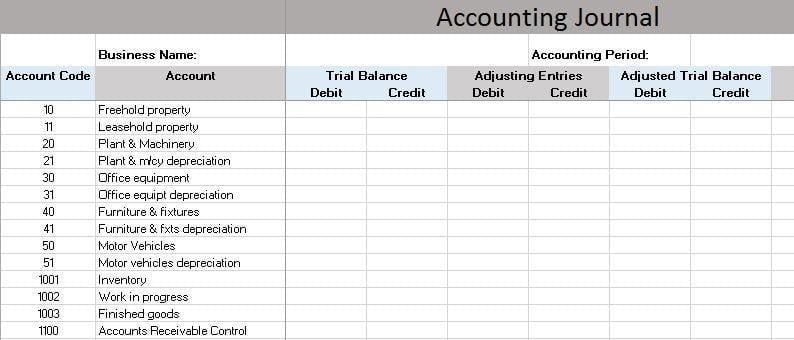

- Trial Balance Sheet: The template includes a trial balance sheet that lists all account balances in the accounting system as of a specific date. This ensures that debits and credits are in balance and helps you spot discrepancies or errors.

- Adjustment Entries: The template allows you to include adjustment entries to correct errors or to reflect transactions that have not yet been recorded in the accounting system. This ensures that your financial records are accurate and up-to-date.

- Adjusted Trial Balance: After making the necessary adjustment entries, the template will generate an adjusted trial balance. This balance sheet lists all account balances after the adjustments have been made.

- Income Statement: The template also includes an income statement that shows your business’s revenues and expenses over a specific period of time. This statement helps you determine your business’s profit or loss during that period.

- Customizable Format: The Excel-based template is fully editable, allowing you to tailor it to your specific needs and preferences.

- Comprehensive Journal Entry Recording: The template includes sections for recording journal entries with all necessary components, such as the date, account name and number, debit and credit amounts, reference numbers, and transaction descriptions.

Benefits of Using an Editable Excel Accounting Journal Template

- Simplified Financial Tracking: The template streamlines the process of tracking and managing financial transactions, making it easier for you to stay on top of your business’s financial health.

- Improved Accuracy: By allowing you to include adjustment entries and generate an adjusted trial balance, the template ensures that your financial records are accurate and free from errors.

- Enhanced Financial Analysis: With an included income statement, the template enables you to analyze your business’s revenues and expenses, helping you make informed decisions about growth strategies and cost management.

- Customizable Solution: The editable Excel format allows you to tailor the template to your specific requirements and preferences.

Conclusion

An editable Excel template for an accounting journal is a powerful tool for small businesses and individuals looking to simplify their financial tracking and management processes. By providing comprehensive journal entry recording and key financial documents such as trial balance sheets and income statements, this template allows you to maintain accurate financial records and gain valuable insights into your business’s financial health. Download a free editable Excel accounting journal template today and experience the benefits of streamlined financial management.