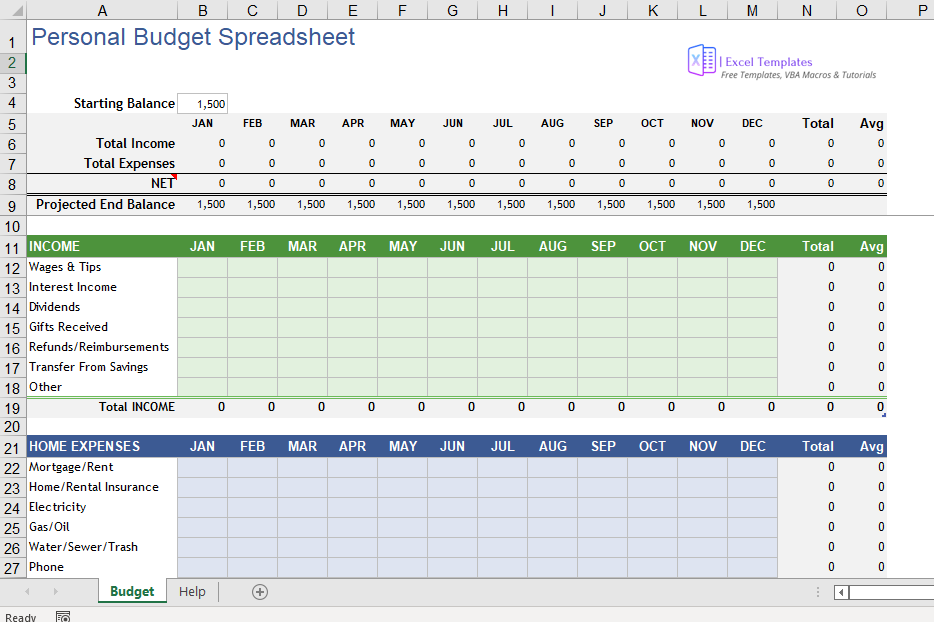

A personal budget is creating a spending plan basis your income and expense plan for the year. Moreover, it is a key tool to improve your financial health. The person’s expenses are further separated into their spending categories which helps them to make planning easier. For instance, Personal budgets also may include a section for tracking the user’s overall spending.

How to use Excel for your Budgeting?

1. Excel then Google Sheets and OpenOffice are free options to consider and use

2. The reason to use Excel in working and business budgets is that gives complete compliance and track of the information.

3. Creating a simple personal budget (only on paper) is one of the first steps to control your spending habits. Track your income and all spending comes both before and after making a budget. For expense tracking, you could use Income and Expenses, Checkbook Worksheet, and money manager. above all, a budget is useless without a record of what you’re spending.

How to make Personal Budget

1. Collect Your Financial Statement i.e Financial Records like

- Bank statements

- Investment accounts and loan statements

- Service bills

- Credit card and bills

- Receipts from the last four months

This will help you to estimate your monthly average budget expenditure

2. Your Monthly Income

If your income is in the form of a regular basis where taxes are abstracted in this you can use net income amount is fine. If you are self-employed or have another source of income then you have to add all these sources of income as well. Add this total income as a monthly amount and make a report.

3. List your daily expenses

- Personal Care

- bills and payments

- Groceries

- Fees

- Insurance

- Loans

- Entertainment

4. Variable Expenses and Constant Expenses

Constant expenses are those mandatory expenses that you have to pay on the regular basis like any bill amount, rent payments, car payments, internet service fee, and regular childcare. And any other amount you pay as a standard credit card payment also includes that and any other essential spending.

5. Add all your income and expenses

If your monthly income is more than your expenses, you have a good start. This means you have some extra money and you can put some funds towards areas of your budget, such as paying off debt or retirement savings. But if your expenses are more than your income, that means you are overspending and need to make changes and reduce some expenses.

Importance of personal budgeting

- To control your spending

- Keeps you organized

- Budgeting helps you to save money

- Helps in your financial contentment and prepare you for emergencies