Master Your Company’s Cash Flow with a 3-Year Cash Flow Statement Excel Template

Understanding and managing cash flow is critical for any business, regardless of its size or industry. A cash flow statement is a vital financial document that offers insights into a company’s liquidity and solvency by tracking the inflow and outflow of cash over a specific period. This blog post will discuss the benefits of using a 3-year cash flow statement template and how it can help you analyze your company’s financial health with ease.

What is a 3-Year Cash Flow Statement Template?

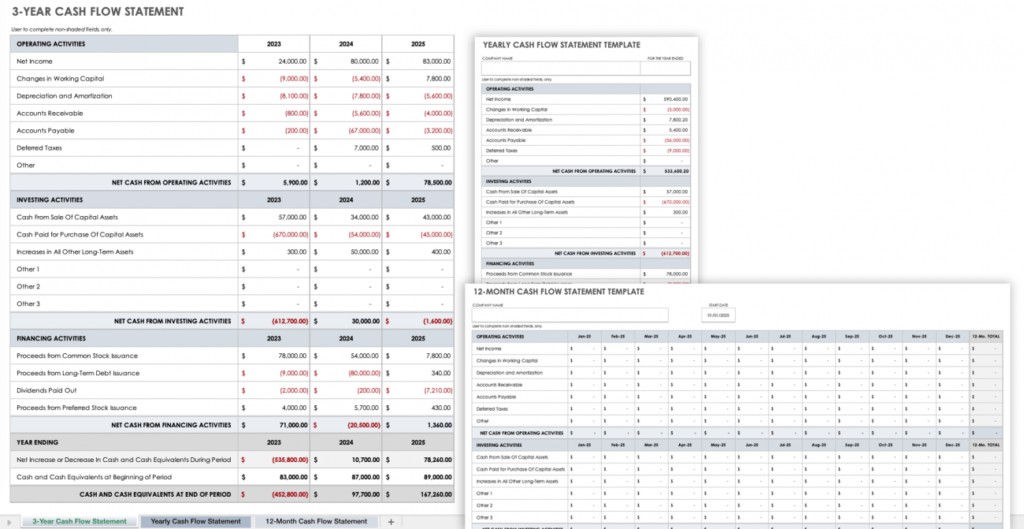

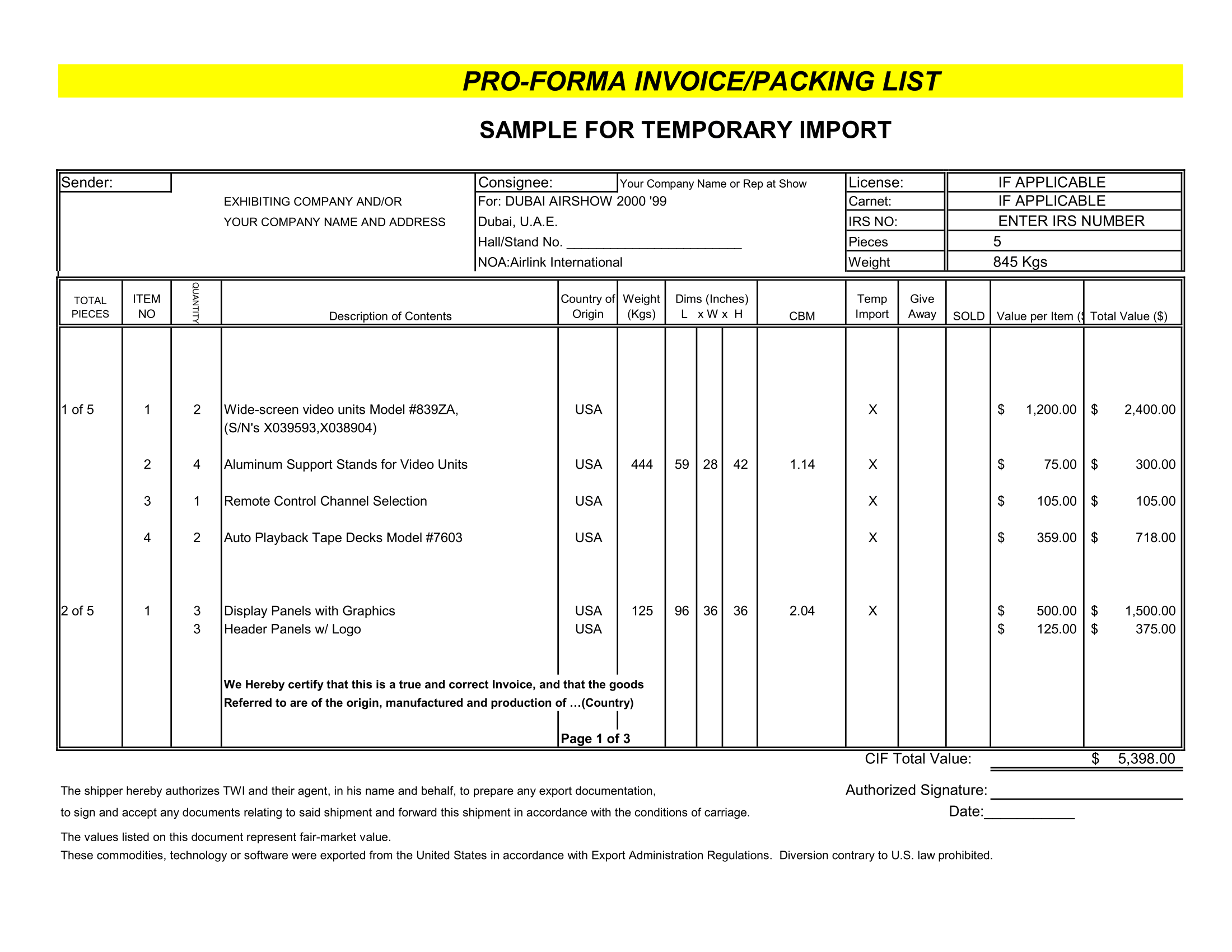

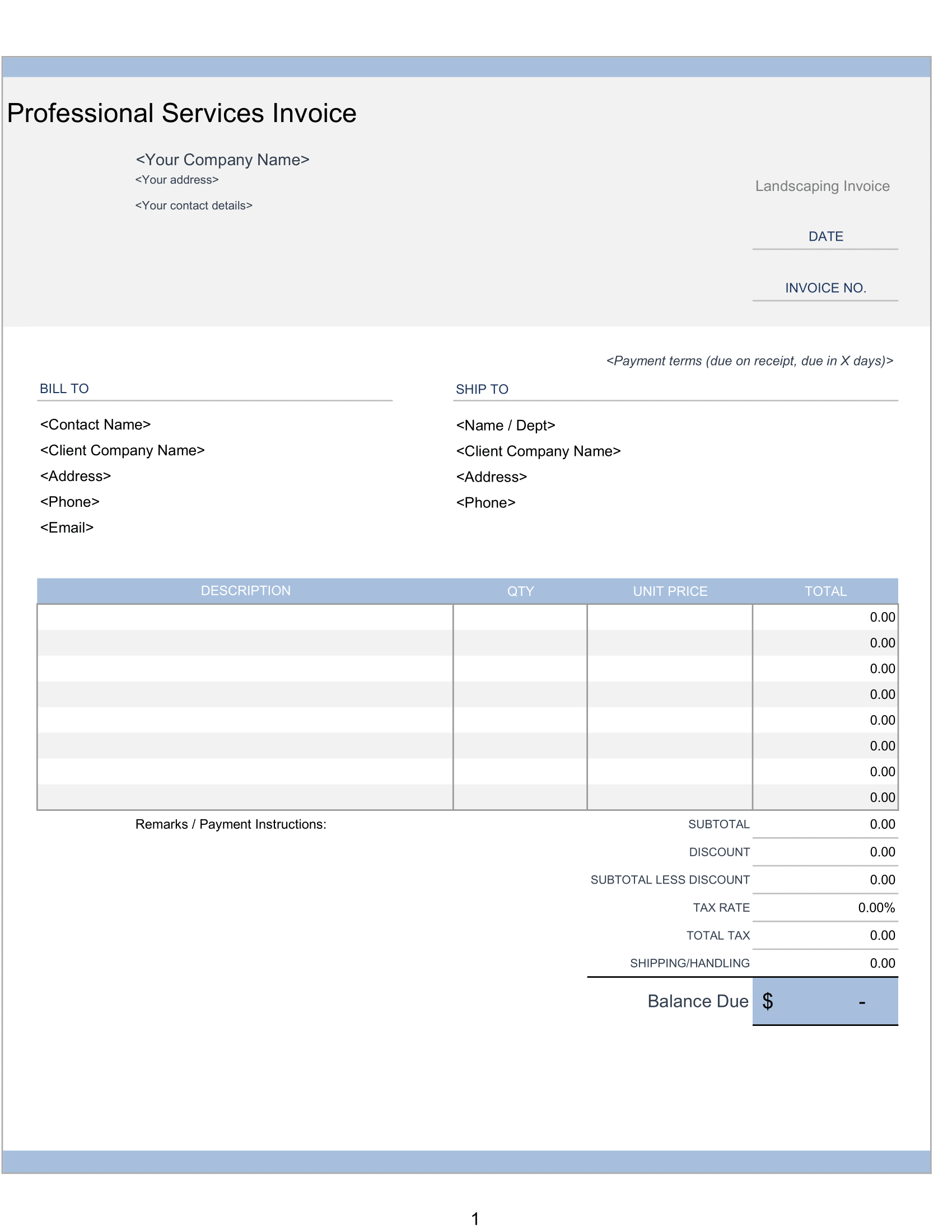

A 3-year cash flow statement template is a Microsoft Excel-based tool that enables you to create cash flow statements for three consecutive years, offering a comprehensive view of your company’s cash flow performance. This template typically includes three worksheets: a summary sheet, an annual cash flow statement, and a monthly cash flow statement. Each worksheet serves a specific purpose, providing insights into different aspects of your business’s financial health.

Key Features of a This Excel Template

- Fully customizable: Tailor the template to meet your unique needs and preferences by editing the Microsoft Excel document.

- Formula-driven: Save time and effort by entering relevant data, and the template will automatically calculate the results.

- Year-over-year comparison: Easily compare cash flow performance over a 3-year period, enabling you to identify trends and patterns that may not be immediately apparent from a single-year statement.

- Monthly and yearly cash flow statements: Gain a more granular view of your company’s cash flow by analyzing both monthly and yearly cash flow statements.

Benefits of Using a 3-Year Cash Flow Statement Template

- Comprehensive financial analysis: A 3-year cash flow statement template allows you to thoroughly examine your company’s financial performance, providing valuable insights into its liquidity and solvency.

- Improved decision-making: By analyzing your company’s cash flow trends and patterns, you can make informed decisions about investments, growth strategies, and debt management.

- Enhanced communication: Presenting a comprehensive cash flow analysis to stakeholders, such as investors and creditors, can help build trust and confidence in your company’s financial health.

- Proactive financial management: Identifying potential cash flow issues early enables you to address them proactively, mitigating risks and maximizing growth opportunities.

Conclusion

A 3-year cash flow statement Excel template is an indispensable tool for businesses looking to better understand their financial performance and make data-driven decisions. With its customizable features and automated calculations, this template offers a comprehensive, easy-to-use solution for analyzing your company’s cash flow. By using a 3-year cash flow statement template, you can gain valuable insights into your business’s financial health, empowering you to make well-informed decisions that drive growth and success.