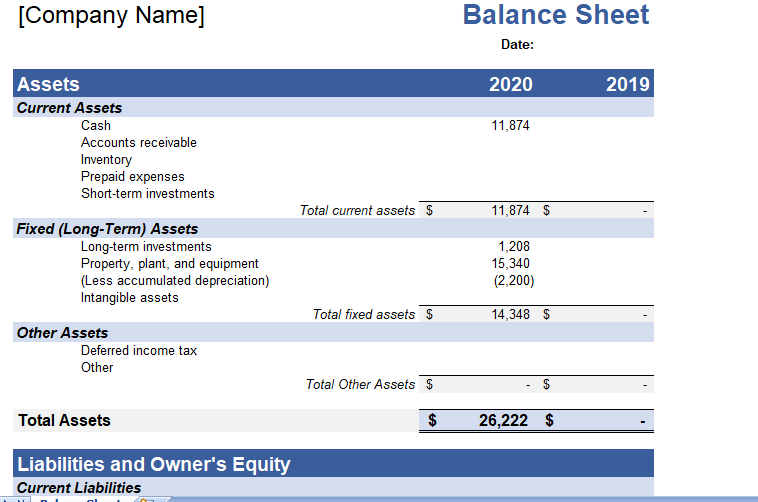

Master Your Finances with Our Free Balance Sheet Format in Excel Template

A balance sheet is a crucial financial statement that provides a snapshot of an organization’s financial health at a specific point in time. It summarizes a company’s assets, liabilities, and equity, giving valuable insights into its financial stability and performance. Our free Balance Sheet Format in Excel Template simplifies the process of creating a balance sheet and helps you gain better control over your finances. In this blog post, we will discuss what a balance sheet is, its key components, and how to use our user-friendly template to create your own balance sheet.

What is a Balance Sheet?

A balance sheet is a financial statement that presents an organization’s financial position at a given moment. It provides a comprehensive overview of the company’s assets, liabilities, and equity, allowing stakeholders to assess its liquidity, solvency, and overall financial health. A balance sheet is a critical tool for decision-making, as it helps organizations identify areas for growth, evaluate risks, and make informed financial decisions.

Components of Balance Sheet: Explained in Detail

A balance sheet consists of three main components:

-

Assets

- Current Assets

- Cash and cash equivalents: Currency, bank deposits, and highly liquid investments.

- Short-term investments (marketable securities): Investments that can be easily converted to cash within a year.

- Accounts receivable: Amounts owed to the company by customers for goods or services provided on credit.

- Notes receivable: Written promises by customers or other parties to pay a specific amount by a certain date.

- Inventory: Raw materials, work-in-progress, and finished goods held for sale.

- Prepaid expenses: Payments made in advance for future expenses, such as insurance premiums or rent.

- Other current assets: Miscellaneous short-term assets not included in the categories above.

- Non-Current Assets

- Long-term investments: Investments held for longer periods, such as stocks, bonds, or real estate.

- Property, plant, and equipment (PPE): Tangible assets used in operations.

- Land: The ground owned by the company.

- Buildings: Structures owned by the company, such as offices, warehouses, or factories.

- Machinery and equipment: Production machinery, tools, and other equipment.

- Vehicles: Company-owned cars, trucks, and other transportation equipment.

- Furniture and fixtures: Desks, chairs, shelves, and other furnishings.

- Leasehold improvements: Renovations or improvements made to a leased property.

- Intangible assets: Non-physical assets with long-term value.

- Patents: Legal protection for inventions or processes.

- Trademarks: Exclusive rights to use a brand name or logo.

- Copyrights: Exclusive rights to reproduce and distribute creative works.

- Goodwill: The value of a company’s reputation, customer relationships, and other intangible factors.

- Other non-current assets: Long-term assets not included in the categories above, such as deferred tax assets or long-term prepaid expenses.

- Current Assets

-

Liabilities

- Current Liabilities

- Accounts payable: Amounts owed to suppliers or vendors for goods or services received on credit.

- Short-term loans: Borrowings that must be repaid within a year, such as lines of credit or working capital loans.

- Taxes payable: Taxes owed but not yet paid to the government.

- Accrued expenses: Expenses incurred but not yet paid, such as wages or utilities.

- Notes payable: Short-term debt obligations, typically with a maturity of one year or less.

- Unearned revenue: Payments received in advance for goods or services that have not yet been delivered.

- Other current liabilities: Miscellaneous short-term obligations not included in the categories above.

- Non-Current Liabilities

- Long-term loans: Borrowings that are due after a year, such as mortgages or term loans.

- Bonds payable: Long-term debt securities issued by a company to raise capital, with a promise to pay interest and principal at specified dates.

- Deferred tax liabilities: Taxes that are due in the future due to differences between financial and tax reporting.

- Pension and other post-employment benefit obligations: Liabilities related to employee retirement benefits.

- Other non-current liabilities: Long-term obligations not included in the categories above, such as capital leases or asset retirement obligations.

- Current Liabilities

-

Equity

- Share Capital: Funds contributed by shareholders in exchange for shares of ownership in the company (stocks or paid-in capital).

- Retained Earnings: Accumulated profits that have not been distributed as dividends and are reinvested in the business.

- Treasury Stock: Shares of a company’s own stock that have been repurchased by the company and are held in treasury.

- Additional Paid-in Capital: The amount of capital contributed by shareholders in excess of the par value of shares issued.

- Accumulated Other Comprehensive Income (AOCI): Unrealized gains and losses from various sources, such as foreign currency translation adjustments, pension plan adjustments, or unrealized gains/losses on available-for-sale securities.

- Non-controlling Interest (Minority Interest): The portion of equity in a subsidiary that is not owned by the parent company.

- Other equity components: Miscellaneous items that may be included in equity, such as stock options, warrants, or convertible securities.

By organizing a balance sheet with these components, a company can clearly present its financial position to shareholders, investors, and other stakeholders. This information is essential for making informed decisions regarding the management of the company’s resources, risk exposure, and overall financial health.

Conclusion

Our free Balance Sheet Format in Excel Template offers a user-friendly and efficient solution for creating a balance sheet, helping you better understand your organization’s financial health. With its customizable format and automatic calculations, this template makes it easy to create and maintain an accurate balance sheet. Download our Balance Sheet Format in Excel Template today and take control of your finances like never before.

Explore our other balance sheet template