Mastering the Cash Flow Statement: Creation and Analysis for Financial Success

Introduction:

The cash flow statement is a vital financial document that showcases the inflows and outflows of cash in a business over a specific period. It provides crucial insights into a company’s liquidity, solvency, and overall financial health. In this blog post, we will discuss how to create a cash flow statement and how to analyze it effectively to optimize your financial decision-making. By incorporating high-searched keywords such as cash flow, financial statement, operating activities, investing activities, and financing activities, this guide aims to be an informative and SEO-friendly resource for business owners, entrepreneurs, and financial enthusiasts.

Creating a Cash Flow Statement:

A cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. Follow these steps to create an accurate cash flow statement:

- Operating activities: This section reflects the cash generated from the primary business operations. Begin by calculating the net income from your income statement. Then, adjust the net income for non-cash items, such as depreciation, and changes in working capital, including accounts receivable, inventory, and accounts payable.

Operating activities include cash inflows and outflows related to a company’s core business operations. Some items typically included in this section are:

- Cash receipts from sales or services rendered

- Cash payments to suppliers and employees for goods and services

- Interest received or paid on loans or investments

- Taxes paid

- Cash collected from customers or clients

- Cash paid for operating expenses, such as rent, utilities, and insurance

- Investing activities: This section represents the cash flow from investments in assets, such as property, plant, and equipment (PPE), as well as acquisitions and divestitures. Record the cash inflows and outflows related to these activities, and ensure that you factor in both purchases and sales.

Investing activities involve cash transactions related to acquiring or disposing of long-term assets, investments, and acquisitions or divestitures. Items in this section include:

- Cash spent on acquiring property, plant, and equipment (PPE)

- Cash received from the sale of PPE

- Cash invested in or received from the sale of marketable securities

- Cash spent on acquiring or investing in other businesses

- Cash received from the sale or disposal of business segments or subsidiaries

- Financing activities: This section illustrates the cash flow from financing activities, including issuing or repurchasing stocks, paying dividends, and borrowing or repaying loans. Document the cash inflows and outflows associated with these transactions.

Financing activities represent cash transactions related to a company’s capital structure, including equity and debt financing. Items in this section include:

- Cash received from issuing stocks or other equity instruments

- Cash paid for repurchasing stocks or other equity instruments

- Cash received from issuing bonds, loans, or other debt instruments

- Cash paid for repaying principal amounts on debt instruments

- Cash paid as dividends to shareholders

- Calculate the net cash flow: Add the cash flow from operating, investing, and financing activities to determine the net cash flow for the period. Finally, reconcile the beginning and ending cash balances from your balance sheet to verify the accuracy of your cash flow statement.

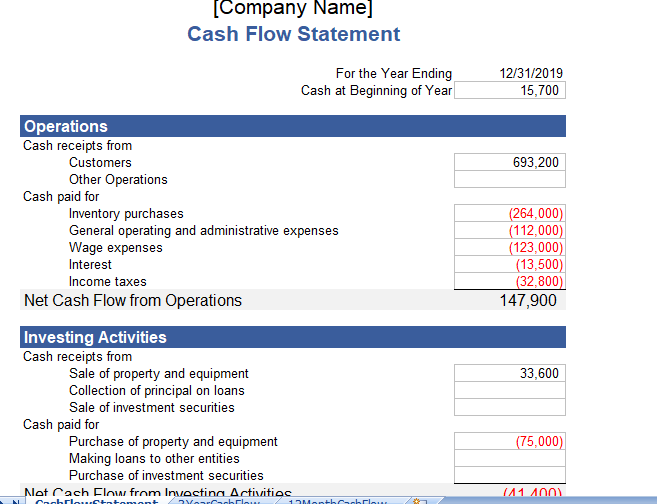

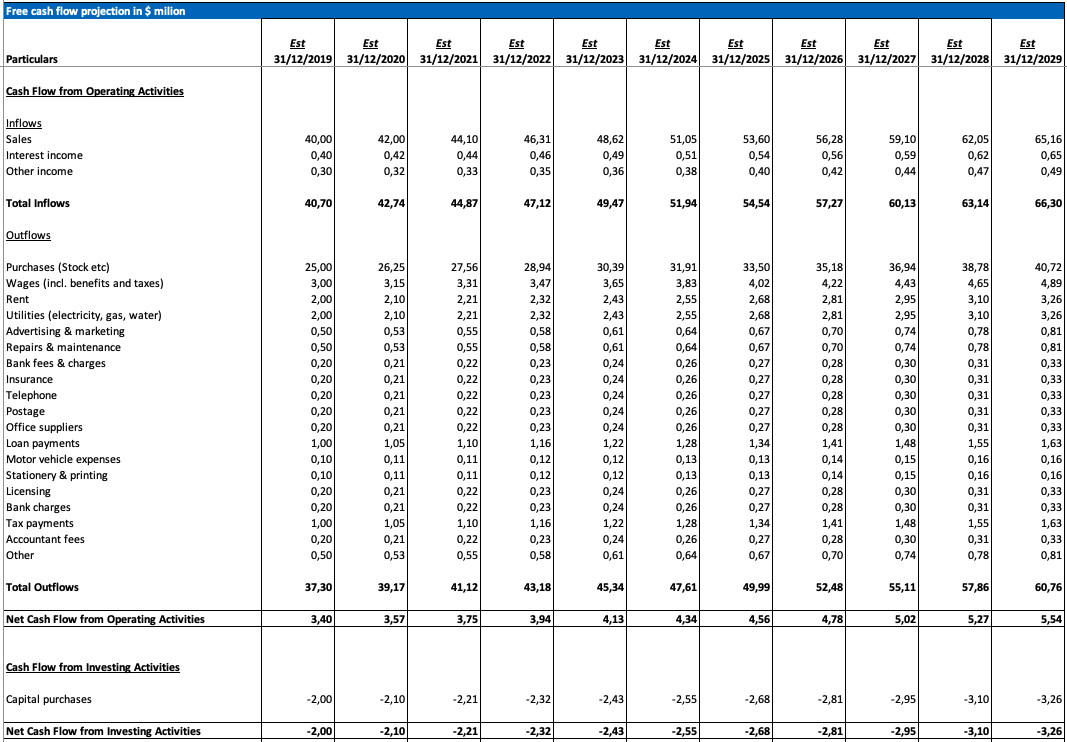

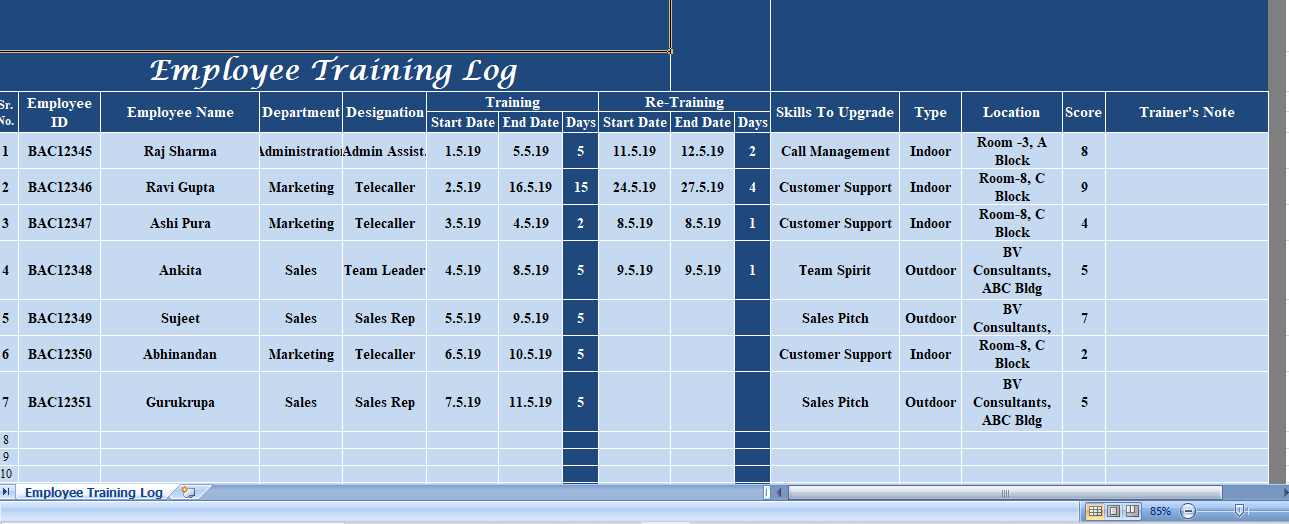

Sample Cash Flow Statement:

Below is a detailed example of a cash flow statement, including a comprehensive list of possible items for each section. Note that not all companies will have every item listed, as the specific transactions will vary depending on the nature of the business.

| ABC Corporation Cash Flow Statement | |

| For the Year Ended December 31, 20XX | |

| Operating Activities: | |

| Net Income | $50,000 |

| Adjustments to reconcile net income: | |

| Depreciation expense | $8,000 |

| Amortization expense | $1,000 |

| Stock-based compensation expense | $2,000 |

| Deferred tax expense | ($1,000) |

| Changes in operating assets and liabilities: | |

| Increase in accounts receivable | ($10,000) |

| Increase in inventory | ($12,000) |

| Increase in prepaid expenses | ($3,000) |

| Increase in accounts payable | $6,000 |

| Increase in accrued expenses | $4,000 |

| Increase in deferred revenue | $2,000 |

| Net cash provided by operating activities | $45,000 |

| Investing Activities: | |

| Purchase of property, plant, and equipment | ($25,000) |

| Purchase of intangible assets | ($5,000) |

| Investments in marketable securities | ($10,000) |

| Sale of marketable securities | $8,000 |

| Investments in other companies | ($6,000) |

| Sale of property, plant, and equipment | $5,000 |

| Acquisition of subsidiary | ($20,000) |

| Net cash used in investing activities | ($53,000) |

| Financing Activities: | |

| Issuance of common stock | $15,000 |

| Repurchase of treasury stock | ($4,000) |

| Issuance of long-term debt | $20,000 |

| Repayment of long-term debt | ($15,000) |

| Repayment of short-term debt | ($5,000) |

| Proceeds from short-term borrowings | $7,000 |

| Payment of dividends | ($10,000) |

| Payment of debt issuance costs | ($2,000) |

| Net cash provided by financing activities | $6,000 |

| Net decrease in cash | ($2,000) |

| Cash at beginning of the year | $25,000 |

| Cash at end of the year | $23,000 |

In this example, ABC Corporation had a net income of $50,000 for the year. After adjusting for non-cash items and changes in operating assets and liabilities, the net cash provided by operating activities amounted to $45,000. The investing activities used $53,000, mainly due to purchases of property, plant, and equipment, intangible assets, investments in marketable securities, and the acquisition of a subsidiary. Financing activities provided $6,000 in cash, primarily from the issuance of common stock and long-term debt, offset by the repayment of long-term and short-term debt and payment of dividends. The net decrease in cash for the year was $2,000, resulting in a cash balance of $23,000 at the end of the year.

Unlocking the Secrets of the Cash Flow Statement: A Comprehensive Guide to In-Depth Analysis

The cash flow statement is a crucial financial report that offers insights into a company’s liquidity and solvency by tracking the inflow and outflow of cash during a specific period. Understanding how to analyze a cash flow statement can provide valuable information about your company’s financial health, helping you make informed decisions for sustainable growth. In this blog post, we’ll dive deep into the cash flow statement analysis and explore the key aspects you need to consider for effective evaluation.

Key Components of the Cash Flow Statement:

A cash flow statement is divided into three main sections:

- Operating activities: This section reflects the cash generated from the primary business operations.

- Investing activities: This section represents the cash flow from investments in assets, such as property, plant, and equipment (PPE), as well as acquisitions and divestitures.

- Financing activities: This section illustrates the cash flow from financing activities, including issuing or repurchasing stocks, paying dividends, and borrowing or repaying loans.

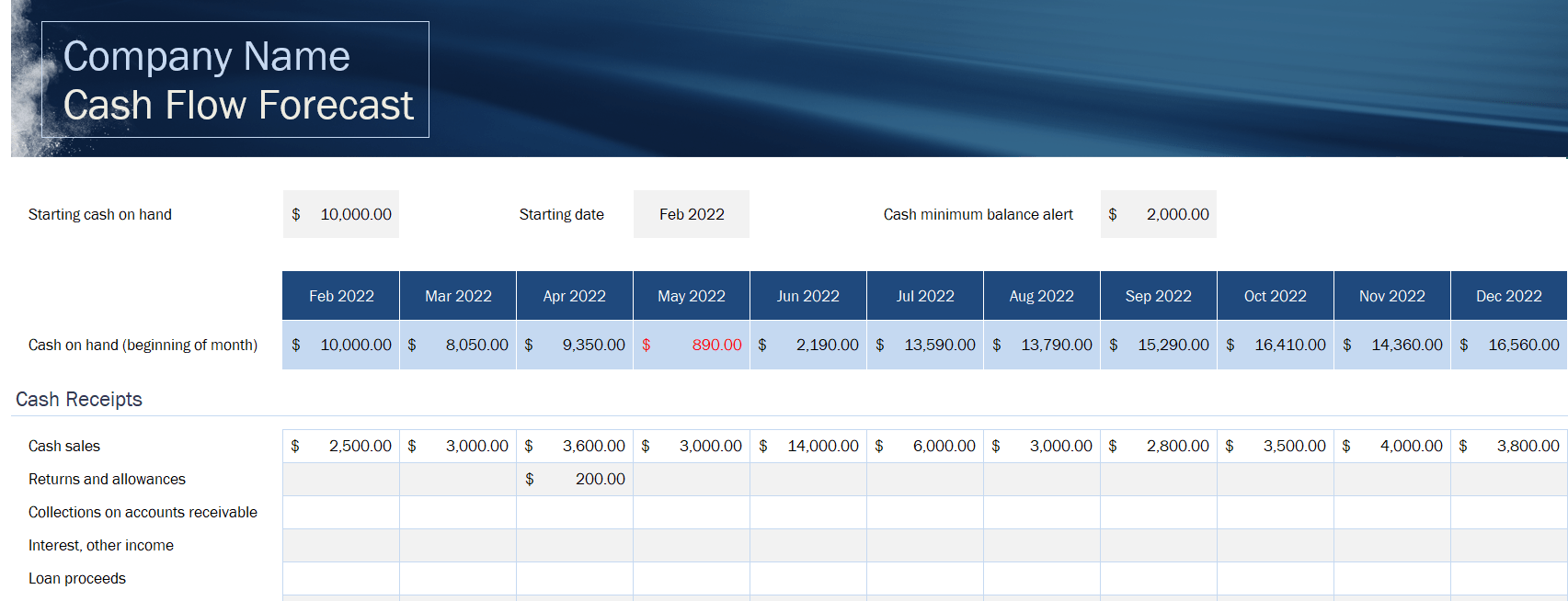

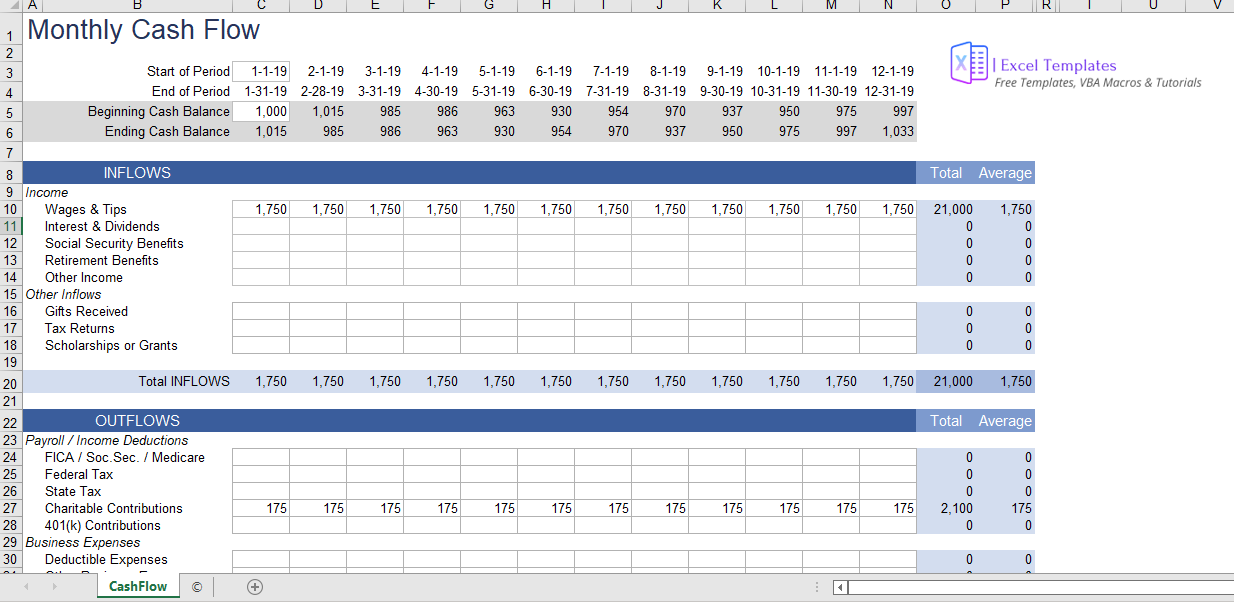

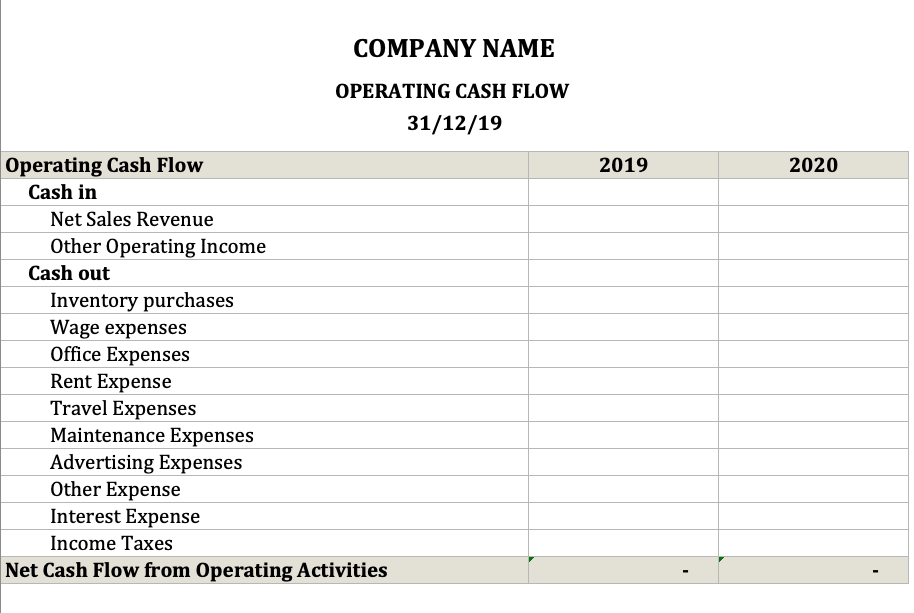

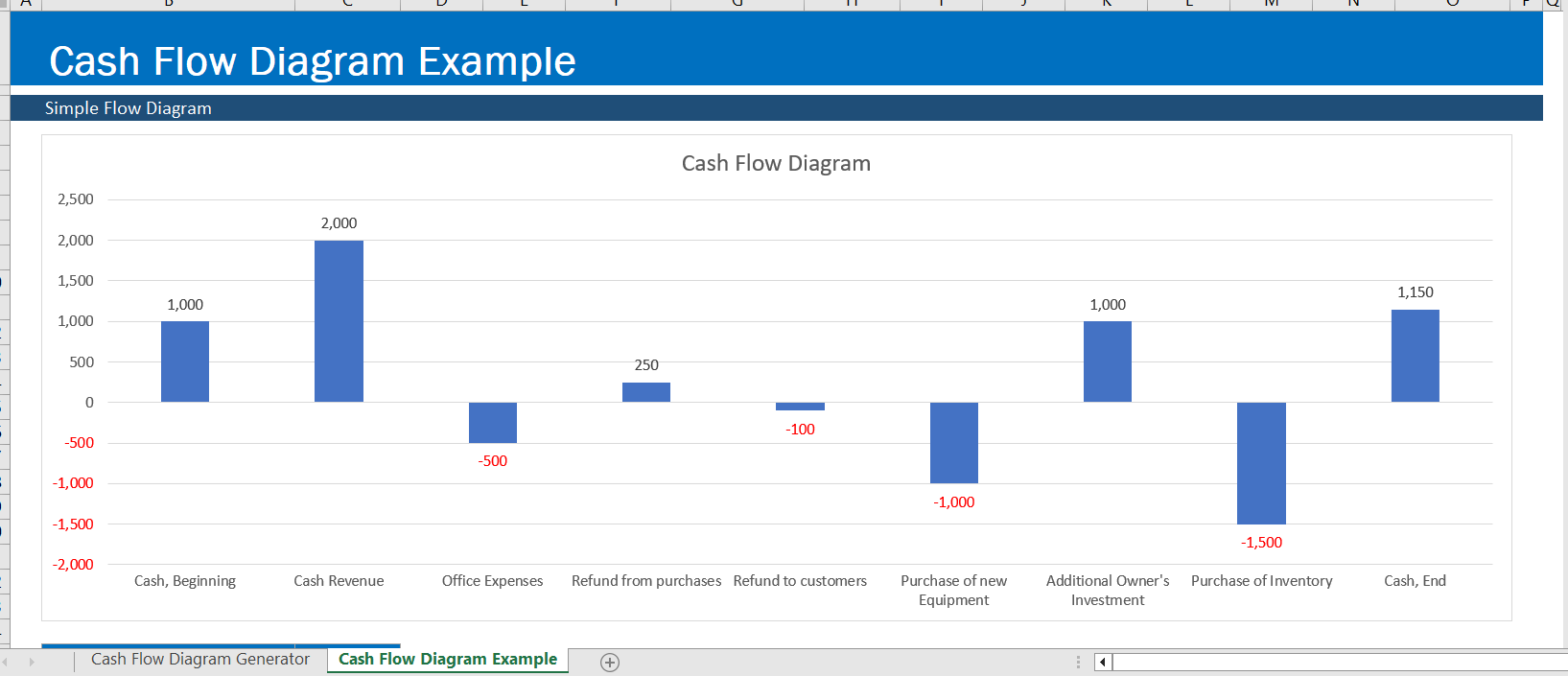

Download Free Editable Cash Flow Templates

Analyzing the Cash Flow Statement in Detail:

- Cash flow from operating activities:

To analyze the cash flow from operating activities, consider the following factors:

a. Net income: Begin by examining the net income, which serves as the starting point for calculating cash flow from operating activities. A positive net income indicates profitability, while a negative net income suggests losses.

b. Non-cash items: Adjustments for non-cash items, such as depreciation and amortization, can reveal the actual cash impact of these expenses. A high level of non-cash expenses can indicate significant investments in fixed assets.

c. Changes in working capital: Analyze the changes in working capital, including accounts receivable, inventory, and accounts payable, to determine the cash impact of these components on the business. Significant changes in working capital may signal potential cash flow issues or opportunities for improvement.

- Cash flow from investing activities:

When analyzing the cash flow from investing activities, consider the following:

a. Capital expenditures: Examine the company’s capital expenditures, which represent investments in long-term assets. High capital expenditures can indicate a focus on growth and expansion, while low capital expenditures may suggest a more conservative approach.

b. Asset sales and acquisitions: Review the company’s history of asset sales and acquisitions to understand its strategy regarding investments and divestitures. Frequent asset sales or acquisitions can signal a dynamic approach to managing the company’s assets.

c. Investments in other companies: If the company has made investments in other companies, consider the potential impact of these investments on the company’s cash flow and overall financial performance.

- Cash flow from financing activities:

To analyze the cash flow from financing activities, consider the following aspects:

a. Equity financing: Analyze the company’s history of issuing or repurchasing stocks to understand its approach to equity financing. Frequent stock issuances or repurchases can signal the company’s strategy for raising capital or managing its ownership structure.

b. Debt financing: Examine the company’s borrowing and loan repayment activities to assess its reliance on debt financing. High levels of debt can indicate potential solvency issues, while low levels of debt may suggest a more conservative financial approach.

c. Dividends: Review the company’s dividend payment history to understand its commitment to returning value to shareholders. Consistent dividend payments can indicate a stable and mature company, while erratic or non-existent dividend payments may signal financial instability or a focus on reinvesting profits for growth.

- Ratios and metrics:

Use various financial ratios and metrics to analyze the cash flow statement more effectively:

a. Operating cash flow margin: This ratio measures the cash generated from operating activities as a percentage of net sales. A high operating cash flow

Conclusion:

Creating and analyzing a cash flow statement is a critical aspect of understanding a business’s financial health. By following the steps outlined in this blog post, you can gain valuable insights into your company’s liquidity, solvency, and overall financial performance. This knowledge will empower you to make informed decisions that drive sustainable growth and financial success for your business.