An expense budget is an estimation of revenue and expenses over a specified period and that is usually re-evaluated periodically. Expense Budgets can be made for a person, a group of people, a business, a government, or just anything else that makes expenses and spends money. For instance, to manage your monthly expenses, prepare for life’s unpredictable circumstances, and be able to afford big-ticket items without going into debt, expense budgeting is important. Following expense rules of how much you earn and spend doesn’t have to be hard work, doesn’t require you to be good at math, and doesn’t mean you can’t buy the things you want. It just tracks that you’ll know where your money goes, you’ll have greater control over your finances and expenses.

Expense Budget in EXCEL

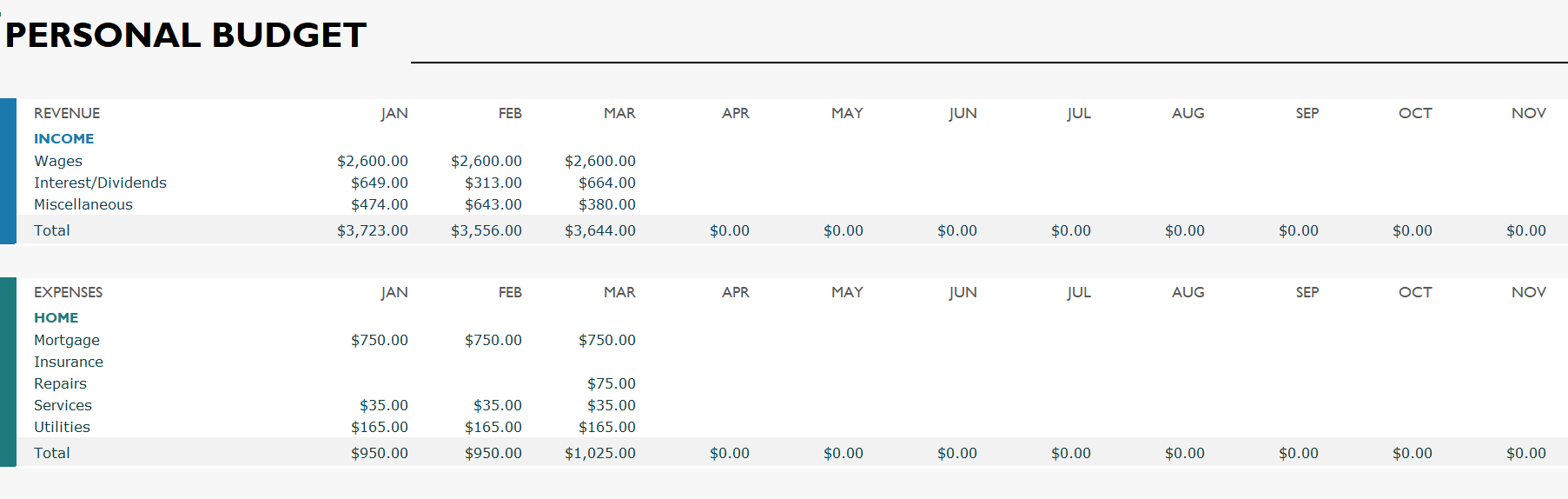

A Simple Budget is not all about your expenses; it is about your revenue too. You need to be perfectly alert of your income to plan your expenses.

List your Revenue

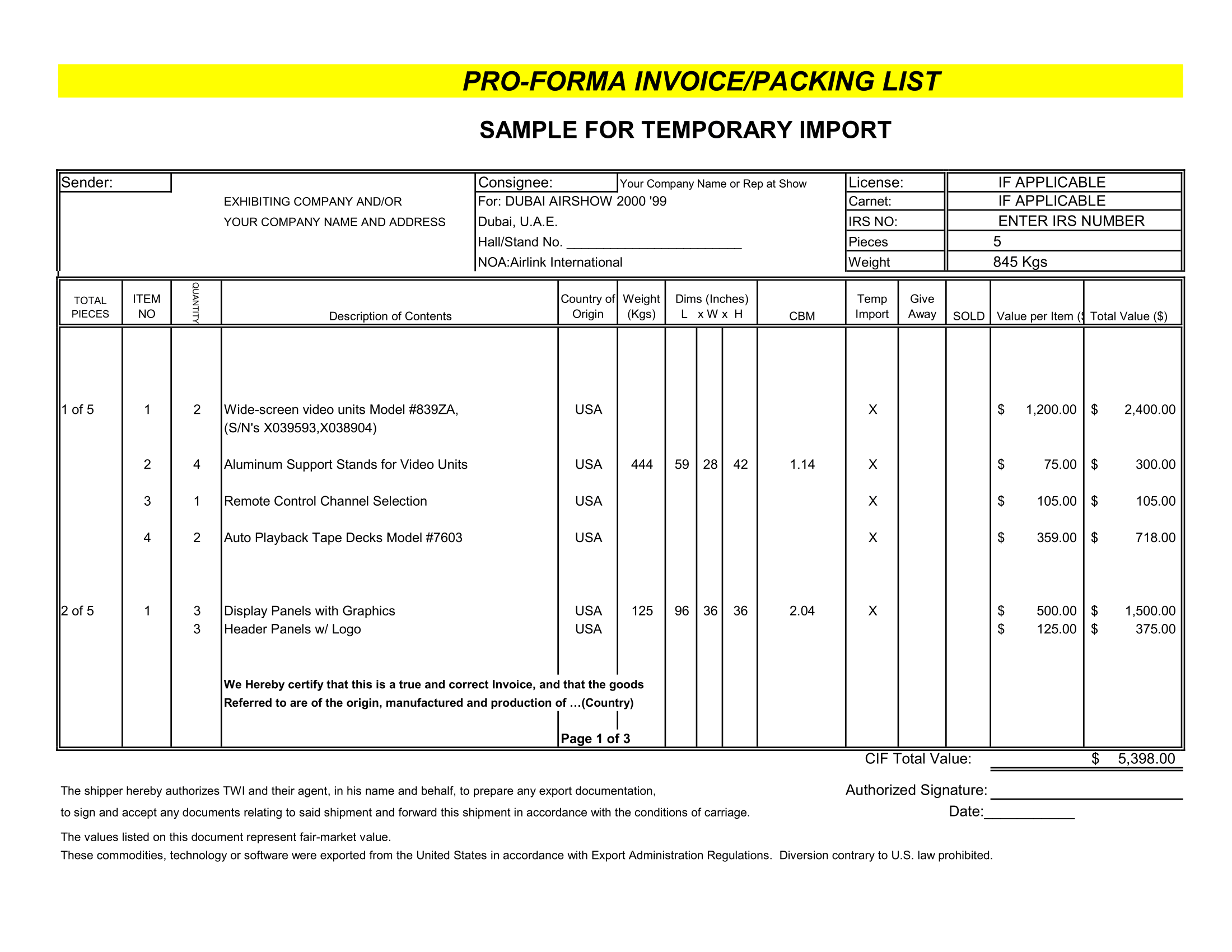

Your Revenue is any money you plan to get during that month—that means your normal paychecks and any extra money coming your way through a side hustle and freelance work or anything like that. So list your revenue expenses like-

Wages

Interest/Dividends

Miscellaneous and total

List Your Expenses

Now that you’ve planned for the money coming in from revenue, you can plan for the money going out. It’s time to list your expenses! in this your bank account or statement gets super helpful. List your expenses like-

MORTGAGE

INSURANCE

REPAIRS

SERVICES

UTILITIES AND TOTAL

For instance, when you’re making an expense budget before you put in all the things you’ll pay for this month, set aside money. We believe in 15% of your expense budget for your savings goals, like an emergency fund. You’ve got to pay yourself first before you pay everyone else.

Track Your Expenses (All Month Long)

Ready for one of the biggest secrets for how to budget—and do it well? Here it is: Track your Transactions and Personal Finance.

Every single one like-

DAILY LIVING

TRANSPORTATION

ENTERTAINMENT

HEALTH

VACATIONS

RECREATION

DUES/SUBSCRIPTION

FINANCIAL OBLIGATIONS

MISC PAYMENTS

Total expenses

Cash short/extra

Putting the plan on paper and app is just a bunch of good intentions without this step. It’s like writing down a goal to run a race.

Make a New Personal Budget Before the Month Begins

When your budget changes too much from month to month, the fact is, no two months are exactly the same. That’s why create a new personal budget every single month—before the month begins.

Importance of Personal Expense Budgeting

Budgets form an important part of any family. The different types of budget ensure that the right amount of money is assigned to different things. For instance, making wrong budgets can be fatal for the home budget as it can lead to inefficient use of resources. Based on the home requirements, a budget is must prepared for the smooth running of the personal expenses.

- Budgeting helps you to control your spending- When you operate your income without budgeting you don’t have anything holding you back from spending money beyond your needs.

- Helps you in future financial contentment- It is good for future finances and keeps you away from overspending.

- Keeps you organized- It keeps your financial life easy without getting messed with your monthly bills, debt payment, and other expenses.

- To prepare for Emergencies- Life is full of unexpected things from hospital bills to home repair if you don’t prepare for these expenses then you won’t be ready when these emergencies take place.

- Helps you to Save Money- If you don’t have control over your spending then you have to immediately start Budgeting for future, emergency, and retirement use. Start investing the saved money in funds.