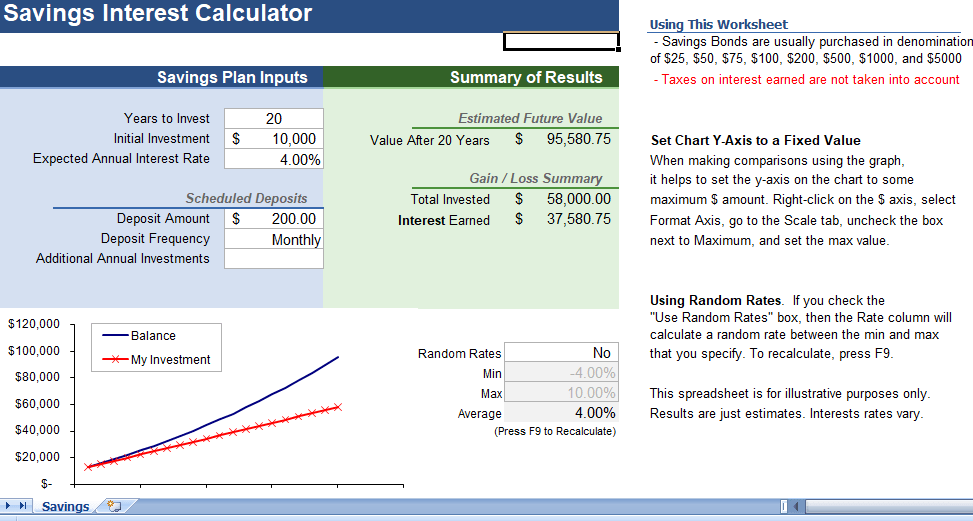

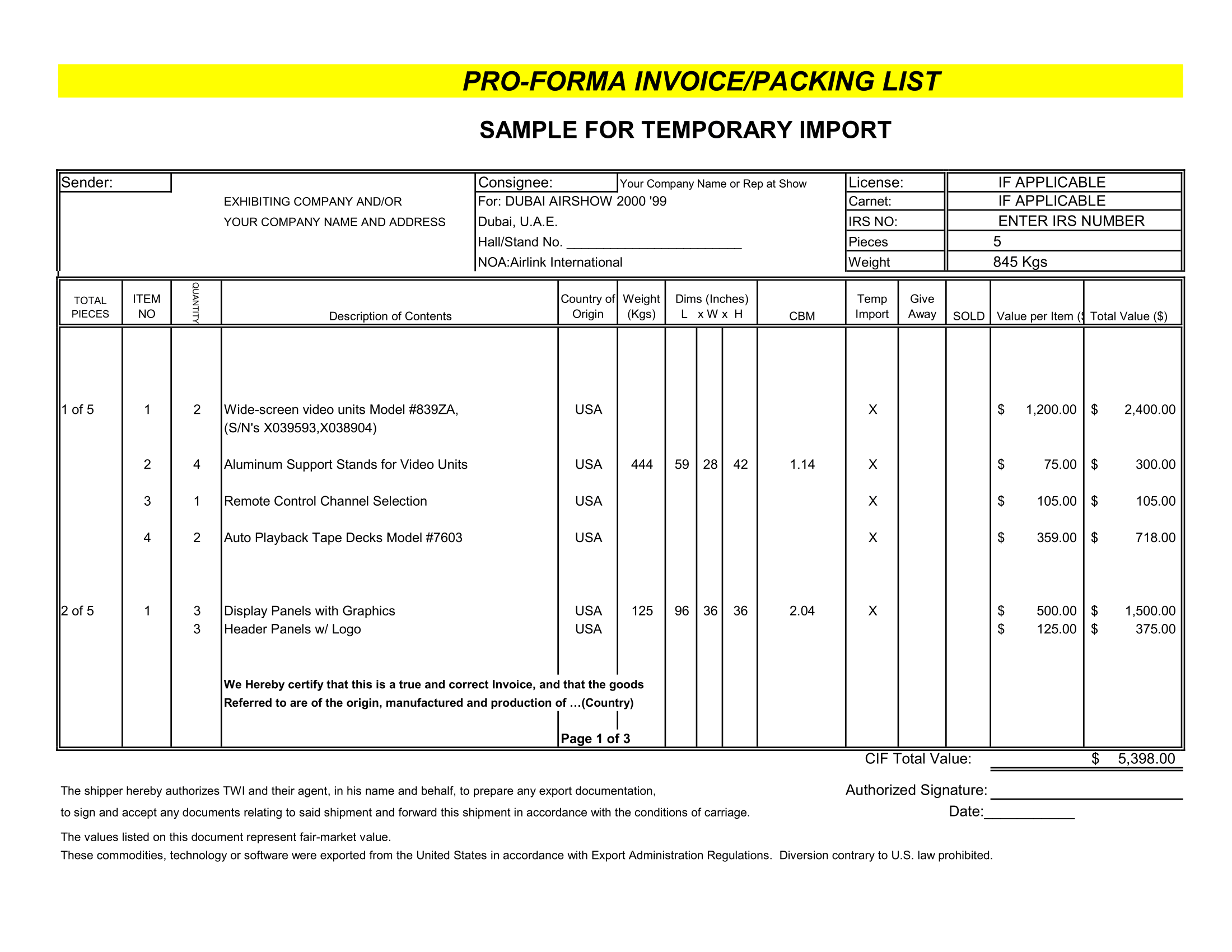

Our Savings Interest Calculator spreadsheet is simple to use and much more powerful than most online calculators that you’ll find. It estimates the future value of your savings account with optional periodic deposits. It also includes a yearly table that lets you add specific annual deposits that may be different for year to year. You can choose to randomize the annual interest rates within the Min/Max values you specify so you can get an idea of your savings in market fluctuations.

Savings account Calculator

Estimate the interest earned in your savings account. Include regular monthly deposits or an annual deposit. This simple to use Excel spreadsheet includes a table showing the interest you are earning every year.

A unique feature of this calculator is the option to select a random rate of interest, to simulate fluctuation in the market. Just press F9 many of times to see how the graph of the balance changes.

The versions for OpenOffice is created using the simpler version of the calculator shown on the left. This doesn’t include the random interest rate feature. You still can manually enter different rates for each year in the interest rate column.

Savings interest rate calculator

Example: Let’s say I start with $5000 in a savings account with a 4.0% annual interest rate. I plan to deposit $100 per month. I also want to deposit my tax return, that may change from year to year. I’m pretty sure that my tax return will be at least $2000 so I enter that in the Additional Annual Investments field.

In the graph, the interest earned is the difference between the End Balance and the Cumulative Interest. The graph shows that until 10 years, the majority of the balance is the cumulative amount I’ve invested instead of interest earned. But, by the end of the 30 years, my balance is almost twice what I have put in.