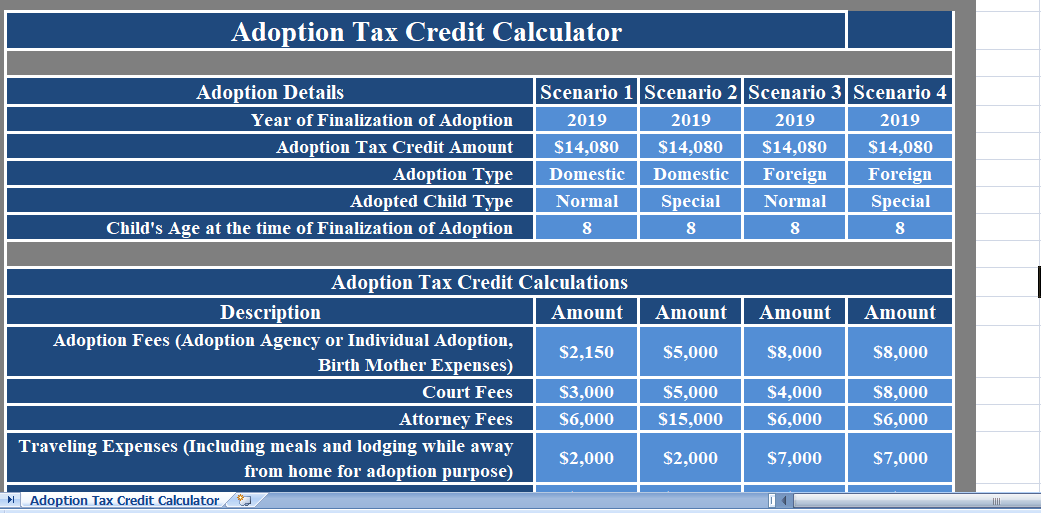

Adoption Tax Credit Calculator is ready-to-use excel template which helps you to calculate the Adoption Tax Credit for 4 different scenarios.

So, With the help of this template, you can calculate adoption credit for the adoption of a domestic normal and special needs child and foreign normal and special needs child.

Furthermore, this template can be use for any of the year. All you have to do is enter the adoption credit limit and the applicable year.

Adoption tax credit 2021

Adoption Tax Credit is a provision that provides the taxpayer the opportunity to deduct expenses spent in the adoption process. A taxpayer can be a qualify expenses approved by the IRS.

Adoption Tax Credit Calculator

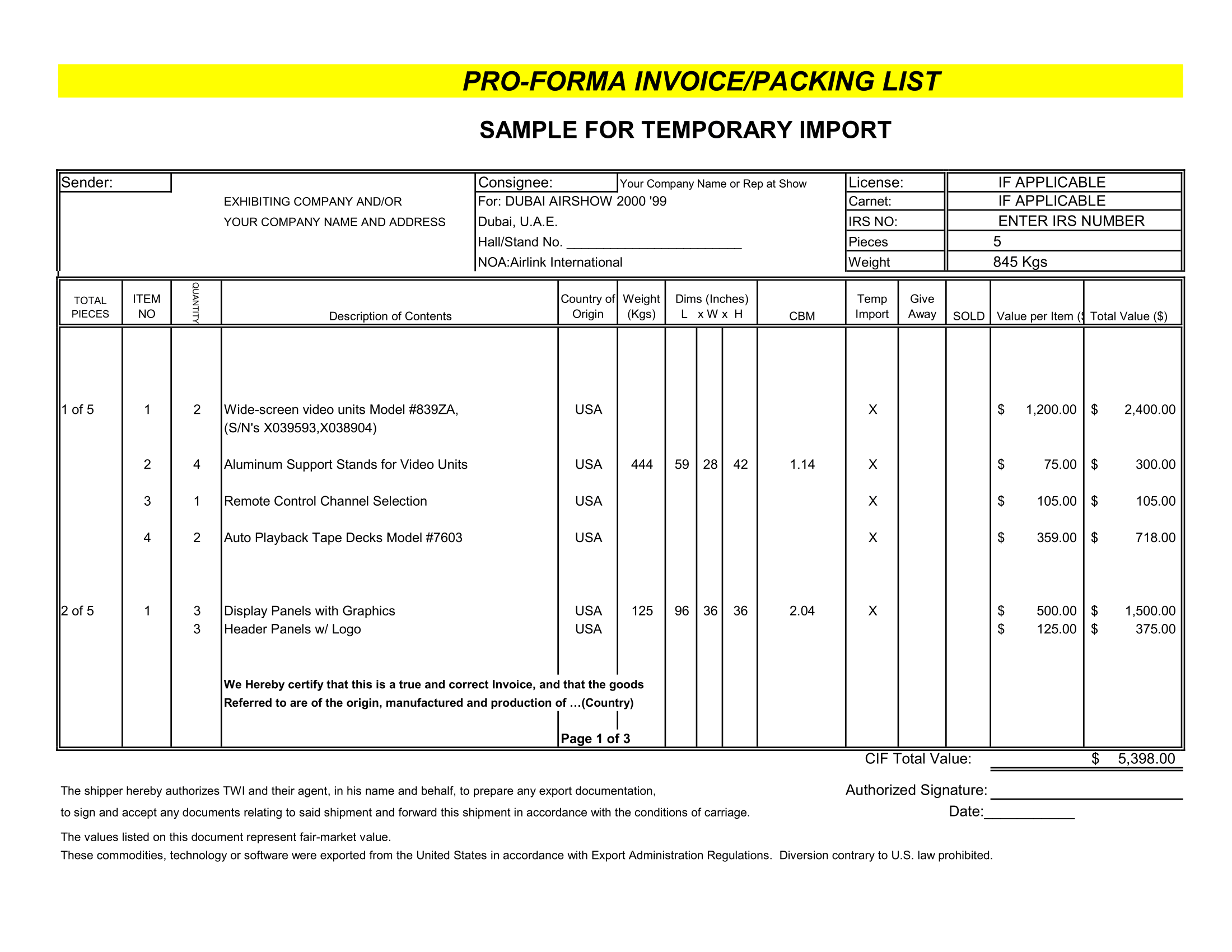

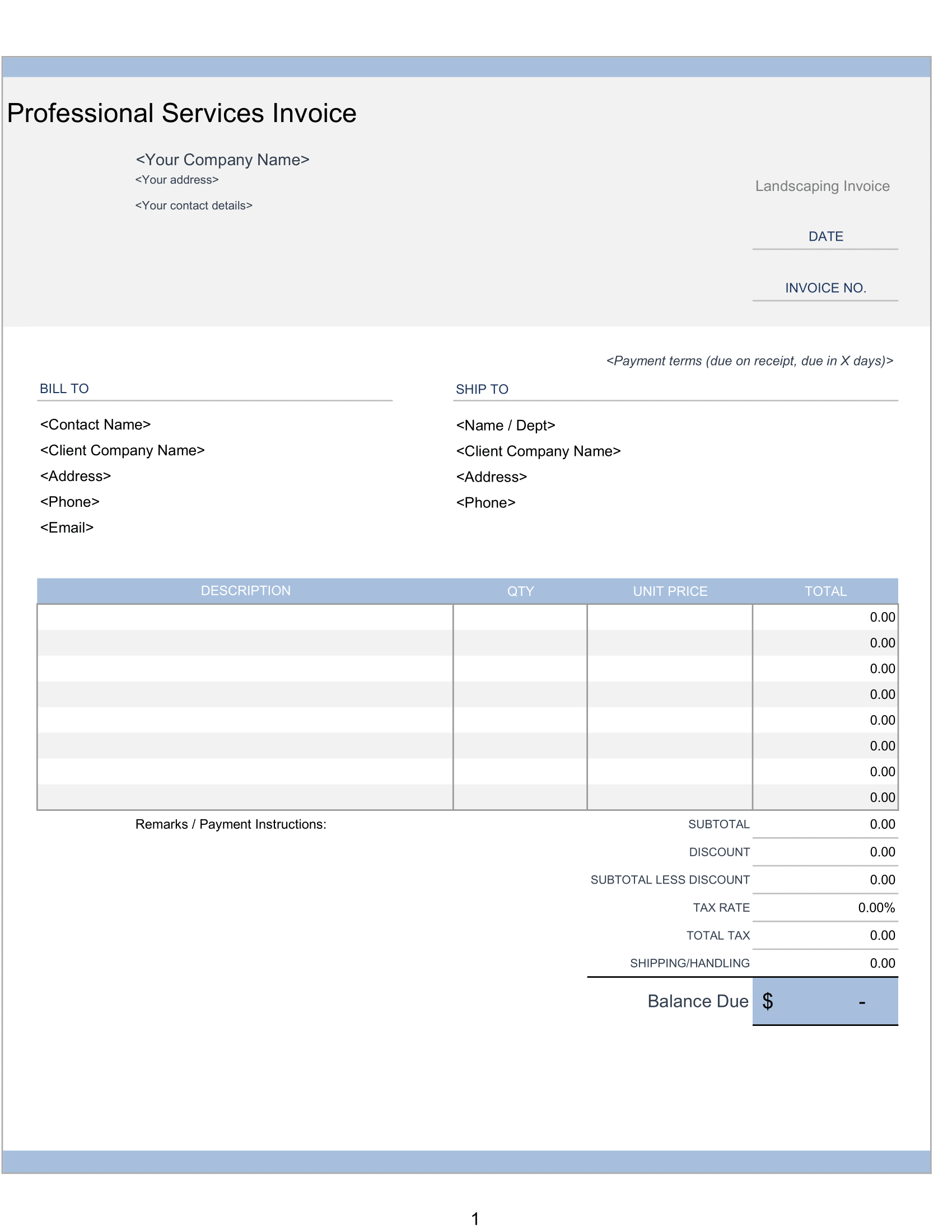

We have created simple and easy Adoption Tax Credit Calculator Excel template with predefine formulas and formatting. Enter your actual expenses for the adoption process. It will automatically calculate claimable adoption credit for you.

Adoption details consist of the following:

Year of Finalization of Adoption

The claim depends on type of adoption. For domestic adoption, the expenses paid before and during particular year can be claimed in the following year of payment.

You can even claim if the adoption has not finalized or even an eligible child is not identified.

In case of foreign adoption, expenses paid before and during the year can only be claim in the year when the adoption becomes final.

Adoption Credit

IRS changes adoption credit limit every year. The credit limit for year 2019 is $ 14,080. Insert the amount that is applicable for the particular year you plan to take this credit.

Moreover, Parents adoption is a normal eligible child, you can claim actually spent expenses up to $ 14,080. Parents adopting eligible special needs are eligible for the maximum amount of $ 14,080 credit in the year of finalization.

Adoption Type

Firstly, Select the type of adoption. It can be either domestic or foreign. Rules are different for both types of adoption.

Adopted Child Type

Similar to the above, rules for availing the credit are different as per adopt child.

Child’s Age at the time of finalization

However, Insert the age of the child at the time of the finalization of the adoption. A child is only eligible for adoption credit if is under the age of 18 who is a U.S. citizen or resident (including U.S. territories) or a non-US citizen.