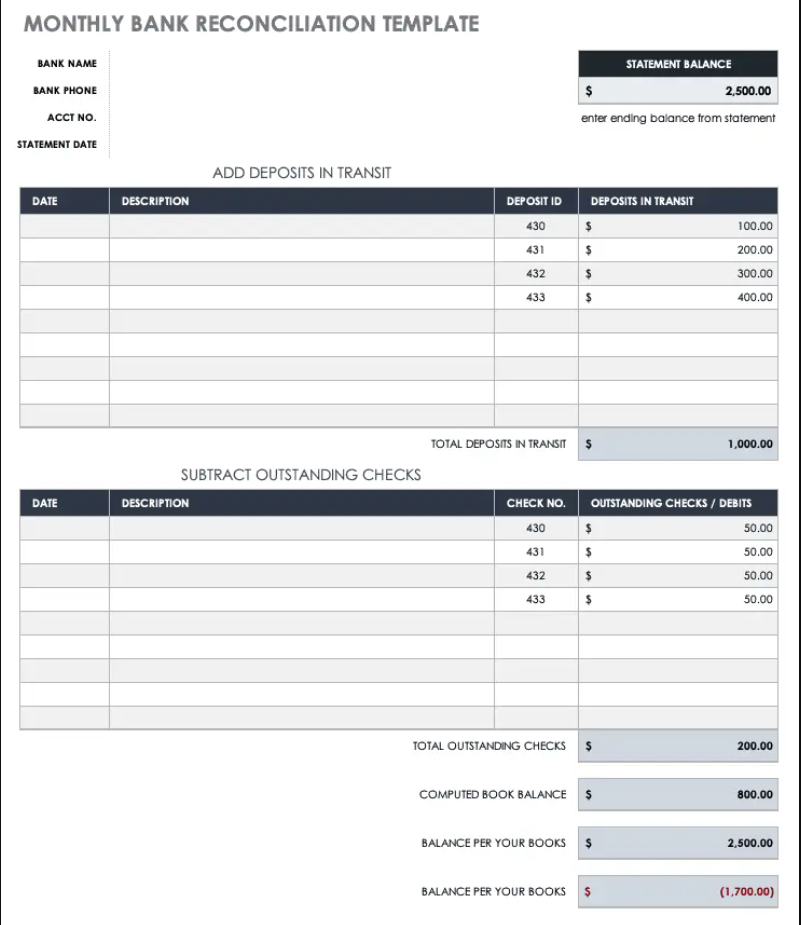

Bank Reconciliation Template in Excel with Automatic Calculation

Our Bank Reconciliation Template in Excel provides a comprehensive and automated way to streamline your bank reconciliation process. Utilizing a robust set of functions, our template empowers you to organize, reconcile, and understand your financial status with incredible ease and accuracy.

What is a Bank Reconciliation Statement?

A Bank Reconciliation Statement is a document that compares the bank balance as per the company’s accounting records with the statement provided by the bank. It is essential to identify any discrepancies between the two and rectify any errors or identify issues such as fraud, double accounting, or missed transactions.

Why is it important to prepare a Bank Reconciliation Statement?

Preparing a Bank Reconciliation Statement is crucial for businesses and individuals for several reasons:

1. Accuracy of Records:

Imagine a situation where your company’s accounting system shows a bank balance of $10,000, but the bank’s statement shows $8,000. This discrepancy could be due to outstanding checks that haven’t been cashed yet, a deposit in transit not yet accounted for by the bank, or it could be a result of an error in your books. By preparing a Bank Reconciliation Statement, you can identify the reason for this difference and make the necessary adjustments, ensuring your records accurately reflect your actual bank balance.

2. Detect Errors or Fraud:

Let’s say your bookkeeper has accidentally recorded a $100 transaction as $1,000. This error would go unnoticed without a bank reconciliation process. However, by comparing your accounting records to your bank statement, you can easily spot this discrepancy and correct it. Moreover, in the unfortunate event of fraudulent activity, such as a dishonest employee siphoning off funds, regular bank reconciliations can alert you to the problem before it spirals out of control.

3. Better Financial Management:

Assume you’re about to make a significant investment in new equipment based on your book balance of $50,000. However, your bank balance is only $40,000 due to several outstanding checks. If you proceeded without conducting a bank reconciliation, you could overdraw your account, leading to unnecessary fees and potential credit issues. Regular bank reconciliation allows you to have a clear picture of your cash position and manage your resources more effectively.

4. Audit Compliance:

During an audit, auditors will likely request a Bank Reconciliation Statement. If your accounting records show a balance of $20,000 and your bank statement shows $18,000, auditors will need to understand why. If you’ve been regularly preparing Bank Reconciliation Statements, you’ll have a clear record showing items such as outstanding checks or deposits in transit that account for the difference. This saves time during the audit and demonstrates that your business maintains accurate financial records.

Features of the Bank Reconciliation Template in Excel with Automatic Calculation

- Automatic Calculation: The template automatically calculates differences between your bank statement and company books, saving time and reducing potential human error.

- Streamlined Interface: The user-friendly design of the template ensures an easy-to-follow process, allowing you to reconcile your bank statement with ease.

- Discrepancy Highlighting: The template swiftly identifies any discrepancies between your bank statement and company books, drawing your attention to these areas for further review.

- Transaction Recording: Record each transaction and mark it as cleared or uncleared, helping track pending transactions.

- Adjustments Tracking: Log any adjustments made during reconciliation to maintain a clear audit trail and ensure future compliance.

- Summary and Insights: Get a snapshot of your reconciled data with summary reports that give you valuable insights into your financial standing.

How is a Bank Reconciliation Statement prepared?

With our Excel template, the bank reconciliation process is simplified:

- Import your bank statement: First, import or manually input your bank statement data into the designated area in the template.

- Input your book records: Then, enter the company’s accounting records for the same period.

- Automatic calculation: The Excel template will automatically compare the two records and highlight any discrepancies for further investigation.

- Identify and correct discrepancies: Go through the highlighted discrepancies and rectify any errors in your accounting books or liaise with the bank in case of errors on their part.

- Finalize your statement: Once all discrepancies are accounted for and adjusted, you have a completed Bank Reconciliation Statement.

The template comes with easy-to-follow instructions and dedicated support to ensure a smooth and efficient bank reconciliation process.

Who should prepare a Bank Reconciliation Statement?

Bank reconciliation should be a regular task for any business, no matter how large or small. It is generally prepared by individuals responsible for financial management, such as accountants or finance managers. However, with our easy-to-use Bank Reconciliation Template, even business owners without a strong financial background can easily carry out this critical task.

Our Bank Reconciliation Template is ideal for:

- Small Business Owners: They can use this tool to manage their financial health and maintain accurate records without needing deep financial knowledge.

- Accountants: This template serves as a useful tool for accountants in streamlining their reconciliation processes, saving them valuable time.

- Finance Teams: Large organizations can also benefit by simplifying their financial reconciliation tasks and ensuring accurate, compliant records.

- Non-profit organizations: Non-profits often run on tight budgets, and accurate bank reconciliation is crucial to manage their finances effectively.

Upgrade your financial management today with our Bank Reconciliation Template in Excel with Automatic Calculation. Save time, improve accuracy, and gain peace of mind knowing your finances are thoroughly organized and reconciled.